GBP/USD Forecast: With room to extend gains despite UK jitters

GBP/USD Current price: 1.3117

- Scotland PM Sturgeon announced a new lockdown in the Aberdeen city council area.

- The Bank of England is expected to keep the monetary policy on hold this month.

- GBP/USD is holding on to gains near the 1.3160 price zone, higher highs still at sight.

The GBP/USD pair continued enjoying dollar’s weakness, extending its weekly advance to 1.3162, now trading around the 1.3130 level. As it been has happening lately, the pair’s advance was backed by a weaker dollar, with the market ignoring negative UK headlines. According to Markit, services activity in the UK expanded less-than-expected in July, with the PMI revised lower to 56.5 in July versus 56.6 previously estimated. In the coronavirus front, news are once again worrisome in the UK. The Scottish first minister, Nicola Sturgeon announced a new lockdown in the Aberdeen city council area, after 54 new coronavirus cases were confirmed, while roughly 200 close contacts have been traced.

This Thursday, the focus will be on the Bank of England monetary policy decision. The central bank is not expected to change its current policy in this particular meeting, although there could be a reference to negative rates, an option that has been on the table these last few months. Still, no action is expected this time, with all eyes on Bailey’s words and economic forecasts.

GBP/USD short-term technical outlook

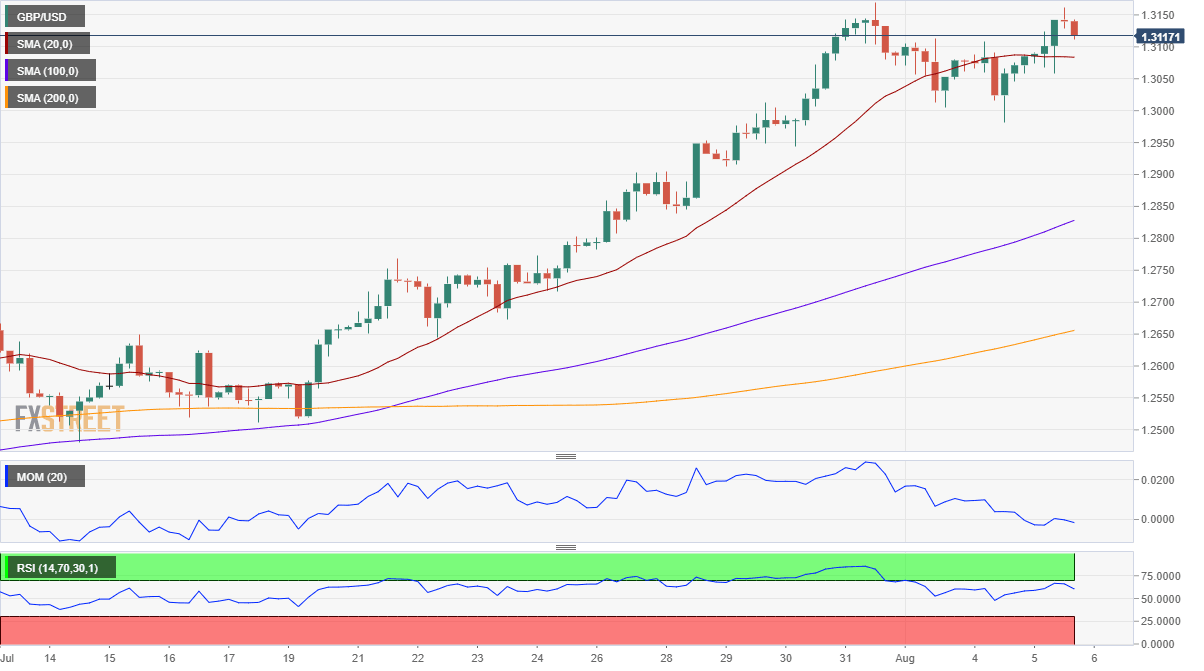

From a technical point of view, the GBP/USD pair offers a bullish perspective in the short-term, with room to extend its advance during the upcoming sessions. The 4-hour chart shows that the pair has recovered above its 20 SMA, while the larger moving averages maintain their bullish slopes below the shorter ones. Technical indicators, in the meantime, remain within positive levels, although with uneven directional strength.

Support levels: 1.3080 1.3035 1.2990

Resistance levels: 1.3165 1.3200 1.3250

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.