GBP/USD Forecast: Will bears stay on sidelines amid BoE speculation?

- GBP/USD has recovered sharply from new all-time-low set early Monday.

- Markets speculate about an emergency BoE rate hike to limit GBP depreciation.

- A four-hour close above 1.0800 could open the door for additional recovery gains.

GBP/USD has erased a large portion of its daily losses after having touched a new all-time low of 1.0340 in the early Asian session. The pair was last seen edging higher toward 1.0800 and bears could stay on the sidelines for the now while trying to figure out whether or not the Bank of England (BoE) will take action to stop the British pound's devaluation.

The UK's government's "mini-budget," which includes massive unfunded tax cuts, triggered a relentless GBP selloff ahead of the weekend. Investors grow increasingly worried over fiscal measures further fueling consumer inflation in the UK and higher public borrowing putting the economy on an unsustainable debt path. Additionally, fiscal measures are having the opposite effect of what the BoE is trying to do with regard to raming inflation.

Hence, investors have started to speculate that the BoE could conduct an emergency meeting and hike its policy rate or postpone its Gilt sales programme at the least.

Mohamed El-Erian, an advisor to Allianz, argued earlier in the day that the BoE should raise its policy rate by 100 bps to try to stabilise the situation.

At this point, it's difficult to say whether an emergency policy action by the BoE will be significant enough to reinstate confidence in the British pound. Nevertheless, the market chatter by itself seems to be helping the currency show some resilience against its rivals for the time being.

Later in the day, several FOMC policymakers will be delivering speeches. The US economic docket will feature the Chicago Fed National Activity Index and the Dallas Fed's Texas Manufacturing Survey but GBP/USD traders are likely to ignore these data amid the BoE uncertainty.

GBP/USD Technical Analysis

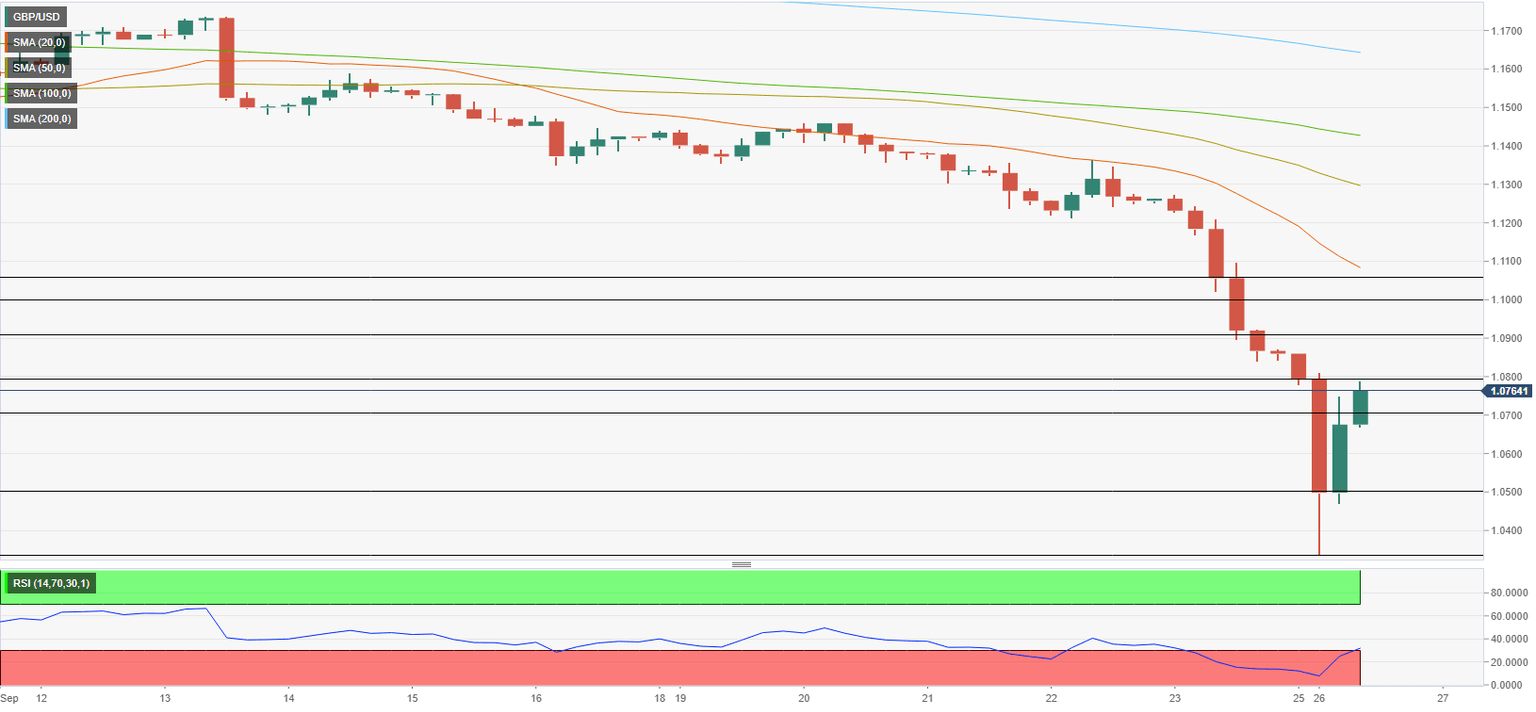

The Relative Strength Index (RSI) indicator on the four-hour chart is yet to reclaim 30 despite two consecutive green four-hour candles, suggesting that GBP/USD could continue to edge higher as part of its technical correction. On the upside, 1.0800 (psychological level) aligns as immediate resistance. In case this level turns into support, 1.0900 (psychological level) and 1.1000 (psychological level, former support) could be seen as the next recovery targets.

Supports are located at 1.0700 (psychological level), 1.0600 (psychological level) and 1.0500 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.