GBP/USD Forecast: UK’s economic reopening underpins sterling

GBP/USD Current price: 1.3739

- UK’s economic reopening continues, providing support to the pound.

- The UK monthly GDP is foreseen at 0.6% MoM in February, improving from -2.9%.

- GBP/USD is still at risk of falling further despite its recent recovery.

The GBP/USD pair bounced nicely from an intraday low of 1.3668 to reach a daily high of 1.3776 during London trading hours. The pound benefited from a new phase of economic reopening in the UK as the country reopened pubs, restaurants and in general, non-essential retailers, In the absence of another catalyst. The UK will publish this Tuesday the March Trade Balance and February Industrial Production, this last, foreseen up by 0.5% MoM. The UK will also release February Gross Domestic Product, foreseen at 0.6% MoM, up from -2.9% in January.

GBP/USD short-term technical outlook

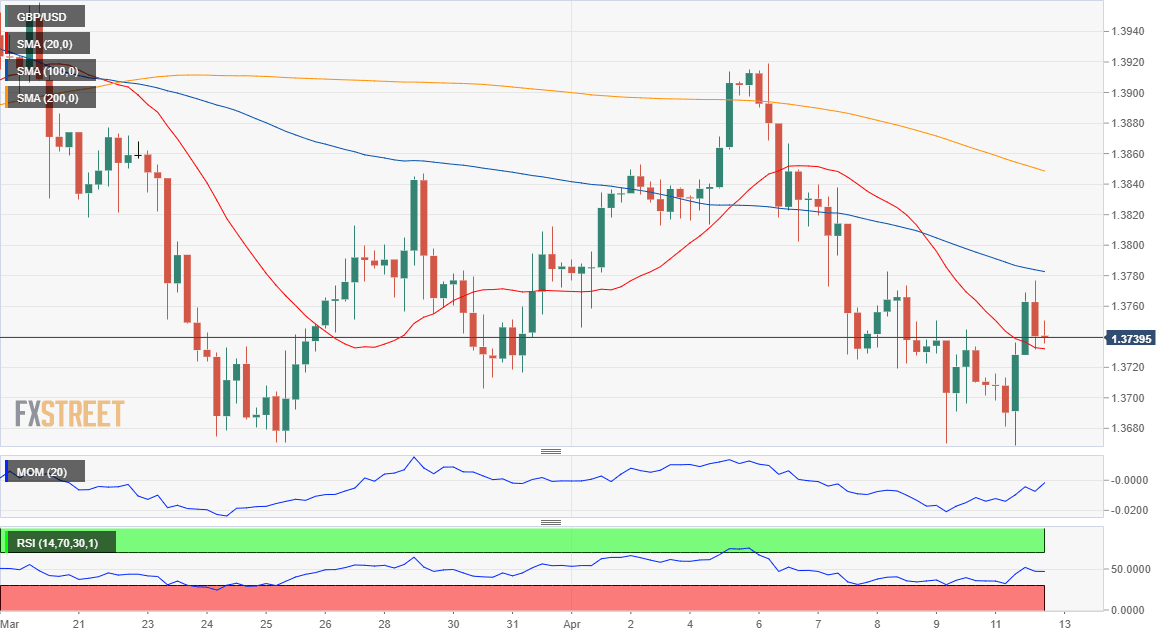

The GBP/USD pair eased from the mentioned daily high to settle around 1.3740. The bullish potential remains limited, according to the 4-hour chart, as technical indicators were unable to enter positive levels, easing from neutral readings. The pair is currently developing a few pips above a bearish 20 SMA, but below the longer ones, with the 100 SMA providing dynamic resistance around 1.3790. As long as the pair holds below the level, the risk is skewed to the downside.

Support levels: 1.3700 1.3665 1.3620

Resistance levels: 1.3790 1.3815 1.3860

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.