GBP/USD Forecast: Sellers encouraged by Brexit concerns, dollar strength

- GBP/USD has broken below post-BoE lows on dollar rally.

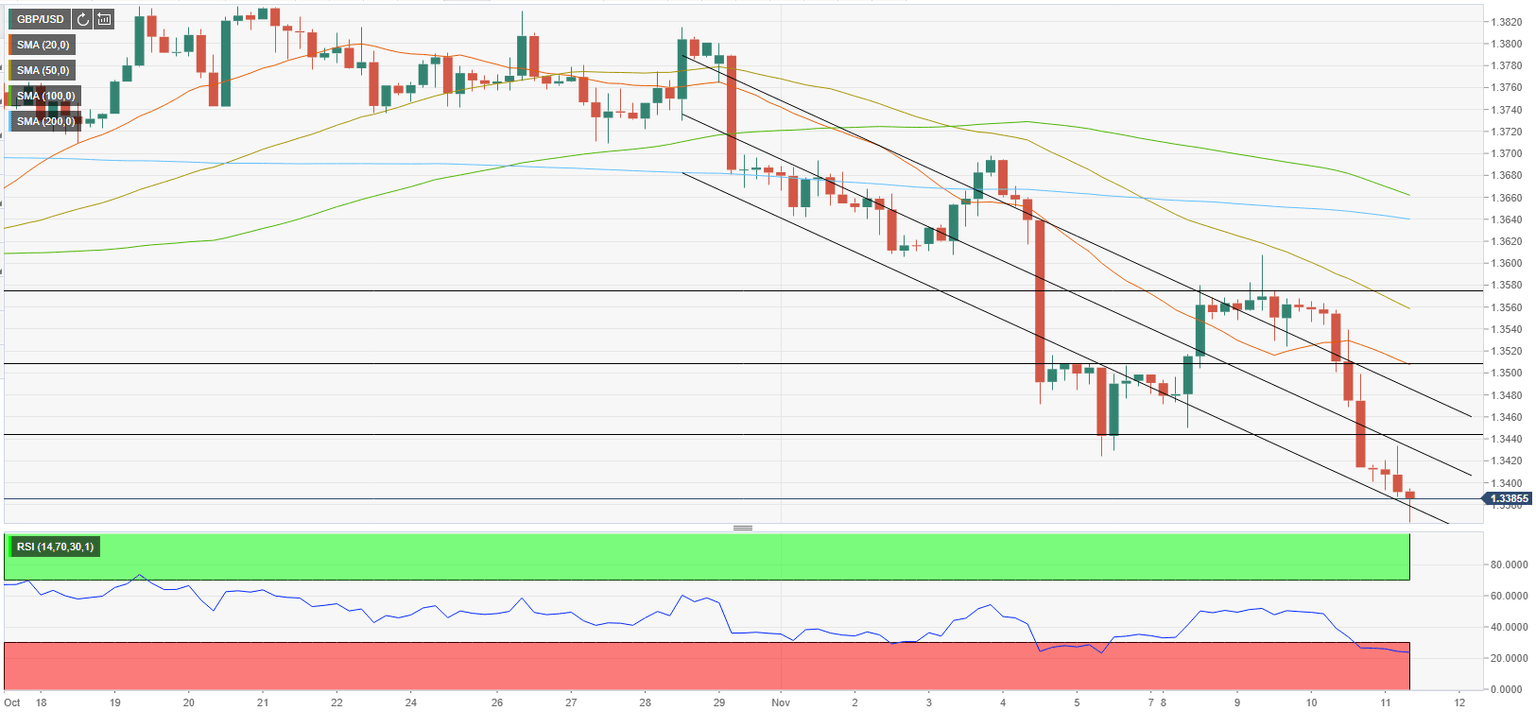

- GBP/USD trades in a descending channel but turns technically oversold.

- EU-UK negotiations over Brexit's Northern Ireland protocol is reportedly not going well.

GBP/USD has come under strong bearish pressure on Wednesday and slumped below 1.3400 to touch its weakest level of 2021. Despite the fact that the pair has turned technically oversold, bears could see corrections as a selling opportunity.

The broad-based dollar strength caused GBP/USD to fall sharply. With the annual Consumer Price Index (CPI) jumping to its strongest level since 1990 at 6.2% in October, investors shifted their focus to the Fed's rate hike prospects and triggered a rally in the benchmark 10-year US Treasury bond yield.

The greenback is likely to continue to outperform its rivals in the near term as the market pricing points to a more-than-70% chance of a 25 bps Fed rate hike by June 2022.

On the other hand, the US inflation doesn't seem to be having a significant impact on the Bank of England's rate hike expectations, leaving GBP/USD at the mercy of the dollar's valuation.

The latest Brexit headlines suggest that sides are struggling to come to terms with the Northern Ireland protocol. According to Reuters, European Commission Vice-President Maros Sefcovic told EU ambassadors that their engagements with the UK had not been going well. Some EU diplomats think that the EU's should respond in a "hard-hitting" and a "proportionate" way in case the UK were to trigger Article 16.

Meanwhile, the data published by the UK's Office for National Statistics revealed on Thursday that the Gross Domestic Product (GDP) expanded by 1.3% on a quarterly basis in the third quarter following the second quarter's growth of 5.5%.

The loss of momentum in the UK's economic activity, unresolved issues surrounding Brexit and unchanged BoE rate hike bets are likely to continue to encourage GBP/USD bears in the near term.

GBP/USD Technical Analysis

Currently, GBP/USD is trading near the lower limit of the descending regression channel coming from late October.

The Relative Strength Index (RSI) on the four-hour chart is staying below 30. When the RSI broke below 30 with the initial reaction to the BoE's decision to leave the policy rate unchanged, the pair staged a rebound and gained more than 100 pips in the next few days. A similar recovery could get underway before the pair extends its slide but the above-mentioned fundamental drivers are likely to limit the pair's upside.

Initial resistance is located at 1.3440 (mid-point of the descending channel, former support) ahead of 1.3480 (upper limit of the descending channel) and 1.3500 (psychological level, 20-period SMA, static level).

On the downside, supports are located at 1.3360 (static level) and 1.3300 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.