GBP/USD Forecast: Roller coaster ready to dive? UK coronavirus data and first virus-infected NFP eyed

- GBP/USD has traded in extreme volatility as coronavirus continued taking its toll.

- Top-tier economic post-crisis data and additional Covid-19 developments are eyed.

- Late March's daily chart is pointing to a resumption of the downturn.

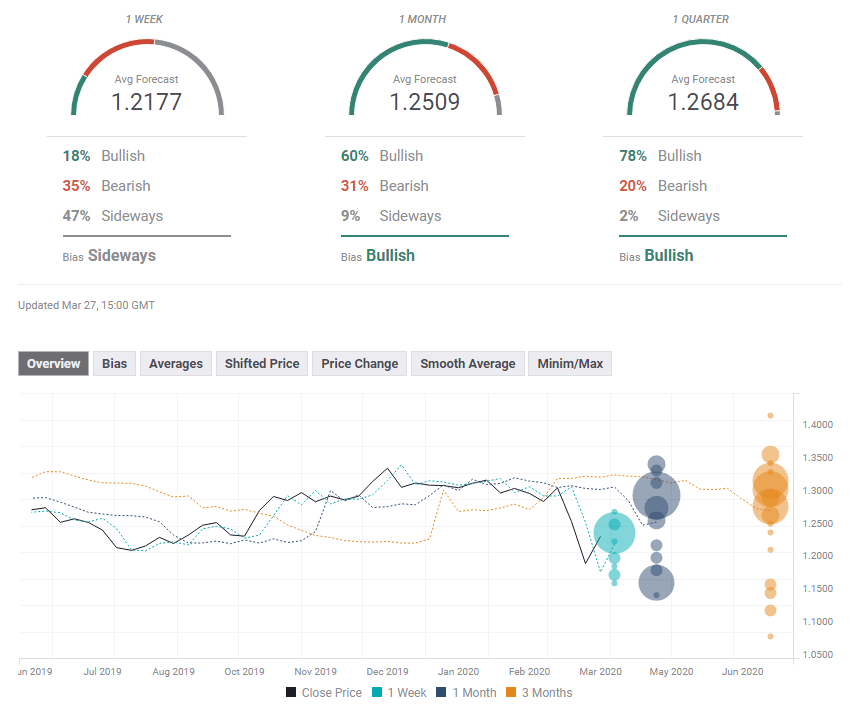

- The FX Poll is pointing to gains in the medium and long terms.

The sharp surge seen on the weekly chart tells only part of the story in an extremely volatile week that saw ups and downs. GBP/USD has been responding to coronavirus headlines, lockdown, central bank action, economic data – and often moving without a clear driver. The upcoming week features more action with end-of-quarter flows, top-tier figures, and non-stop Covid-19 headlines.

This week in GBP/USD: Riding higher on the roller coaster

"You must stay at home," ordered UK Prime Minister Boris Johnson in a televised address, requesting a strict lockdown. By the time he was speaking on Monday night, the move was already priced into GBP/USD. Later in the week, the announcement by Downing Street that Johnson tested positive to Covid-19 seemed to stop the pound's recovery.

The hit to the British economy and sterling was countered by the Federal Reserve's announcement of an open-ended Quantitative Easing program that also includes cheap loans to businesses. The Fed used its "nuclear option" of unlimited spending, but Jerome Powell, Chairman of the Federal Reserve, said that the bank would not run out of ammunition, weighing on the dollar.

The Bank of England left its interest rates unchanged at 0.1% and the QE program at £645 billion in its third scheduled decision in March. Governor Andrew Bailey and his colleagues warned that unemployment could rise steeply.

On the fiscal side, the US Senate passed a stimulus package worth north of $2 trillion, after lengthy deliberations. The bipartisan agreement impressed markets at first, but a significant chunk of the funds is dedicated to loans rather than direct cash to a struggling economy. Moreover, it may be insufficient.

Weekly jobless claims skyrocketed to 3.283 million in the week ending on March 21 – a surge of over 1,000%. While some claims are due to temporary shutdowns, the longer the crisis lasts, the more permanent they could be.

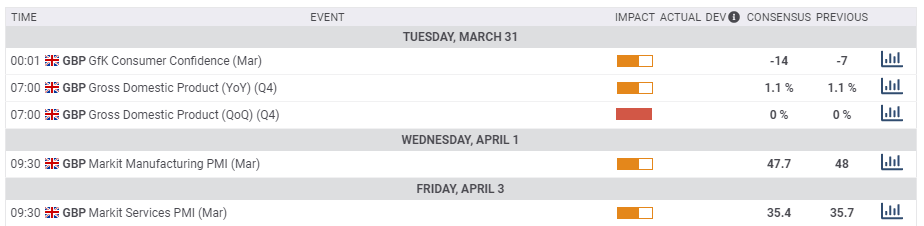

The UK government is also ramping up its support to the self-employed in order to help the economy cope. Markit's preliminary Purchasing Managers' Index for the all-important services sector plunged to 35.7 points, deep in contraction territory. However, manufacturing helps up at 48 points, thanks to a quirk counting delivery delays as a decisive factor.

UK events: Coronavirus cases set to surge

The trading week begins after Brits have only been under strict lockdown measures for one week. The government's late U-turn on coronavirus policy – from "herd immunity" to social distancing will come under scrutiny as the number of deaths could rise above 1,000.

If the UK enacts more rigid measures, the pound could as the economy would come under further pressure. Conversely, if the curve of mortalities and cases flattens, sterling has room to rise.

Chancellor of the Exchequer Rishi Sunak – who, contrary to Johnson, continues working as usual – may introduce additional steps to support the economy. He has been launching plans every week, and sometimes more frequently since the crisis began.

The GfK Consumer Confidence figure for March may be of interest as a gauge of how much the public is scared. Final Gross Domestic Product statistics for the fourth quarter of 2019 will likely be ignored as they predate the crisis.

Markit's final PMI read for March may suffer downgrades, reflecting the worsening of economic conditions as the month progressed.

Here is the list of UK events from the FXStreet calendar:

US events: First corona-NFP

The US has become the world leader in infections, with New York the epicenter. Daily figures from the world's financial capital and media hub are of high interest. Assuming the fiscal package turns into law and after the Fed used its "nuclear bomb," President Trump and governors are in the limelight.

While governors from both parties are adding lockdowns to curb the spread of the virus, Trump has continued touting the reopening of the economy, potentially around Easter. These conflicting messages may slow the response to allow the disease to spread. It also confuses markets, possibly pushing the dollar higher.

The White House's daily updates and announcements from various states will be of interest.

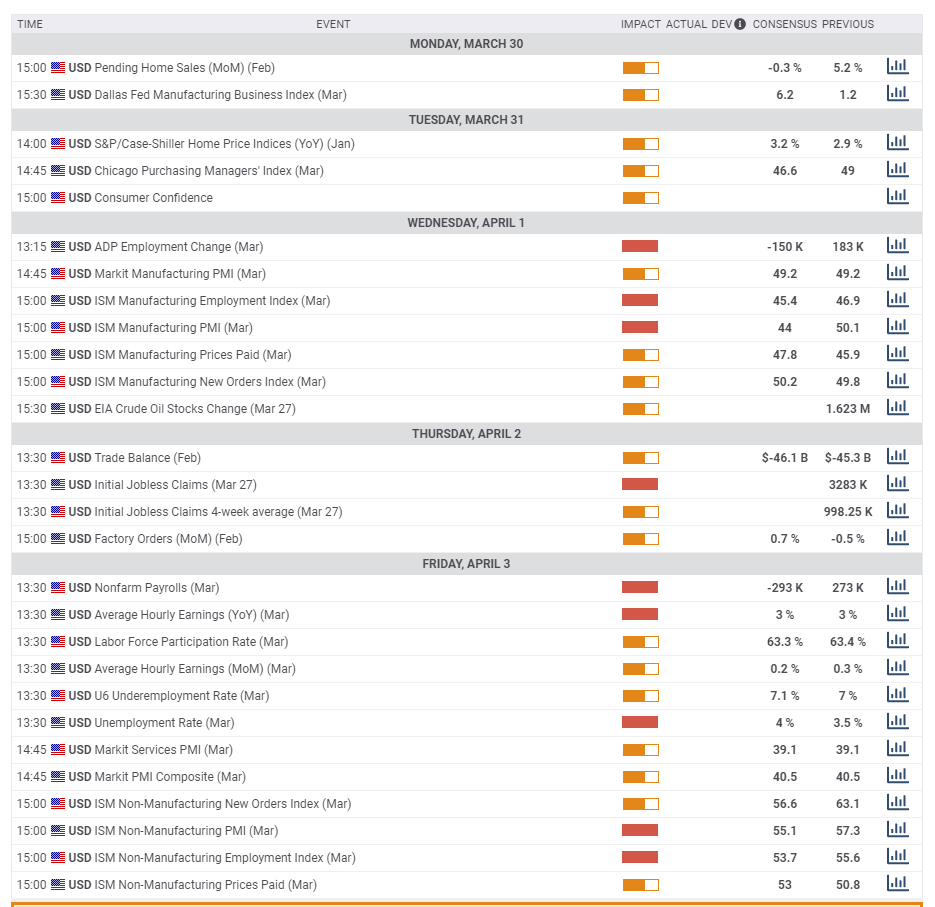

The first significant release is the Conference Board's consumer confidence measure for March. It will likely show a decline amid the crisis, but the scale matters.

The agenda becomes packed on Wednesday, with ADP's private-sector jobs report set to show a moderate drop in jobs – still not capturing layoffs. However, ranges may vary, and any outcome is likely to trigger action in markets. An outright loss of jobs – already in March and first reported by the payrolls firm – may dampen the mood. The correlation between ADP's number and official government figures is often weak, but sensitive investors will probably react. Massive job losses could trigger safe-haven flows to the dollar.

ISM's Manufacturing PMI is of high interest after Markit's statistics were mixed. A significant decline below 50 – the level separating expansion from contraction – is on the cards.

Weekly jobless claims remain considerably important. After surging above three million, a leap above four or five cannot be ruled out as lockdown continue impacting markets. Also, here, the high level of uncertainty implies significant action.

Friday's official Non-Farm Payrolls is the highlight of the week – and it is projected to show a loss of nearly 300,000 jobs due to the crisis. ADP's statistics will shape expectations, but as with previous releases, economists' wide range of estimates means wild action is likely from the "king of forex indicators."

There is room for an upside surprise in the NFP, as not all of March's job losses are reflected in the report. The worst of the crisis came in the latter part of the month, and companies were only beginning to lay off people when the BLS's surveys were taken. That is another factor adding to the uncertainty.

ISM's Non-Manufacturing PMI is published after the labor market report, but may still rock the dollar – it has the last word of the week. The plunge in Markit's services sector PMIs all over the world – including in the US – indicates a massive dive is on the cards. A plummet in the employment component could compound a depressing NFP.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

The Relative Strength Index on the daily chart has emerged from below 30, thus exiting oversold conditions – and allowing for more falls. Momentum remains to the downside, and the currency pair trades well below the 50, 100, and 200-day Simple Moving Averages. All in all, bears are in control.

Some support awaits at 1.22, which provided some relief in mid-March. It is followed by 1.1970, which temporarily paused the recovery. Next, 1.18 held GBP/USD down and is also a round number. 1.1630 was a stepping stone on the way up, and it is followed by the initial low of 1.1440 and the 35-year trough of 1.1414.

Looking up, 1.23 was the high point of the recovery. It is followed by 1.2405, a stepping stone on the way down, and it also played a role in late 2019. The round level of 1.25 held cable up in mid-March. It is followed by 1.2610, and then 1.2720, which provided support in early March and converges with the 50 SMA.

GBP/USD Sentiment

Pound/dollar recovered from a fast and furious fall, but the situation remains dire. Coronavirus is set to worsen in the UK and around the world, with more evidence of rapid economic damage. GBP/USD has room to resume its falls.

The FX Poll is pointing to sideways movement in the short-term, but substantial rises afterward. The outlook for the next week has been upgraded while the medium and long-term forecasts are little changed.

Related Forecasts

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637209205118545712.png&w=1536&q=95)