GBP/USD Forecast: Pound Sterling tests key support

- GBP/USD has edged lower in the early European session on Wednesday.

- The pair trades near key support that aligns at 1.2140.

- Improving market mood could help GBP/USD limit its losses.

After having staged a technical correction on Tuesday, GBP/USD has edged slightly lower in the early European morning on Wednesday. Nevertheless, the pair manages to hold slightly above the key support level that is located at 1.2140. If that level fails, additional losses could be witnessed in the near term.

The improving market mood seems to be helping GBP/USD limit its losses for the time being. As of writing, the UK's FTSE 100 Index was rising 0.6% on the day and US stock index futures were up modestly. Amid a lack of fundamental drivers and high-tier data releases, however, investors could stay on the sidelines and Wall Street's main indexes could have a hard time making a decisive move in either direction.

It's also worth noting that market participants are likely to wait for Thursday's Consumer Price Index (CPI) data before deciding whether risk trade has more legs to go.

The 10-year US Treasury note auction will take place at 1800 GMT on Wednesday. At the time of press, the 10-year US Treasury bond yield was down more than 1.5% on the day at 3.56%. In case the high-yield at the auction comes in below 3.5%, US yields could continue to push lower and hurt the US Dollar.

GBP/USD Technical Analysis

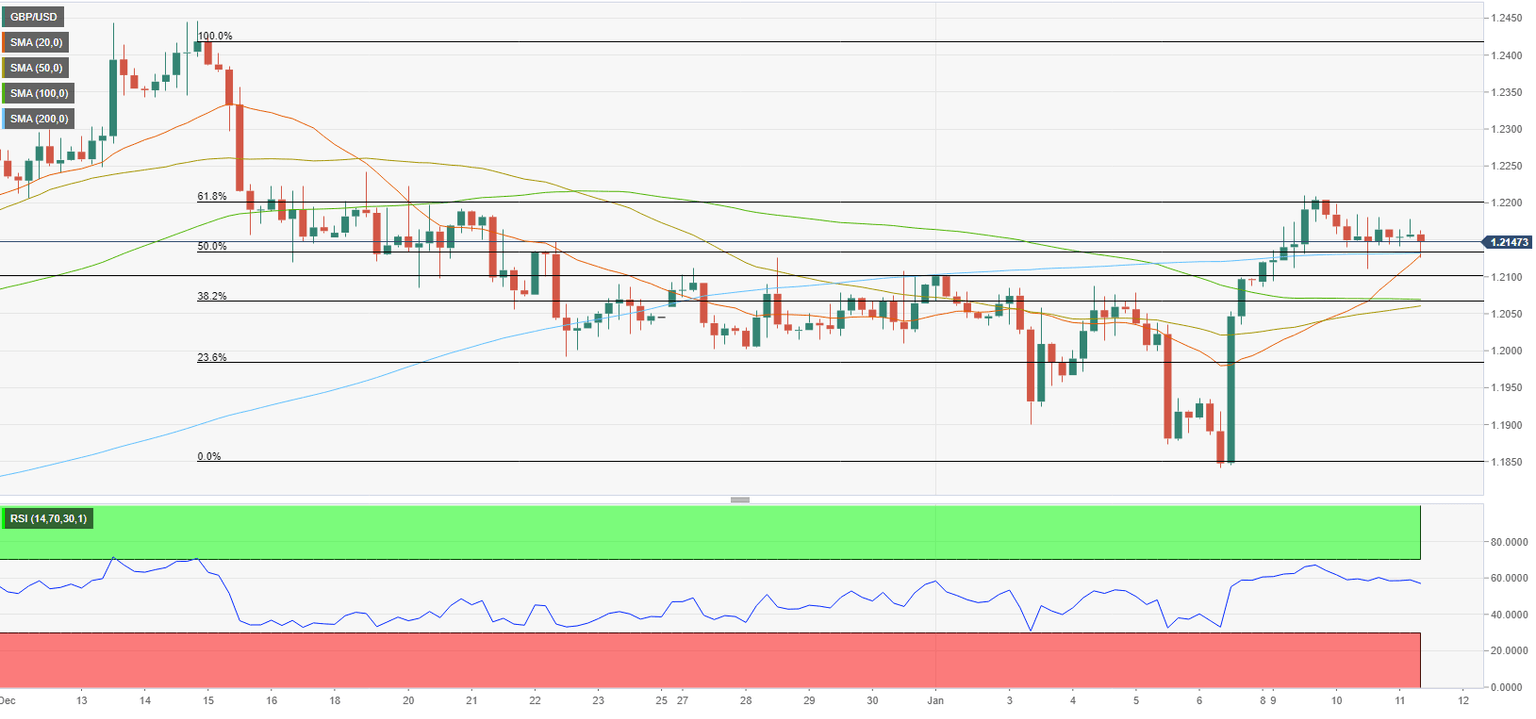

1.2140, where the Fibonacci 50% retracement of the latest downtrend and the 200-period Simple Moving Average (SMA) on the four-hour chart align, acts as significant support in the near term. If GBP/USD falls below that level and starts using it as resistance, it could extend its slide toward 1.2100 (psychological level, static level) and 1.2070 (100-period SMA, Fibonacci 38.2% retracement).

On the upside, GBP/USD is likely to face stiff resistance at 1.2200 (psychological level, static level) before targeting 1.2240 (December 19 high) and 1.2300 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.