GBP/USD Forecast: Pound Sterling remains vulnerable following latest decline

- GBP/USD registered losses for the second consecutive day on Thursday.

- The pair stays below key 1.2650 resistance early Friday.

- An improving risk mood could help GBP/USD rebound ahead of the weekend.

GBP/USD continued to push lower and closed the second consecutive day in negative territory on Thursday. Although the pair holds comfortably above 1.2600 early Friday, the technical outlook does not yet point to a buildup of recovery momentum.

After fluctuating wildly with the immediate reaction to the Personal Consumption Expenditures (PCE) Price Index, the US Dollar (USD) Index settled higher on Thursday, supported by the souring risk mood and cautious comments from Federal Reserve (Fed) policymakers on the policy pivot.

The Core PCE Price Index, the Fed's preferred gauge of inflation, rose 0.4% (MoM) in January and increased 2.8% on a yearly basis. Both of these readings came in line with analysts' estimates. San Francisco Fed President Mary Daly argued that cutting rates too quickly could cause inflation to get stuck and Cleveland Fed President Loretta Mester noted that they can't expect last year's disinflation to continue.

The ISM Manufacturing PMI from the US will be the last data release of the week. Markets expect the headline PMI to edge higher to 49.5 from 49.1. A reading above 50 could help the USD find demand. Investors will also pay close attention to the inflation component of the survey, the Prices Paid Index. An unexpected drop below 50 in this sub-index, which would highlight a decline in input inflation, could hurt the USD even if the headline PMI comes in better than forecast.

In the meantime, US stock index futures trade in positive territory in the European session. A bullish opening in Wall Street could attract risk flows and help GBP/USD edge higher.

GBP/USD Technical Analysis

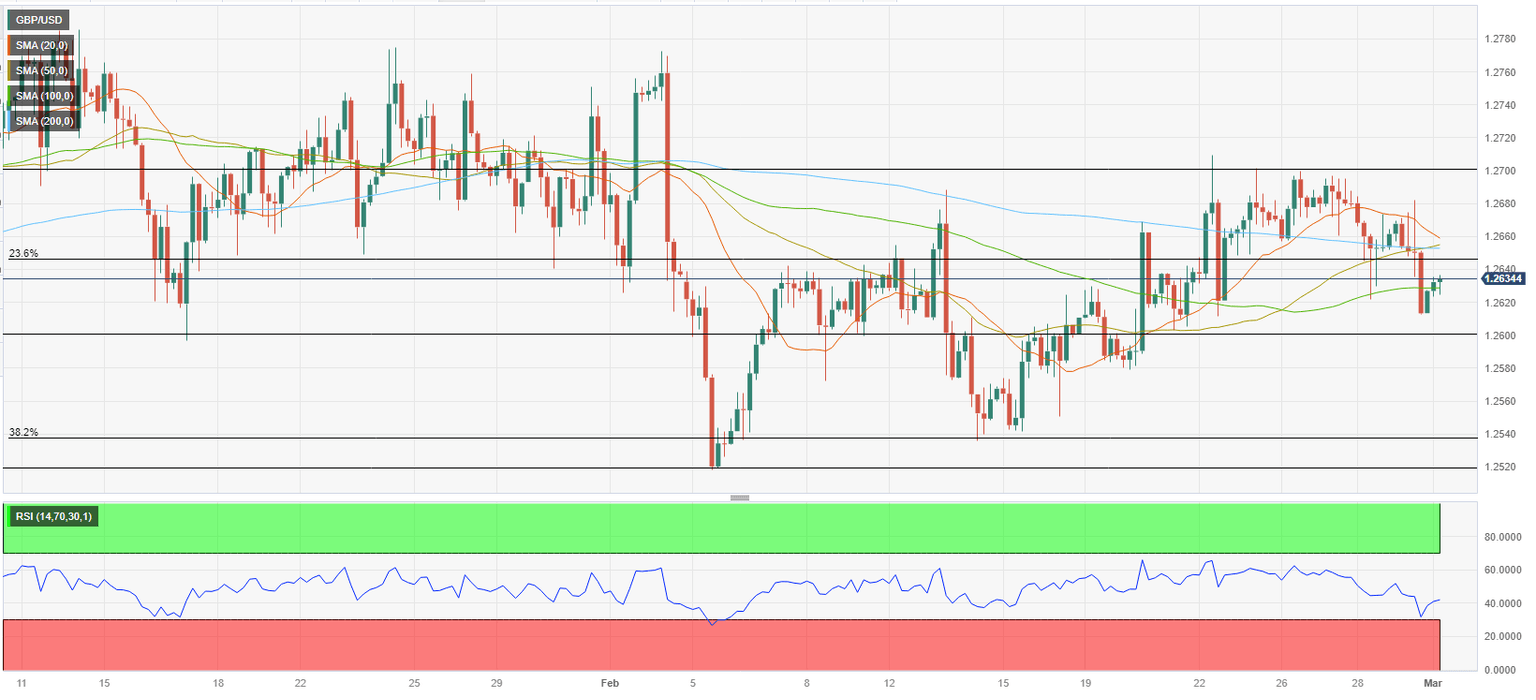

The Relative Strength Index (RSI) indicator on the 4-hour chart stays below 50 and GBP/USD remains below 1.2650, where the 200-period Simple Moving Average meets the Fibonacci 23.6% retracement of the long-term uptrend. In case GBP/USD fails to reclaim 1.2650, sellers could look to retain control. In this scenario, 1.2600 (psychological level, static level) aligns as first support before 1.2540 (Fibonacci 38.2% retracement).

If GBP/USD climbs above 1.2650 and starts using that level as support, technical buyers could take action and open the door for an extended rebound toward 1.2680 (static level) and 1.2700 (static level, psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.