GBP/USD Forecast: Pound Sterling needs to stabilize above 1.2600 to discourage sellers

- GBP/USD is struggling to extend its recovery beyond 1.2600.

- Upbeat UK Retail Sales data failed to provide a boost to Pound Sterling.

- Producer Price Index data from the US will be looked upon for fresh impetus.

GBP/USD benefited from the renewed US Dollar (USD) weakness and snapped a three-day losing streak on Thursday. The pair, however, lost its recovery momentum after testing 1.2600 and edged lower in the early European session on Friday.

The 10-year US Treasury bond yield continued to correct lower following the disappointing Retail Sales data from the US on Thursday and weighed on the USD. Meanwhile, Bank of England's Monetary Policy Committee (MPC) member Megan Greene reiterated on Thursday that the monetary policy will need to remain restrictive for some time, further supporting GBP/USD.

Early Friday, the UK's Office for National Statistics reported that Retail Sales rose 3.4% on a monthly basis in January. Although this reading surpassed the market expectation for an increase of 1.5% by a wide margin, it failed to trigger a noticeable market reaction.

In the second half of the day, January Producer Price Index (PPI) data from the US will be watched closely by market participants.

On a monthly basis, the PPI is forecast to increase 0.1% following the 0.1% decrease in December. A negative print could revive expectations for a Federal Reserve rate cut in May and hurt the USD with the immediate reaction. On the other hand, a stronger-than-forecast increase is likely to weigh on GBP/USD by allowing the USD to stay resilient against its rivals ahead of the weekend.

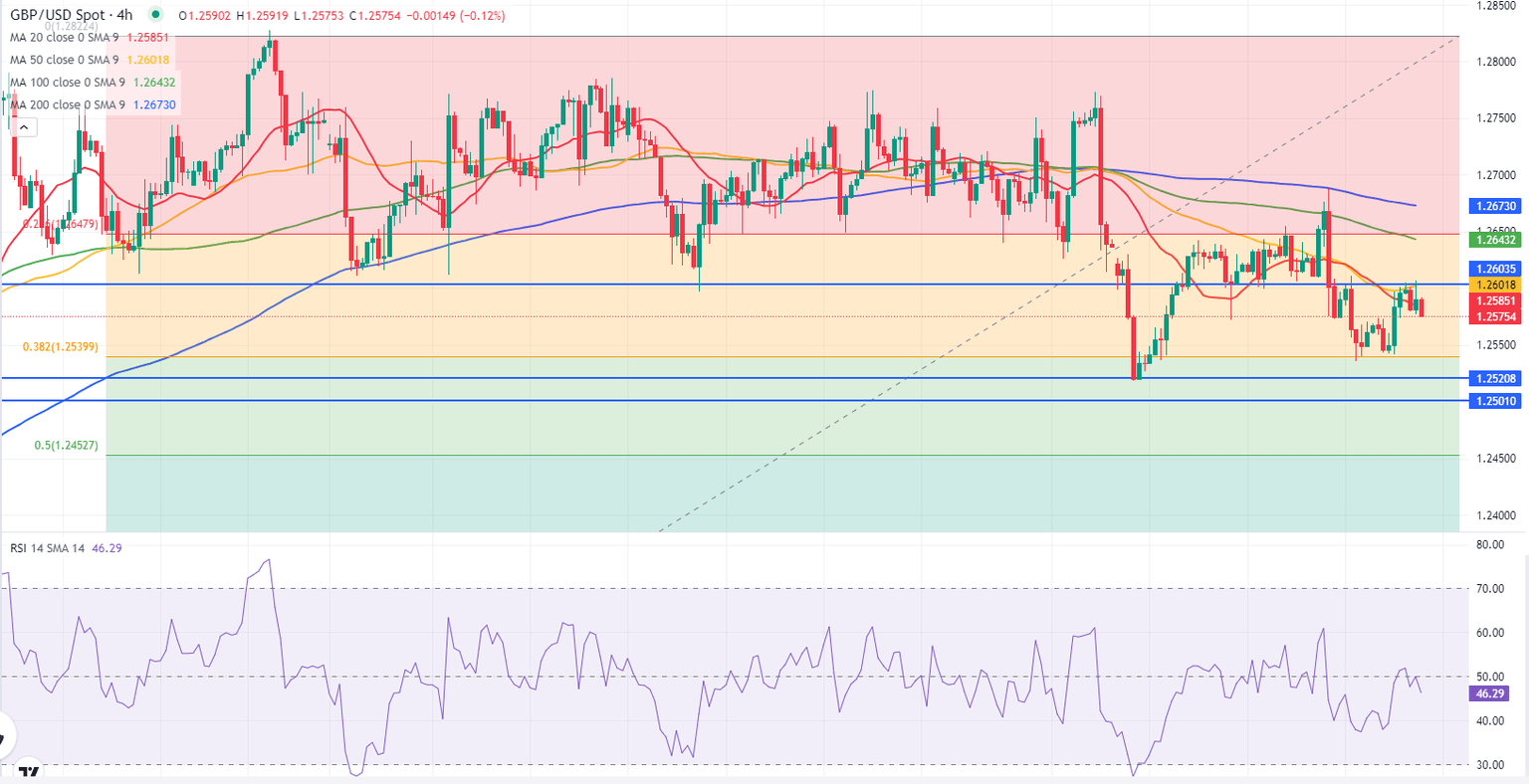

GBP/USD Technical Analysis

1.2600 (static level, psychological level) aligns as first resistance for GBP/USD. In case the pair manages to stabilize above that level, it could target 1.2650 (100-period Simple Moving Average (SMA) on the 4-hour chart, Fibonacci 23.6% retracement of the latest uptrend) and 1.2675 (200-period SMA).

On the downside, supports are located at 1.2540 (Fibonacci 38.2% retracement), 1.2520 (static level) and 1.2500 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.