GBP/USD Forecast: Parliament set to pummel the pound, ending the dead-cat bounce

- GBP/USD has been licking its wounds after last week's Brexit-related blows.

- Parliament is set to debate a controversial bill that has aggravated the EU.

- Monday's four-hour chart is pointing to further losses.

The rebels are back – despite having a large majority in parliament, Prime Minister Boris Johnson's victory in passing a controversial Brexit-related bill is unclear. The House of Commons will debate the Internal Markets bill, legislation which violated the Withdrawal Agreement – as ministers openly admit. The PM seems to have changed his mind on allowing for a customs border on the Irish Sea – a concession that was critical for striking an accord with the EU last year.

Brussels expressed anger at the move and laid down an ultimatum to London – rescind the bill by the end of September or face sanctions. Instead of proceeding to discuss future relations, Britain and the bloc are at loggerheads over the divorce deal signed nearly a year ago.

MPs kick-off he debate on Monday, with several members of the PM's Conservative Party saying they will vote against it or abstain. The House of Commons is set to vote on amendments and the entire bill before it goes to a committee. Discussions will last all week and form part of the never-ending Brexit saga.

The pound dropped sharply last week and may extend its gains if it goes through and triggers additional angry exchanges with the EU.

Apart from Brexit, investors cheer the comeback of the Phase 3 coronavirus vaccine trial by AstraZeneca and the University of Oxford. The project – considered one of the world's most advanced – was halted last week after a participant fell ill. A rival effort by Pfizer is also gaining traction after the American pharma behemoth said it hopes to provide immunization doses by year-end.

UK coronavirus cases continue rising as new restrictions are introduced. Gatherings are limited to six people and some areas are under more substantial limitations. In the US, infections and deaths are falling, albeit from a high level.

Market optimism is somewhat constrained after last week's correction and ahead of rate decisions on both sides of the Atlantic later this week.

The Federal Reserve is set to sit on the sidelines after announcing a long-term dovish policy shift. The Bank of England is also on course to wait for the government's next moves before acting. Both banks' updated forecasts – which will likely express optimism from the recovery but concerns about the virus – will be closely watched.

Overall, the debate in parliament stands out, leaving the pound vulnerable for another fall.

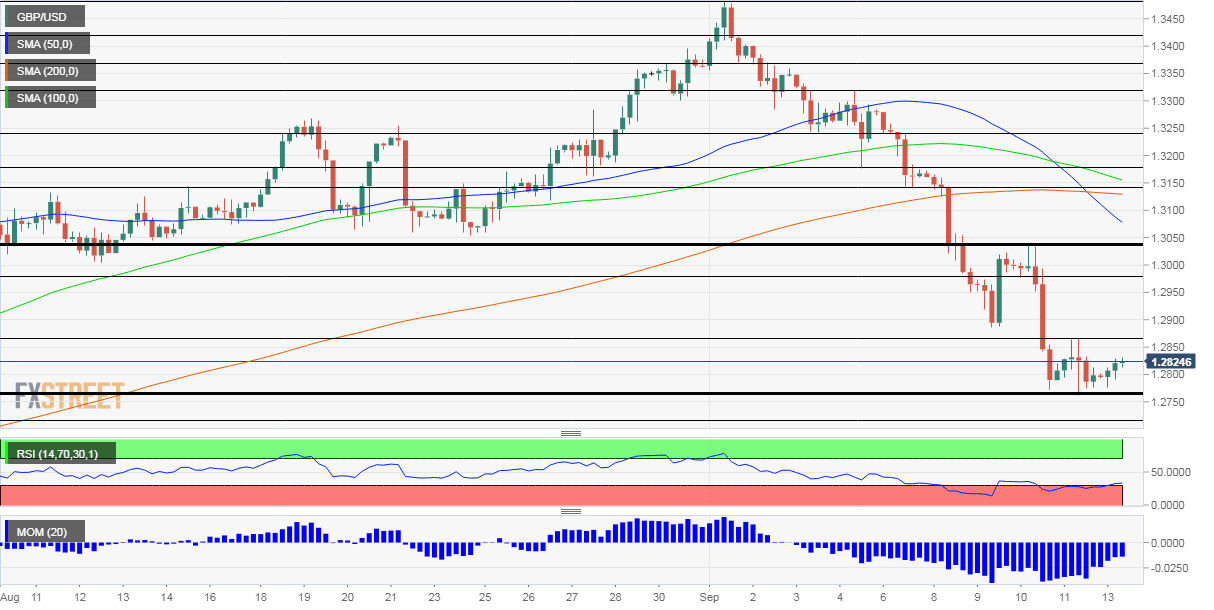

GBP/USD Technical Analysis

Pound/dollar continues suffering from downside momentum on the four-hour chart despite the recent stabilization. The 50 Simple Moving Average crossed the 200 SMA to the downside – another bearish development. The Relative Strength Index has topped the 30 level, thus exiting oversold conditions and opening the door to more falls.

Overall, the recent upside move looks like a "dead cat bounce" – not the beginning of a turnaround.

Support awaits at last week's low of 1.2760, followed by 1.2720, 1.2650, 1.26, and 1.2525 – all levels dating back to July.

Resistance is at 1.2865, the peak of the recent low range. The next level to watch is 1.2970, which supported sterling late last week, before 1.3045, which capped a recovery attempt.

More GBP/USD Weekly Forecast: Boris blows pound's rally, BOE, Fed, and Brexit all eyed

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.