GBP/USD Forecast: Mounting pressure hints another leg south

GBP/USD Current price: 1.4158

- The UK May Markit Manufacturing PMI was downwardly revised to 65.6 from 66.1.

- The UK reported zero new coronavirus-related deaths for the first time since the pandemic began.

- GBP/USD is pressuring its daily low and poised to extend its decline.

The British Pound was the worst performer this Tuesday, as GBP/USD fell from an early high at 1.4228, a fresh two-year high, to as low as 1.4154, ending the day near the latter. The decline was triggered by a downward revision of the UK Markit Manufacturing PMI, which resulted in 65.6 in May from 66.1. However, the decline continued despite limited buying interest for the greenback.

The pound was not able to recover, even after the UK reported zero new coronavirus-related deaths in the last 24 hours, for the first time since the pandemic began. At the same time, the kingdom reported 3,165 new cases, although Prime Minister Boris Johnson said there is no evidence to delay reopening. On Wednesday, the UK will publish April Mortgage Approvals and M4 Money Supply for the same month.

GBP/USD short-term technical outlook

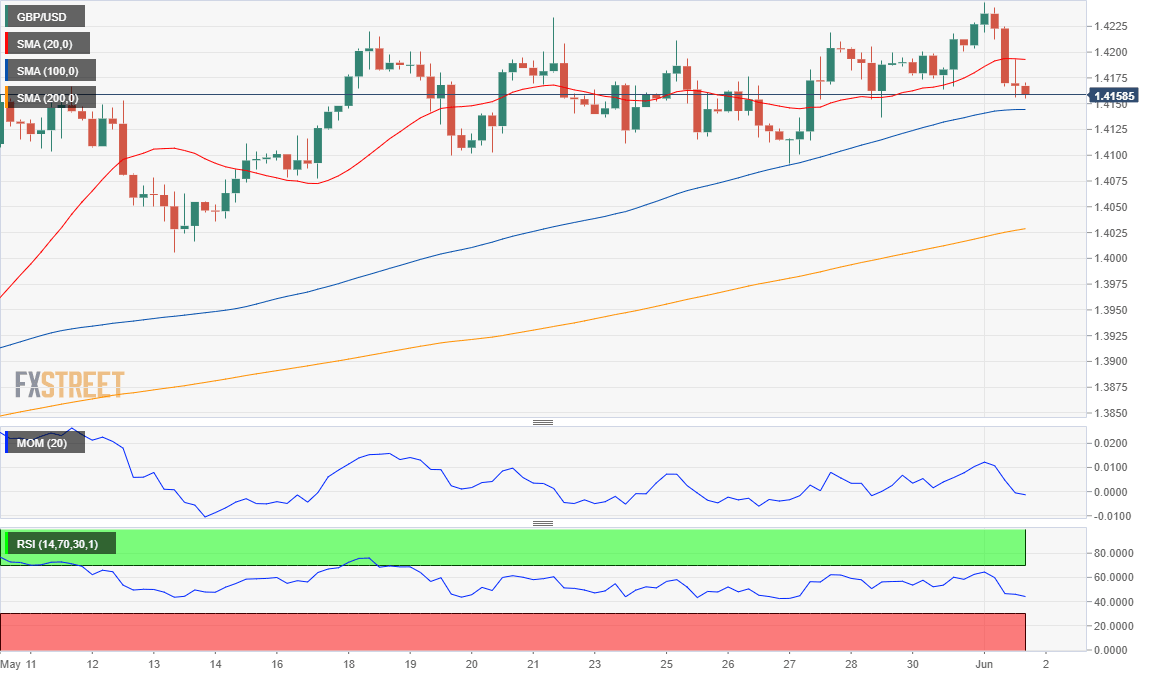

The GBP/USD pair is pressuring the daily low heading into the Asian opening, a sign of further slides ahead. The 4-hour chart shows that it has broken below a bullish 20 SMA, now providing dynamic resistance at 1.4190, and approaching an also bullish 100 SMA, the latter at 1.4140. The Momentum indicator advances within neutral levels, but the RSI is stable around 45, indicating constant selling pressure.

Support levels: 1.4140 1.4100 1.4060

Resistance levels: 1.4190 1.4235 1.4285

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.