GBP/USD Forecast: Market participants waiting for UK employment figures

GBP/USD Current price: 1.3837

- The UK will publish employment-related data on Tuesday, focus on unemployment.

- Irish companies working their way around the Brexit protocol.

- GBP/USD edged lower amid renewed demand for the safe-haven dollar.

The GBP/USD pair bottomed for the day at 1.3827, recovering some ground in the American afternoon to end the day at around 1.3854. The pair depended solely on the dollar’s demand, or the lack of it, ignoring news coming from the United Kingdom. Nevertheless, news showed a sharp increase in the value of goods imported from Northern Ireland to the Republic, up by 77%, while the value of exports rose 43%. Companies on both sides of Ireland are making their way to avoid difficulties resulting from the Brexit protocol.

On Tuesday, the UK will release employment-related data. The ILO unemployment rate for the three months to June is foreseen steady at 4.8%, although the focus will be on the September Claimant Count Change, the number of people claiming from jobless benefits, which printed at -114.8K in the previous month. Finally, Average Earnings are foreseen up in the three months to June.

GBP/USD short-term technical outlook

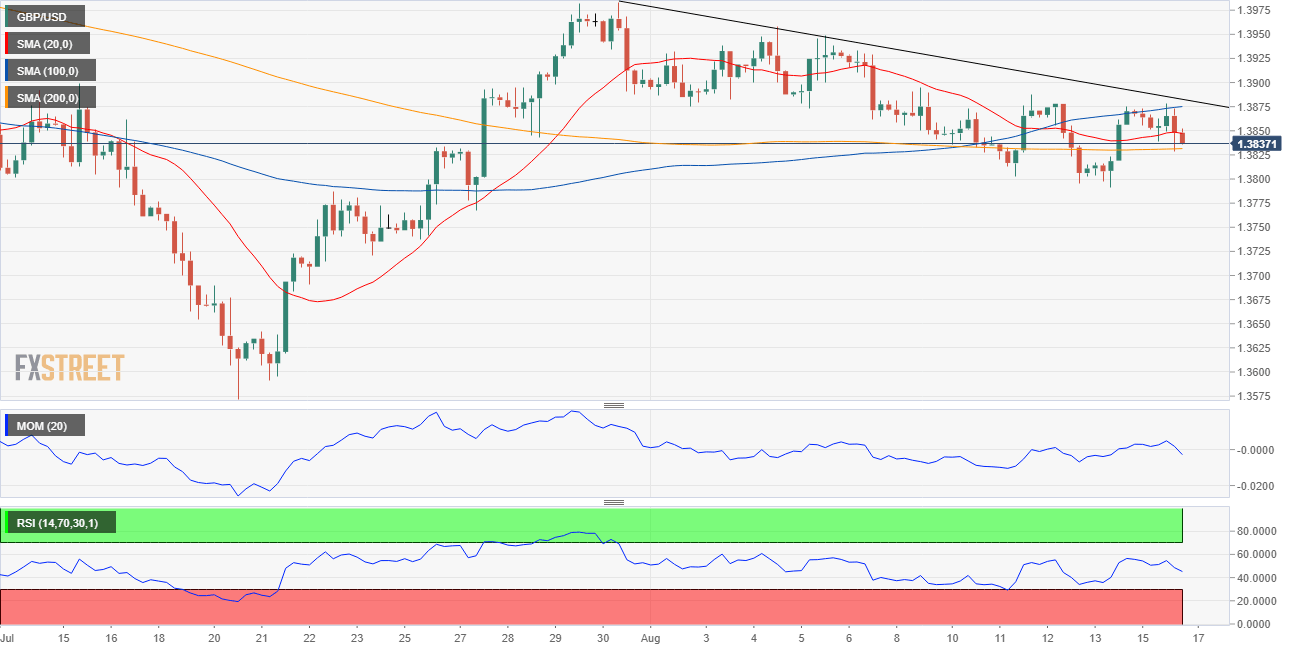

The GBP/USD pair is held below a daily descendant trend line coming from July’s high at 1.3983 and remains neutral in the near-term. The 4-hour chart shows that it is trading mid-way between directionless 100 and 200 SMAs while hovering around an also flat 20 SMA. Additionally, technical indicators hover around their midlines without directional strength. The mentioned trend line is currently at 1.3880, providing immediate resistance.

Support levels: 1.3790 1.3755 1.3705

Resistance levels: 1.3880 1.3935 1.3980

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.