GBP/USD Forecast: Is the recovery over? Massive dollar strength and a trio of UK issues point down

- GBP/USD has been struggling to recover from Wednesday's sharp fall.

- Taper-related dollar strength will likely continue as Fed Chair Powell speaks again.

- Brexit, the end of the furlough scheme and petroal shortages are set to weigh on sterling.

- Thursday's four-hour chart is showing cable is outside oversold territory.

Is the pound an emerging market currency? Sterling's 300+-pip collapse raised the unflattering comparison, and several reasons suggest more falls could come.

The dollar is the main downside driver. US 10-year Treasury yields remain at elevated levels in response to the Federal Reserve's signal that it would taper its bond-buying scheme in the next meeting. Investors are selling US debt ahead of the bank's reduction of such puchases, and the resulting higher yields make the greenback more attractive.

Fed Chair Jerome Powell is set to testify before Congress later in the day, in his third public appearance in as many days. On Wednesday, he remained optimistc that supply chain issues – the main source of inflation – would be resolved, but seemned intent on tapering. Lawmakers' questions on inflation could push Powell to make statements that would remind markets of the Fed's upcoming withdrawal of support. That would be dollar positive.

On the other side of the pond, final UK Gross Domestic Product figures for the second quarter showed a 5.5% growth rate, better than 4.8% initially reported. However, Q2 is in the rearview mirror and this GDP report is where the good news ends. Three issues weigh on the pound.

1) Furlough finishes: Around 5% of the British workforce is still on the pandemic-era furlough program which expires on Thursday. While some will return to their jobs, others could remain out of the workforce for various reasons. High uncertainty about the implications of the move could weigh on the pound.

2) Gasoline crisis: Petrol stations are still suffering from long queues amid fears that they would dry out. The lack of lorry drivers – many are EU nationals – resulted in dryouts. The army is ready to help but the crisis has yet to be resolved.

3) Brexit: Apart from the problems at the pump, the UK and France remain at odds over fishing rights in the English Channel. The seemingly neverending row over the Northern Irish protocol also keeps a lid on the pound.

Later in the day, end-of-quarter flows could result in some temporary dollar-selling – countering recent moves, as money managers adjust their portfolios. However, cable is set to struggle for all the reasons mentioned above.

GBP/USD Technical Analysis

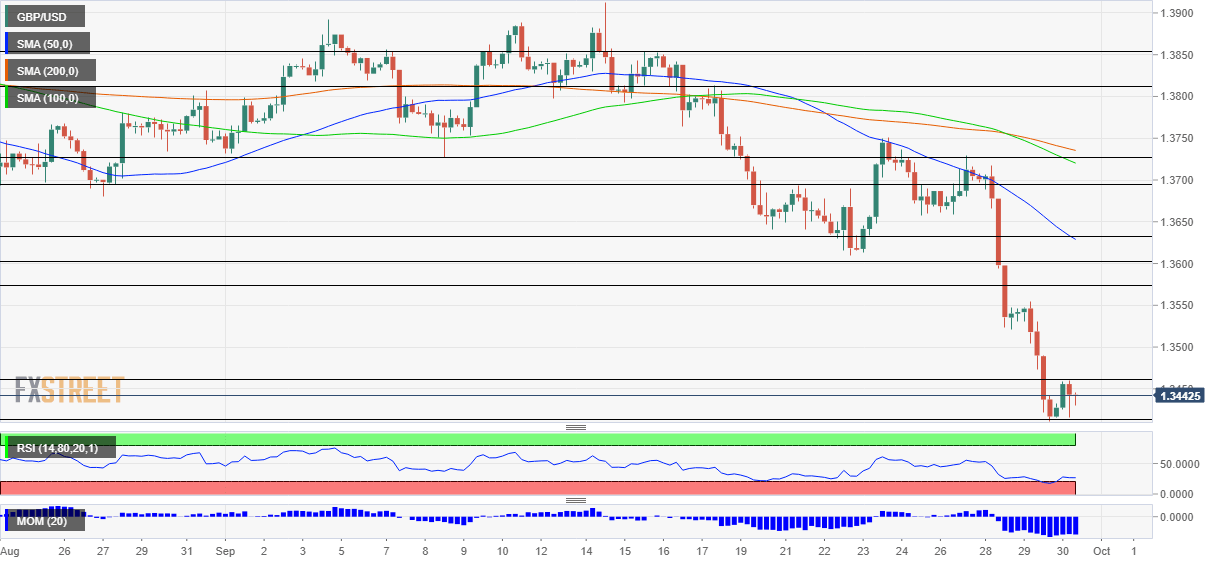

Pound/dollar has bounced from the lows, pushing the Relative Strength Index (RSI) on the four-hour chart above 20 – outside extreme overbought conditions. That allows for further falls. Momentum is to the downside and the pair is trading below the 50, 100 and 200 Simple Moving Averages. Overall, bears in control.

Support awaits at the fresh September low of 1.3410. It is followed by levels last seen late last year, such as 1.3390, 1.3310 and 1.3295.

Immediate resistance is at the daily high of 1.3460, followed by the psychologically significant 1.35 line and then by 1.3570.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.