GBP/USD Forecast: Free-fall set to continue as a UK rate cut seems unstoppable

- GBP/USD has tumbled down after the UK reported a considerable fall in retail sales.

- Further speculation about the BOE and US consumer confidence are on the radar.

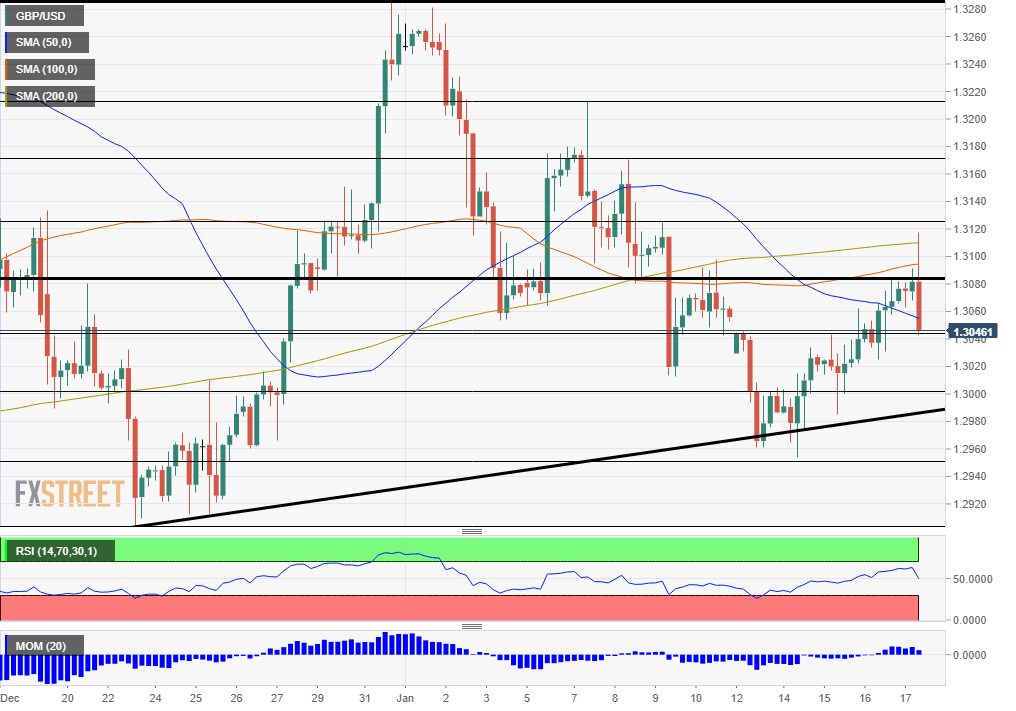

- Friday's four-hour chart is showing that the pair is nearing overbought conditions.

Triple trouble for the pound – UK Retail Sales for December have badly disappointed with a fall of 0.6%, far worse than an increase that was expected. Moreover, To add insult to injury, it came on top of a downward revision to November's numbers.

GBP/USD bulls had been frontrunning the figures and pushing the pair higher – and now find pound/dollar down nearly 70 pips from the highs of 1.3118.

Friday's devastating figures complete a trio of downbeat statistics that all lead to one conclusion – the Bank of England is set to cut rates at the end of the month. Moreover, several BOE officials such as Governor Mark Carney have laid down heavy hints that they will act sooner rather than later.

Earlier this week, Gross Domestic Product data disappointed with a drop of 0.3% in November. Worse for the BOE, the annual Consumer Price Index decelerated to 1.3% – the lowest since 2016.

Brexit uncertainty has been weighing on the economy for a considerable time, and this is unlikely to change anytime soon. Prime Minister Boris Johnson is vying to have Big Ben bong on Brexit Day, January 31, but for the economy, the party seems to be over.

Beyond the BOE

Outside the UK, the mood is more cheerful. Markets continue applauding the Sino-American trade deal despite questions about its implementation. The upbeat market mood is weighing on the safe-haven dollar and Japanese yen.

Moreover, the Chinese economy is doing well according to fresh data released from Beijing. While Gross Domestic Product slowed to 6% in the fourth quarter of 2019, the figure met expectations. Moreover, industrial output, retail sales, and fixed investment all beat estimates. This further adds to pressure on the greenback.

After US retail sales figures for December beat expectations – the Control Group jumped by 0.5% – more up to date consumption insights are due out on Friday. The University of Michigan's preliminary Consumer Sentiment figures for January are forecast to show ongoing strong confidence by shoppers.

See US Michigan Consumer Sentiment Preview: No change is good

Overall, speculation about the timing of the British rate cut and US data are set to move pound/dollar.

GBP/USD Technical Analysis

The Relative Strength Index on the four-hour chart has neared 70 – on the verge of overbought conditions – implying a downside correction. Other indicators are positive, with the currency pair breaking above the 200 Simple Moving Average after topping the 50 and 100 SMAs.

Resistance waits at 1.3125, which was a swing high last week. It is followed by 1.3170 and 1.3210, which were stepping stones on the way down in early January. The late-December peak of 1.3285 is the upside target.

Looking down, support awaits at 1.3080, which provided support in early January and capped the pair before its recent rise. Further down, 1.3040 was a swing high earlier this week, and it is followed by 1.30, a psychologically significant level. The weekly low of 1.2950 is next.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.