- GBP/USD has been under pressure after the UK announced a new lockdown.

- Progress on fisheries in Brexit talks has been keeping sterling from falling.

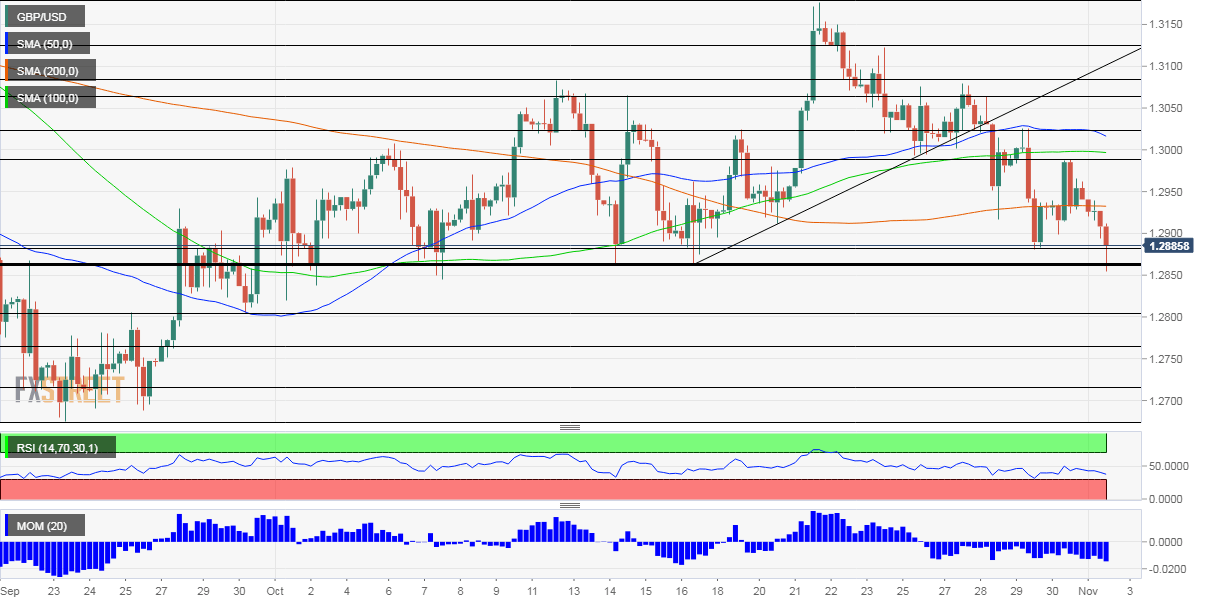

- Monday's four-hour chart is showing bears are in control.

Is France ready to fry fewer fish? Reports about progress on the sensitive issues of fisheries – perhaps due to a compromise from Paris – has been holding the pound from falling. However, this temporary reprieve may fizzle out.

First, EU and UK negotiators have had their bouts of optimism but these were often followed by reports of disagreements and occasionally break up in the talks. Yet even if a deal between Brussels and London are near, sterling grapples with other issues.

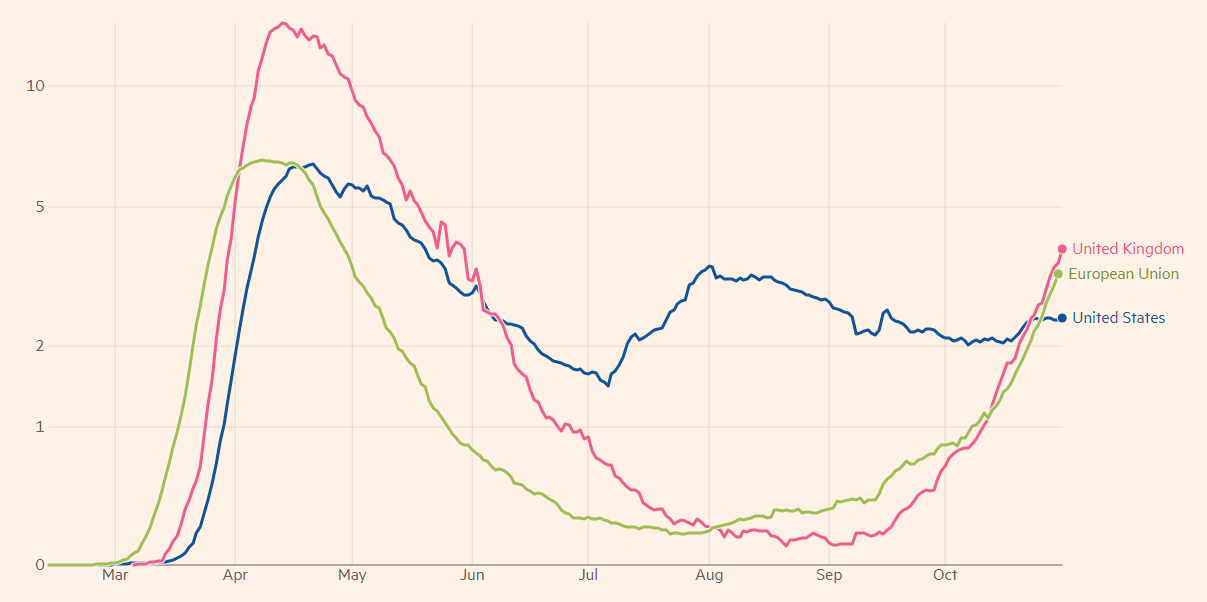

UK Prime Minister Boris Johnson announced a nationwide lockdown in England – a complete reversal from his previous stance, saying that shuttering would be a disaster. Parliament is set to approve the restrictions designed to curb the spread of COVID-19 on Wednesday, paving the way for a month-long lockdown from Thursday.

Britain is struggling with a surge in cases, infections, and hospitalizations, with current figures surpassing the government's "reasonable best-case scenario." If confirmed by the House of Commons, the shuttering will take place just as the Bank of England announces its rate decision on "Super Thursday." The BOE could follow through on its talk and set sub-zero borrowing costs, further weighing on sterling.

Source: FT

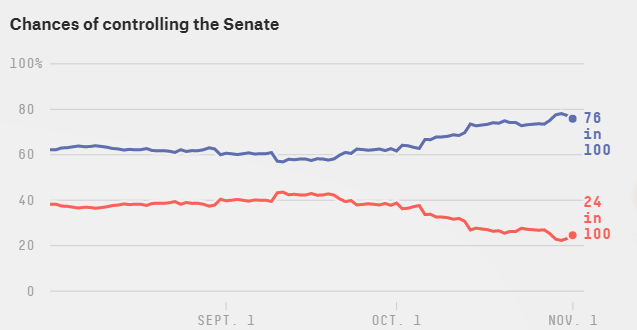

On the other side of the pond, tensions have reached elevated levels ahead of the elections. President Donald Trump continues trailing rival Joe Biden – yet the race is tighter in swing states than on the national level. Nate Silver's FiveThirtyEight gives the Democrat an 89% chance of winning – yet investors remain skeptical of surveys after Trump's surprising win in 2016.

Markets are eyeing a large stimulus bill, which would require not only a Biden victory but also for his party to win the Senate. where the race is closer.

Source: FiveThirtyEight

Over 94 million Americans have already voted, taking advantage of early an mail-in voting. That consists of 68% of the total vote count in 2016. Florida, the eternal swing state, has a high turnout and is already processing votes. It should provide an early read, but all eyes this year are on Pennsylvania, which has the highest chance of being the tipping-point state.

For the Senate, North Carolina is of high interest, and there are additional states to watch.

See 2020 Elections: Three states traders should watch, plus places that could provide surprises

Markets fear the prospects of a contested election – in which Trump declares victory before all the votes are counted and/or the race goes down to the wire or to the courts. Such concerns are boosting the greenback.

While the greenback could fall in a relief rally, that would not happen until there is a clear result.

On the data front, Markit's final UK Manufacturing Purchasing Managers' Index for October marginally beat estimates with 53.7 points, up from 53.3 originally reported. The industrial sector has likely continued expanding in the US as well, with the ISM Manufacturing PMI set to hold above 55 points.

US October Manufacturing PMI Preview: Eyes on the New Orders Index

Overall, covid and politics are set to continue dominating trading, and that may weigh on cable.

GBP/USD Technical Analysis

Pound/dollar has dipped below 1.2865, a double-bottom recorded during October. While the break is yet to be confirmed, pressure is mounting. Momentum on the four-hour chart is to the downside, and the currency pair failed to break above the 200 Simple Moving Average. Moreover, the Relative Strength Index is above 30, thus outside oversold conditions.

All in all, bears are in control.

Below 1.2865, the next support lines were last seen in September and were stepping stones on the way up. These include 1.28 and 1.2770, and 1.2665.

Some resistance is at 1.2880, which was a low point last week. It is followed by 1.2985, a wing high, and then by 1.3020.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD bounces back from five-month lows

AUD/USD ends its three-day decline on Wednesday, bouncing back from levels not seen since mid-November. Nevertheless, hawkish remarks from Federal Reserve officials and the influx of safe-haven flows could bolster the US Dollar and potentially limit the upside of pair in the short term.

USD/JPY trades with mild losses below 155.00 on risk-aversion

USD/JPY trades with mild losses near 154.65 on Wednesday during the early Asian trading hours. The robust US economy and sticky inflation data have triggered the expectation that the Fed might delay the easing cycle to September from June, which provides some support to the US Dollar.

Gold ascends but remains shy of testing $2,400 amid hawkish Fed remarks

Gold prices edged higher late in North American session, gaining 0.22% following a hawkish tilt by Fed Chair Jerome Powell. Economic data from the United States was mixed, though Monday’s Retail Sales report and Powell’s remarks kept US Treasury yields higher, capping the yellow metal’s advance.

Fetch.ai Price Prediction: FET must hold above $1.70 for strength

Fetch.ai is trading with a bearish bias. It comes as chatter about the proposed integration with the Ocean Protocol and the SIngularityNET ecosystem remains fresh.

UK CPI March Preview: Inflation pressures to dissipate further, adding to bets of BoE rate cuts

The March UK CPI report will be released by the Office for National Statistics on Wednesday. United Kingdom’s headline and core annual inflation are set to ease in March. The UK CPI report could hint at the BoE’s interest rate cut, rocking the Pound Sterling.