GBP/USD Forecast: Could UK GDP boost pound?

GBP/USD Current price: 1.3866

- UK Q2 Gross Domestic Product is foreseen at 4.8% QoQ from -1.6% in the previous quarter.

- A not so hawkish BOE is likely to maintain the pound’s demand subdued.

- GBP/USD lost bullish momentum after approaching the 1.3900 threshold.

The GBP/USD pair trades near a daily high of 1.3887, as the market’s good mood boosted demand for the high-yielding pound. The pair started the day on the back foot, trading as low as 1.3802 during the European session, as the greenback strengthened on the back of US stimulus news.

Demand for the Sterling cooled after the BOE announced it will start selling bonds purchased under its quantitative easing policy when it has raised interest rates to 1%, while the current interest rate stands at a record low of 0.1%. Speculative interest was looking for a more hawkish stance coming from the UK’s central bank amid the better shape of the economy post-reopening.

Meanwhile, the UK macroeconomic calendar had nothing relevant to offer so far this week. The country will publish on Thursday, June Industrial Production and Manufacturing Production and the preliminary estimate of Q2 Gross Domestic Product, the latter expected at 4.8% QoQ from -1.6% in Q1. The NIESR GDP Estimate for the three months to July is foreseen at 4.4%, down from the previous 4.8%.

GBP/USD short-term technical outlook

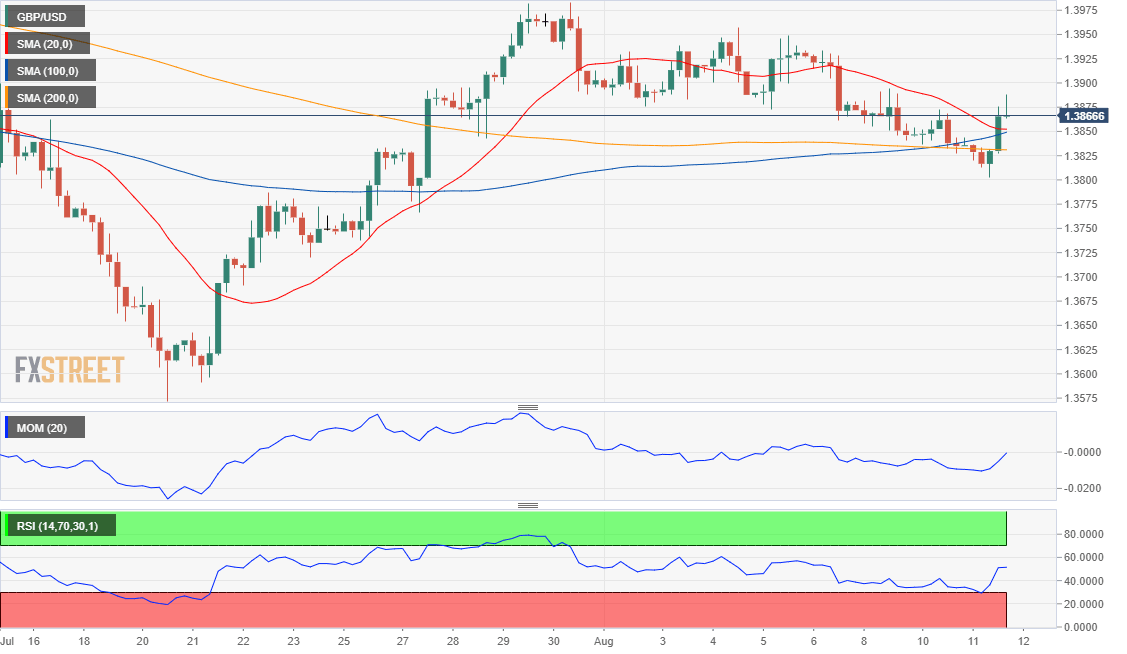

The GBP/USD pair trades in the 1.3870 price zone, losing bullish momentum in the near-term. The 4-hour chart shows that the pair has recovered above all of its moving averages, which anyway converge directionless in a 20 pips range. At the same time, technical indicators lost their bullish strength and stabilized around their midlines, reflecting decreased buying interest as the price approached the 1.3900 threshold.

Support levels: 1.3845 1.3790 1.3755

Resistance levels: 1.3910 1.3960 1.4000

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.