GBP/USD forecast: Can the British pound rally sustain as the Dollar dips and risk tensions mount?

-

GBP/USD holds a cautiously bullish tone as dollar weakness dominates short-term momentum.

-

Stabilizing UK data and lack of BOE dovishness help sterling maintain an edge despite political risks.

-

With rate differentials narrowing between the Fed and BOE, the pound may extend gains if USD remains soft.

With the U.S. dollar under pressure and UK data stabilizing, the British pound could extend gains - but fragile sentiment and political risks may limit upside.

Sterling holds ground as Dollar softens

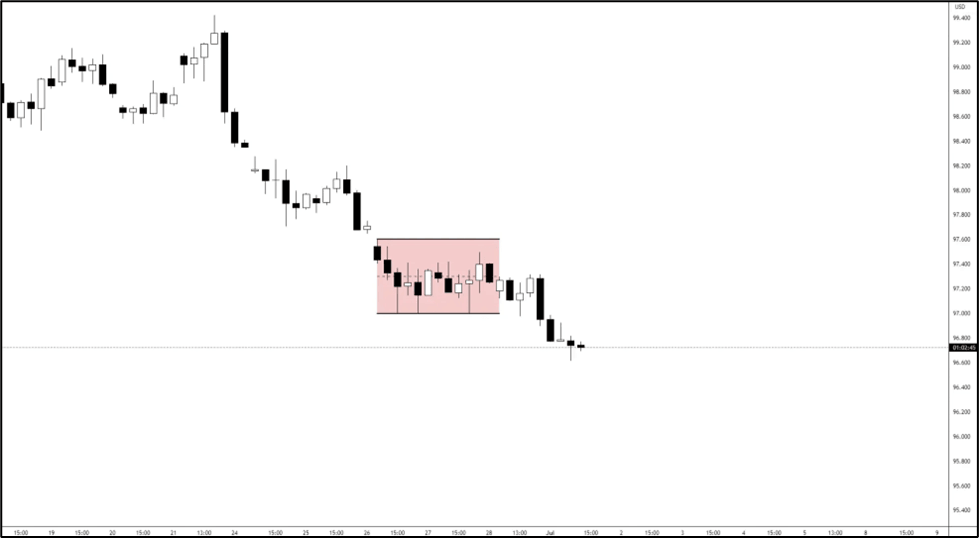

The British pound is trading with a cautiously bullish tone, finding strength above the 1.3700 level as the U.S. dollar loses momentum. While Fed rate cut bets and falling U.S. bond yields continue to drag the greenback lower, sterling's gains are more a reflection of dollar weakness than overwhelming UK strength.

Still, the pair has shown resilience in recent sessions, supported by stabilizing UK data and a lack of dovish surprise from the Bank of England.

Fed, tariffs, and the fragile Dollar

The broader macro narrative driving GBP/USD this week is rooted in U.S. monetary policy and geopolitical developments:

-

Rate cut expectations for September now sit at 75%, pressuring the dollar across the board.

-

U.S.-China tariff tensions are back in focus as the July 9 deadline looms.

These forces have shifted momentum in favor of the pound - but not without caution.

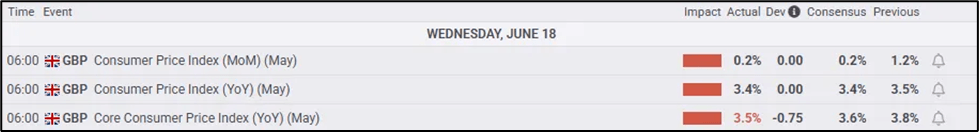

Domestic Factors: UK Cautiously Steady

Signs of moderating inflation and stabilizing services data are helping sterling retain support. While the Bank of England remains data-dependent, markets are not yet pricing aggressive cuts, which gives the pound a slight policy advantage over the Fed in the near term.

That said, political risks remain in the backdrop, especially as the UK navigates post-election fiscal direction and potential trade policy shifts.

Technical outlook: Can GBP/USD break higher?

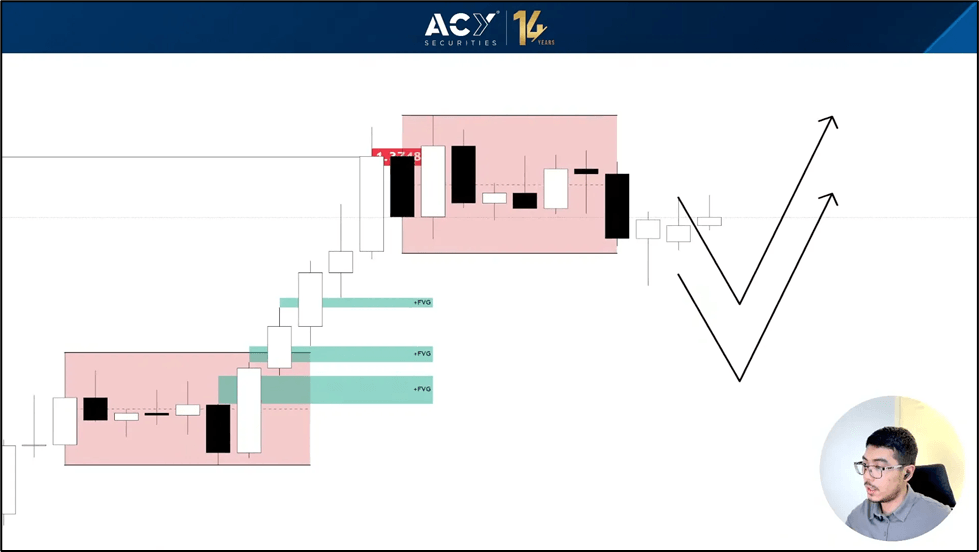

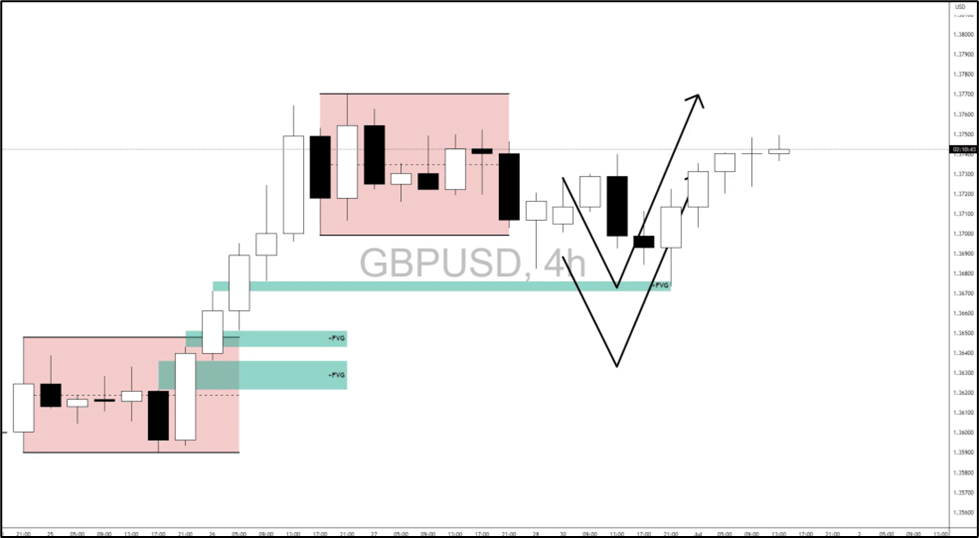

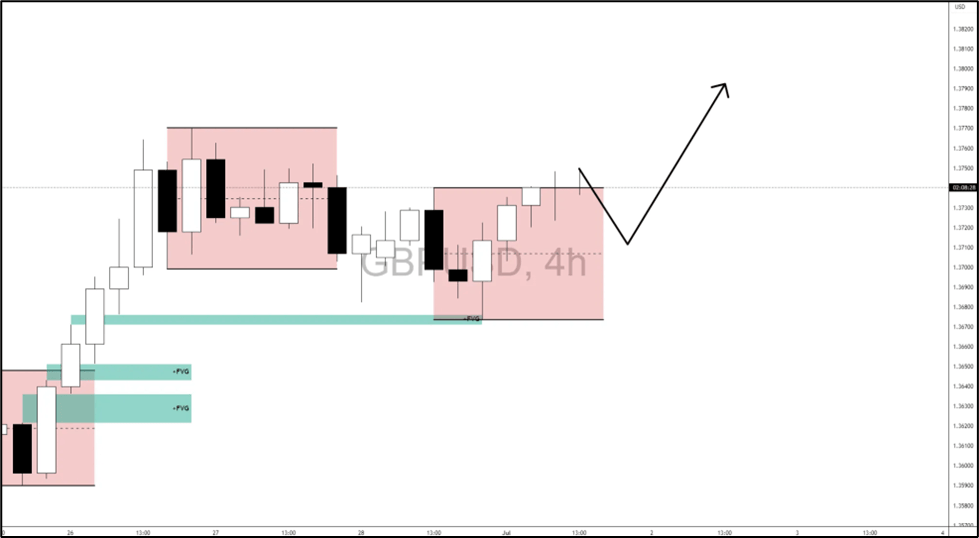

In the previous forecast - Dollar, majors, indices and Gold gameplan for this week - GBP/USD was expected to lean bullish, and that outlook is now materializing. The pound is pushing to fresh highs, in line with the scenario outlined yesterday.

GBP/USD has bounced decisively from the 1.36712-1.36763 FVG level, forming a potential higher low and showing signs of bullish continuation. Price is now pushing above the 1.3720 handle, suggesting short-term momentum favors buyers.

Bullish scenario

GBP/USD is now creating new highs relative to where it bounce off, 1.36712-1.36763 FVG level. Bullish scenario would continue materialize as long as:

-

1.36712-1.36763 FVG level remains intact.

-

Price does not trade and close below the 1.3700 level.

-

Dollar continued weakness.

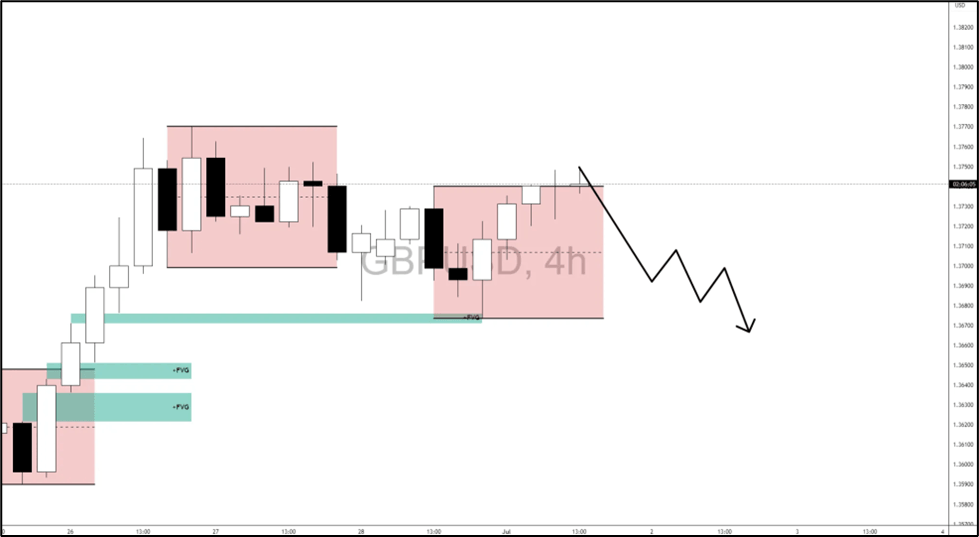

Bearish scenario

GBP/USD remains at risk of a bearish reversal if price fails to hold above the 1.3730 resistance zone. If pound rolls over and:

-

Breaks below 1.3700 level.

-

Dollar gains traction.

-

1.36712-1.36763 FVG level fails to hold.

We could see a flip of pound to the downside.

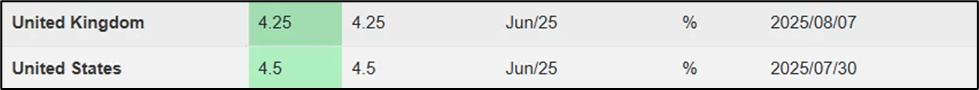

Interest rates differentials closing in between GBP & USD: More upside on GBP?

The ongoing GBP/USD rally is driven more by dollar weakness than underlying UK strength. Expectations of a Fed rate cut continue to support the pound as interest rate differentials narrow. However, if geopolitical tensions escalate or the Fed signals a more hawkish stance, sterling could quickly come under renewed pressure.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.