GBP/USD Forecast: Buyers are struggling to defend 1.2700

- GBP/USD declined below 1.2700 in the European morning on Friday.

- The USD could preserve its strength in case safe-haven flows continue to dominate the markets.

- December PCE inflation data will be featured in the US economic docket.

GBP/USD lost its traction and dropped below 1.2700 in the early trading hours of the European session on Friday. Although the near-term technical outlook is yet to highlight a build-up of bearish momentum, buyers could remain discouraged unless the pair manages to reclaim 1.2700.

Upbeat macroeconomic data releases from the US provided a boost to the US Dollar (USD) during the American session on Thursday. The Bureau of Economic Analysis (BEA) reported that the US' Gross Domestic Product grew at an annual rate of 3.3% in the fourth quarter (first estimate). This reading surpassed the market expectation for a 2% expansion and helped the USD outperform its rivals.

In the second half of the day, the BEA will release the Personal Consumption Expenditures (PCE) Price Index data, the Federal Reserve's preferred gauge of inflation, for December. The GDP report showed on Thursday that the PCE Price Index rose 2% on a quarterly basis in the fourth quarter, matching the previous quarter's increase and the market expectation. Thus, monthly PCE inflation figures are unlikely to offer any significant surprises.

Instead, market participants could remain focused on risk perception. US stock index futures were last seen losing between 0.3% and 0.8% on the day. A bearish opening in Wall Street, followed by an extended decline in major equity indices, could help the USD hold its ground ahead of the weekend and make it difficult for GBP/USD to regain its traction.

GBP/USD Technical Analysis

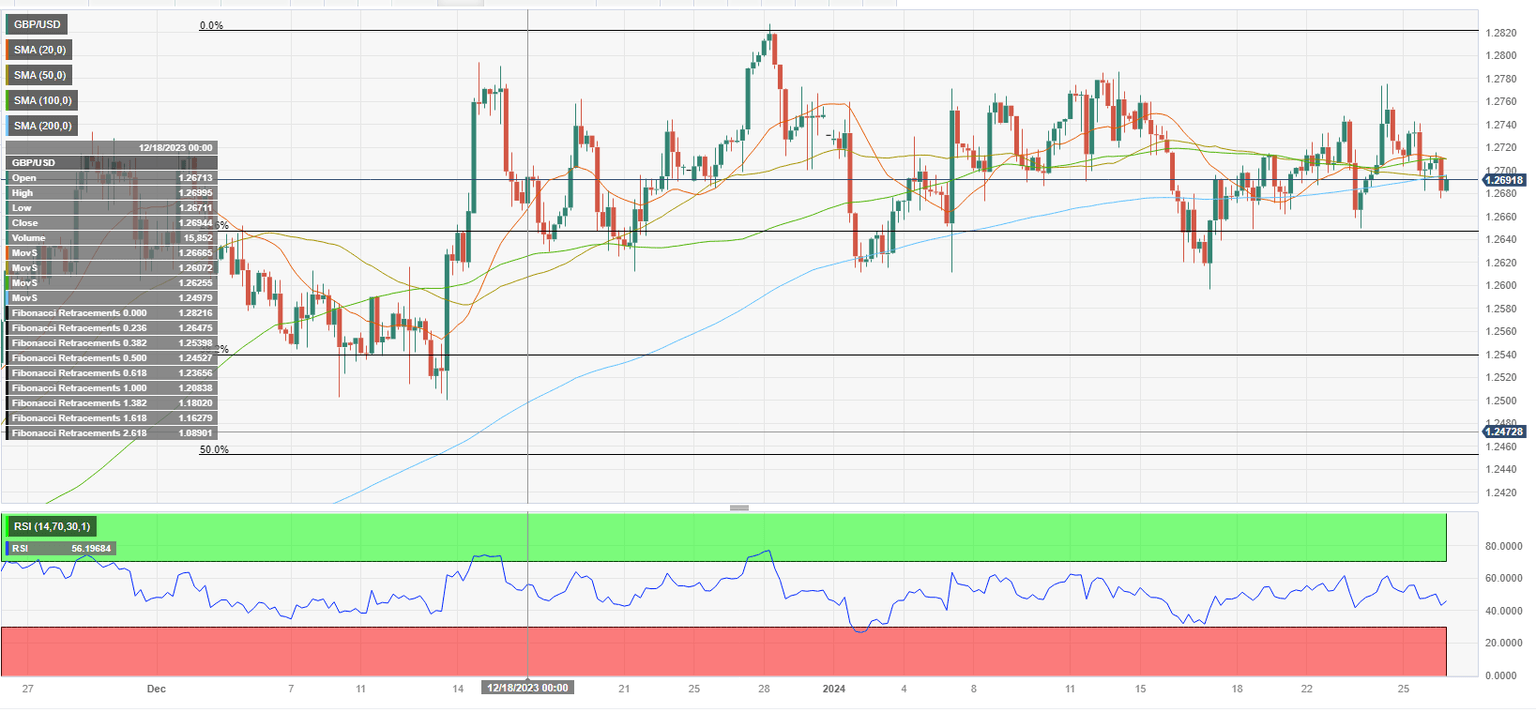

The 200-period Simple Moving Average (SMA) on the four-hour chart aligns as a pivot level at 1.2700. If GBP/USD continues to use that level as resistance, technical sellers could remain interested. In this scenario, 1.2650 (Fibonacci 23.6% retracement of the October-December uptrend) and 1.2600 (psychological level, static level) could be seen as next bearish targets.

On the upside, resistances could be at 1.2760 (static level) and 1.2780 (static level) in case GBP/USD stabilizes above 1.2700.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.