GBP/USD Forecast: Bulls to retain control as long as 1.1600 holds

- GBP/USD has advanced to a fresh 10-day high above 1.1600 on Friday.

- Broad-based dollar weakness helps GBP/USD stay bullish during the European session.

- UK PM Truss announced a two-year energy price guarantee on Thursday.

GBP/USD has gathered bullish momentum following Thursday's indecisive action and advanced to its strongest level in over a week above 1.1600. The pair remains on track to snap a three-week losing streak and additional recovery gains could be witnessed as long as buyers continue to defend 1.1600.

During the European trading hours on Thursday, GBP/USD gained traction after British Prime Minister Liz Truss announced that they will introduce a two-year "energy price guarantee." Truss explained that a typical household will pay no more than £2,500 a year on energy bills, translating into an annual saving of roughly £1,000 based on October prices.

In the second half of the day, the renewed dollar strength forced the pair to turn south but with risk flows returning to markets in the early Asian session on Friday, the greenback started to weaken against its major rivals. The US Dollar Index, which touched a multi-decade high of 110.78 on Friday, was last seen losing 1% on the day at 108.55.

Reflecting the upbeat market mood, the UK's FTSE 100 Index is up nearly 1.7% on a daily basis. Moreover, US stock index futures are rising between 0.8% and 1% ahead of Wall Street's opening bell.

The US economic docket won't feature high-impact data releases on Friday. Before the Fed foes into the blackout period over the weekend, several FOMC officials, including Chicago Fed President Charles Evans and Kansas City Fed President Esther George, will be delivering speeches.

The fact that the CME Group FedWatch Tool points to a market pricing of a nearly-90% probability of a 75 basis points rate hike suggests that Fedspeak is unlikely to trigger a dollar rebound. Instead, investors will keep a close eye on risk perception.

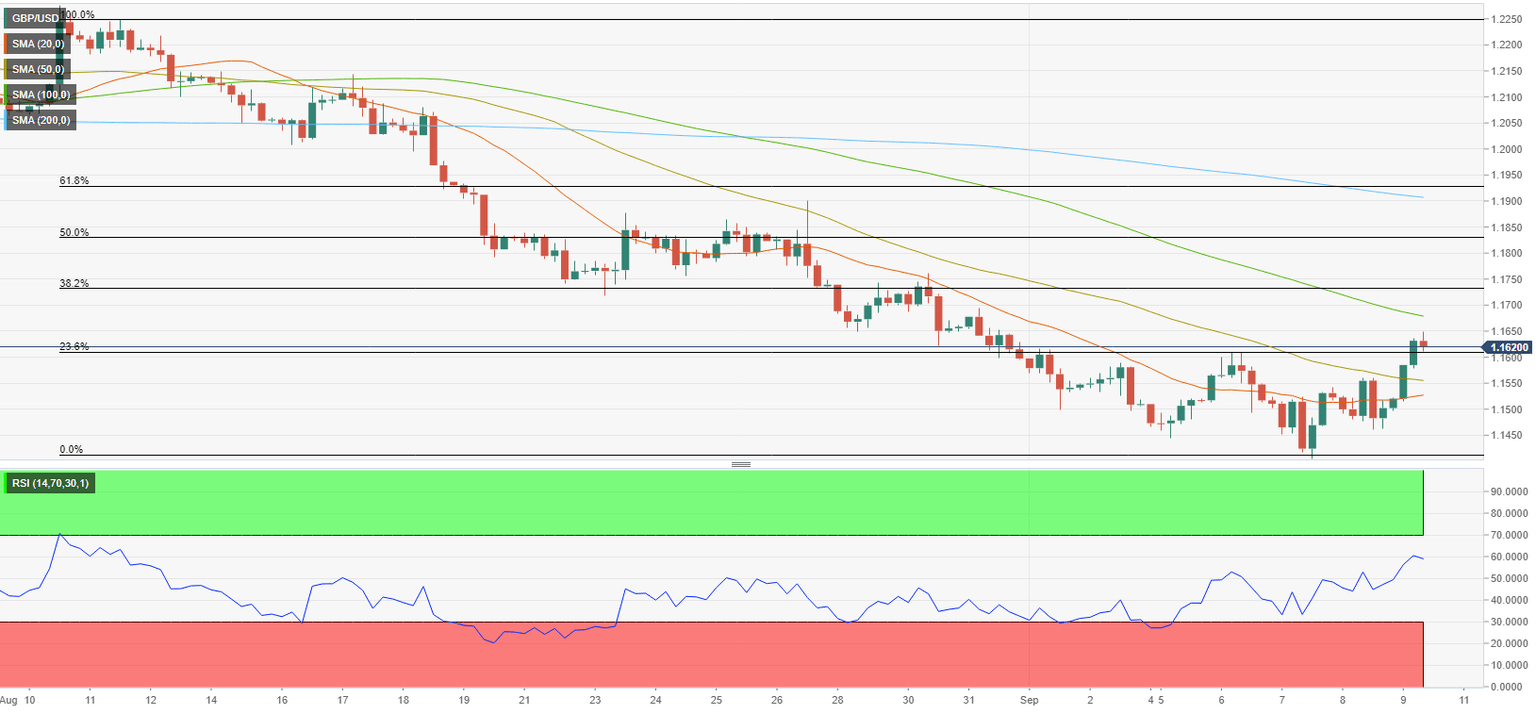

GBP/USD Technical Analysis

1.1600 (psychological level, Fibonacci 23.6% retracement of the latest downtrend) aligns as key support for GBP/USD in the near term. In case the pair manages to hold above that level, buyers are likely to look to dominate the action. In that case, 1.1670 (100-period SMA) could be seen as the next bullish target ahead of 1.1700 (psychological level, and 1.1730 (Fibonacci 38.2% retracement).

On the downside, a drop below 1.1600 could attract sellers and trigger a downward correction toward 1.1550 (50-period SMA), 1.1530 (20-period SMA) and 1.1500 (psychological level).

In the meantime, the Relative Strength Index is holding comfortably above 50, reflecting a bullish shift in the short-term technical outlook.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.