GBP/USD Forecast: Bulls hold the grip, 1.3800 at sight

GBP/USD Current price: 1.3729

- UK employment data came in better than anticipated, backed the pound.

- The number of new coronavirus contagions in the UK keeps retreating.

- GBP/USD is technically bullish and ready to break beyond 1.3745.

The GBP/USD pair peaked at 1.3744, flirting with the yearly high and holding nearby as the day comes to an end. The pound got boosted by better than expected UK employment data, as the ILO unemployment rate came in at 5% for the three months to November. The December Claimant Count Change resulted at 7K much better than the 35K anticipated, while average earnings rose by more than anticipated, including and excluding bonus, up by 3.6% in the three months to November.

The UK won’t publish macroeconomic data this Wednesday, with the focus on US Durable Goods Orders, and the Federal Reserve monetary policy announcement, although the Fed is not expected to surprise. The number of new coronavirus contagions in the UK continues decreasing, as the country reported 20,089 cases this Tuesday.

GBP/USD short-term technical outlook

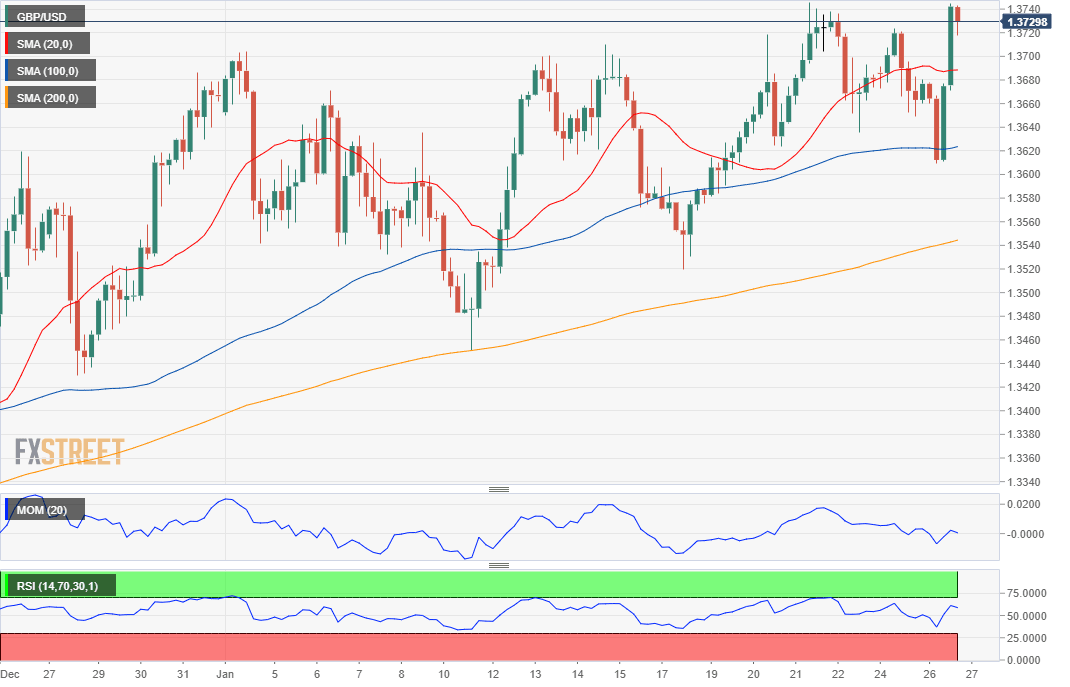

The GBP/USD pair holds on to gains, trading around 1.3730. The near-term picture is bullish, as, in the 4-hour chart, it has advanced above all of its moving averages, which remain directionless. Technical indicators hold well into positive ground, partially losing their bullish strength. Renewed buying interest beyond 1.3745, the year high, should open the doors for a steeper advance regardless of the market’s sentiment.

Support levels: 1.3695 1.3650 1.3605

Resistance levels: 1.3745 1.3790 1.3840

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.