GBP/USD Forecast: British pound loses ground as markets doubt BoE hike in November

- British pound has lost its traction after softer-than-expected inflation data.

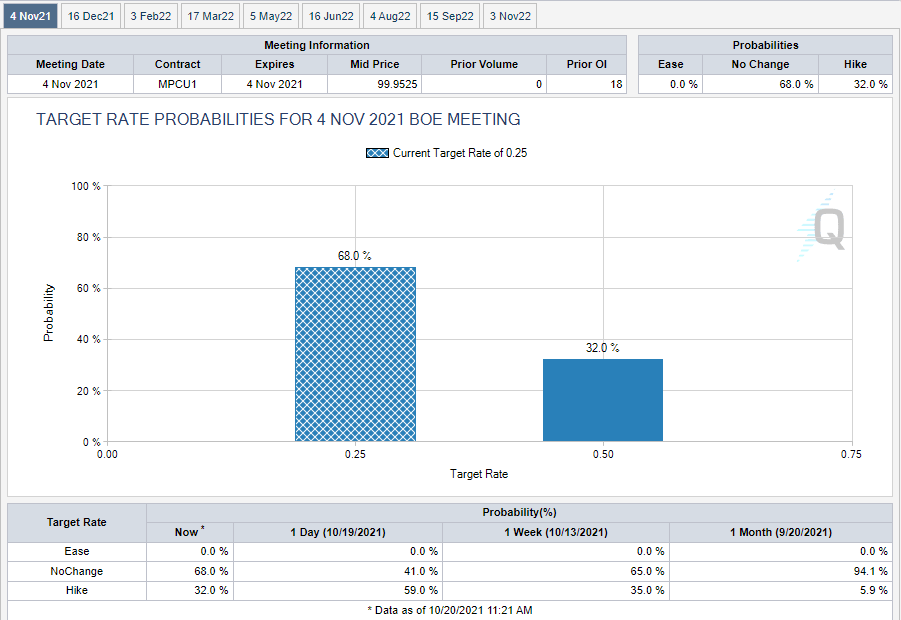

- Odds of a BoE rate hike in November declined to 32% from 59%.

- Dollar finds its footing on rising Treasury bond yields.

Following Tuesday's rally to a fresh five-week high of 1.3835, the GBP/USD pair has reversed its direction and fell below 1.3800 on Wednesday after the data from the UK showed that inflation in September wasn't as scary as anticipated.

The UK's Office for National Statistics (ONS) reported that the annual Consumer Price Index (CPI) edged lower to 3.1% in September from 3.2% in August. Moreover, the Core CPI, which excludes volatile food and energy prices, retreated to 2.9% from 3.1%. Further details of the publication revealed that the Producer Price Index - Input rose to 11.4% on a yearly basis, falling short of the market expectation of 11.6%.

The inflation report seems to be weighing on the British pound by impacting the Bank of England's rate hike expectations.

According to the CME Group's BoEWatch Tool, markets are pricing in a 32% of a 25 basis points rate increase in November, compared to 59% on Tuesday. Nevertheless, the probability of a rate hike before the end of the year stays unchanged at around 70%, suggesting that the recent decline in GBP/USD is a correction rather than a reversal of direction.

Source: cmegroup.com

The Federal Reserve will release its Beige Book at 1800 GMT on Wednesday and investors will look for fresh clues regarding the persistence of input price pressures.

Before the Fed goes into the blackout period on October 23, this publication could hint at a reduction of asset purchases as early as November, which in turn would provide a boost to the US Treasury bond yields and the greenback.

Meanwhile, the US Dollar Index is struggling to gather bullish momentum and consolidating its losses below 94.00, helping GBP/USD limit its losses for the time being.

GBP/USD technical analysis

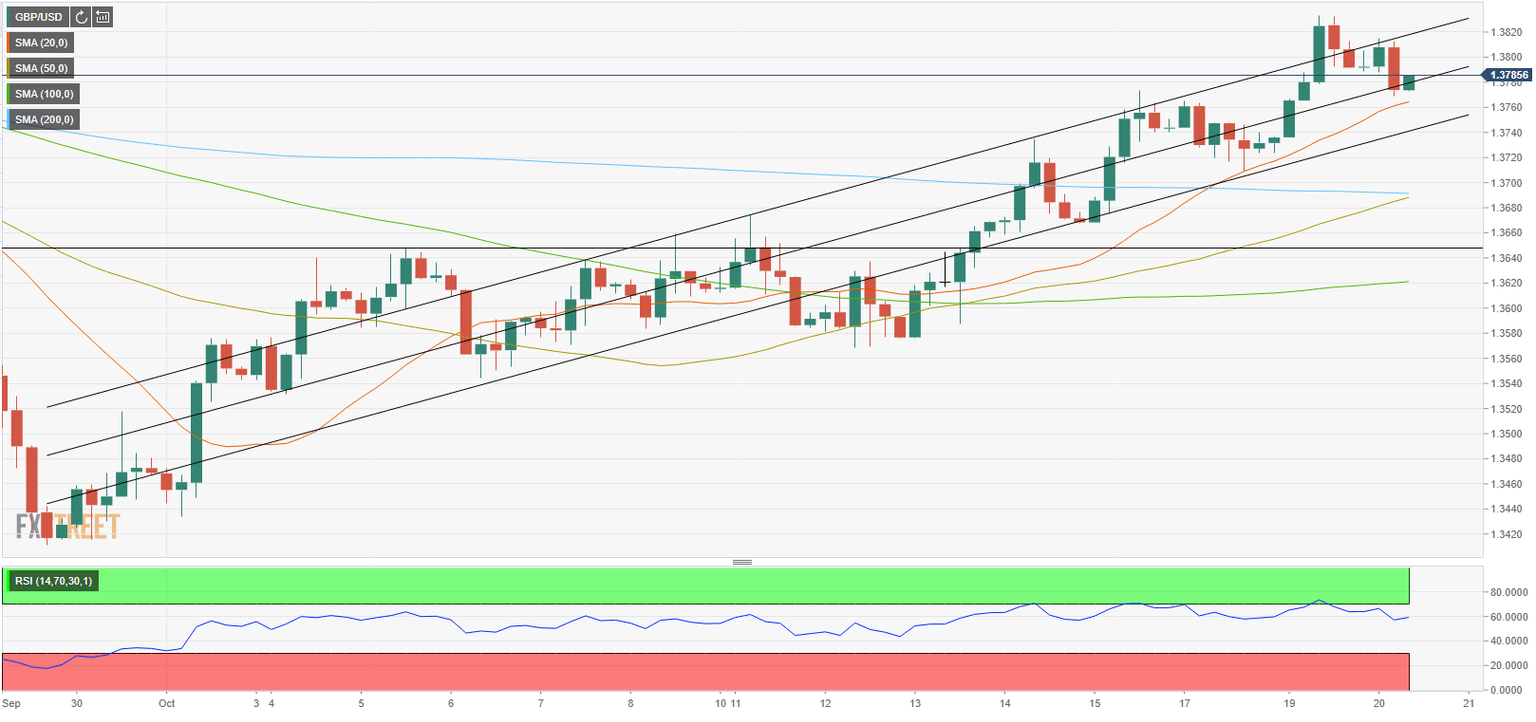

Despite the recent decline, GBP/USD continues to trade within the ascending regression channel coming from late September. Furthermore, the Relative Strength Index (RSI) indicator on the four-hour chart holds around 60, confirming the view that the bullish bias remains intact while the pair is making a technical correction.

In case the pair drops below the lower limit of the channel at 1.3750, it could extend its correction toward the 200-period SMA on the four-chart, which is currently floating around 1.3700. 1.3650 (static level) and 1.3620 (100-period SMA) could be seen as the next support levels.

On the other upside, the initial hurdle is located at 1.3800 (psychological level) before 1.3835 (October 19 high) and 1.3850 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.