GBP/USD Forecast: Brexit deal and coronavirus second wave leading the way

GBP/USD Current price: 1.2916

- UK PM Johnson considering new restrictive measures amid coronavirus second wave.

- Brexit negotiations remain stuck although renewed hopes provided support these days.

- GBP/USD is technically bearish, a steeper decline expected once below 1.2860.

The GBP/USD pair stalled its weekly recovery on Friday, ending the day in the red at around 1.2915. Mild hopes related to a post-Brexit trade deal with the EU provided modest support to Sterling earlier in the week. The UK currency lost momentum on the heels of an increase in the number of COVID-19 cases. The kingdom put under lockdown some cities in the north, and, over the weekend, PM Johnson was said to be considering tightening restrictions as they are now “seeing a second wave.” News suggest that the UK will ban households mixing and reduce opening hours for pubs.

By the end of the week, the kingdom released August Retail Sales, which rose 0.8% MoM, beating expectations, while sales were up 2.8% when compared to a year earlier, missing expectations but doubling the previous 1.4%. This Monday, BOE members will speak before a parliamentary committee presenting the Inflation Report Hearings.

GBP/USD short-term technical outlook

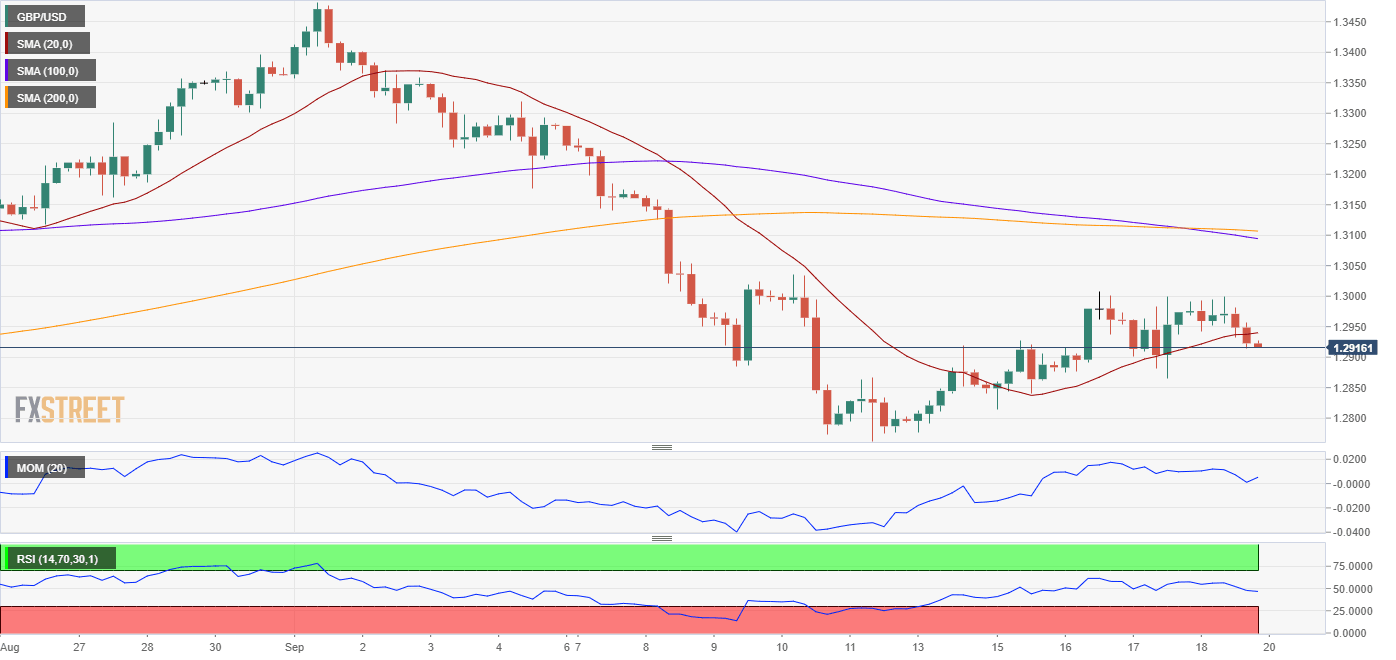

The daily chart for the GBP/USD pair indicates that the risk remains skewed to the downside, as the pair keeps developing below a mildly bearish 20 DMA, while technical indicators head south within negative levels. The pair bottomed at 1.2762 this month, with the 100 and 200 DMAs converging not far below the level. In the 4-hour chart, technical readings also support another leg lower, as the pair broke below its 20 SMA after spending most of the week below the lager ones, as technical indicators entered negative territory with sharp bearish slopes.

Support levels: 1.2900 1.2860 1.2810

Resistance levels: 1.2950 1.2990 1.3045

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.