GBP/USD Forecast: Bearish pressure could increase below 1.3480

- GBP/USD has turned south pressured by the renewed dollar strength.

- Additional losses could be witnessed with a drop below 1.3480.

- Market participants will continue to pay close attention to US Treasury bond yields.

GBP/USD has reversed its direction after rising to its highest level in nearly two months at 1.3600 late Wednesday as the dollar's market valuation continues to impact the pair's action. Although the pound seems to have steadied around 1.3500 in the early European session, additional losses could be witnessed in case it drops below 1.3480.

The minutes of the FOMC's December meeting minutes revealed that policymakers saw it appropriate for the Fed to start the balance sheet normalization process soon after the first rate hike. The publication showed that participants see the current economic conditions warranting a faster pace of balance sheet runoff compared to the previous normalization episode.

As a result, the benchmark 10-year US Treasury bond yield climbed above 1.7% for the first time in ten months and helped the dollar regather its strength. The US Dollar Index is currently posting small daily gains above 96.20, allowing GBP/USD to stay in a consolidation phase. 1.75% aligns as key resistance for the 10-year yield and a move beyond that level could trigger another leg higher in the dollar and weigh on GBP/USD.

In the meantime, the report published by IHS Markit showed that the business activity in the UK service sector continued to expand at a modest pace in December but investors paid little to no attention to this data.

Later in the day, the US Department of Labor's weekly Initial Jobless Claims data, the ISM's December Services PMI and November Factory Orders figures will be looked upon for fresh impetus. Markets will continue to pay close attention to US T-bond yields as well.

GBP/USD Technical Analysis

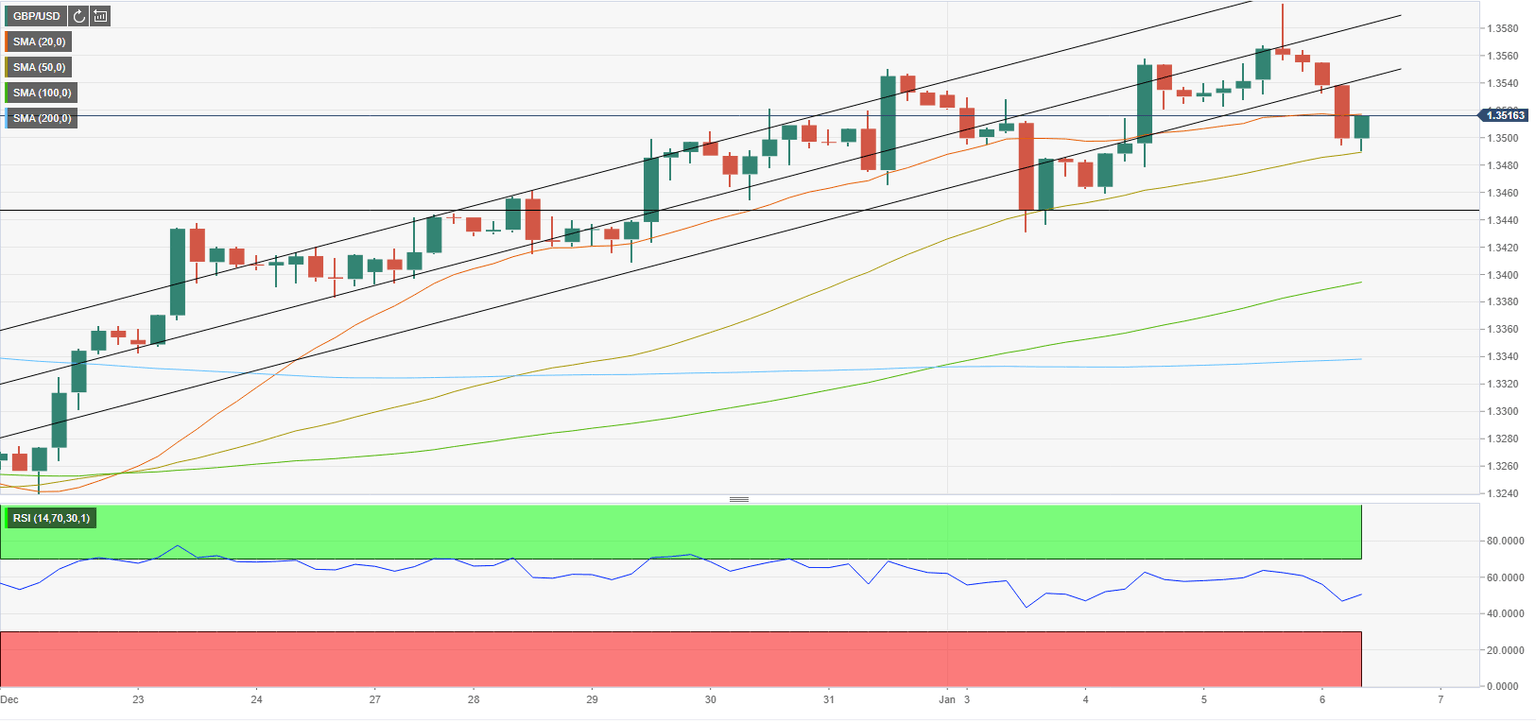

The near-term technical outlook shows that buyers have moved to the sidelines with the Relative Strength Index (RSI) indicator retreating to 50 on the four-hour chart. Furthermore, GBP/USD is now trading below the ascending regression channel coming from December 21.

The 50-period SMA on the same chart, currently located at 1.3480, has managed to trigger a reversal several times in the past couple of weeks and the bearish pressure could increase in case a four-hour candle closes below it. The next support could be seen at 1.3450 (static level) before 1.3400 (psychological level, 100-period SMA).

In order to attract bulls, GBP/USD needs to rise above 1.3550 to return with the ascending channel. Above that level 1.3580 (middle line of the channel) aligns as next resistance before 1.3600 (psychological level, January 5 high).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.