GBP/USD Forecast: 1.2500 proves to be a tough resistance to crack

- GBP/USD lost its recovery momentum near 1.2500 on Friday.

- Pound Sterling could have a hard time finding demand, with markets forecasting a lower peak rate.

- A 4-hour close above 1.2500 could discourage sellers.

After losing more than 100 pips in a three-day slide, GBP/USD corrected higher in the Asian session on Friday. The pair, however, lost its momentum near 1.2500, highlighting the importance of this technical level.

The US Dollar preserved its strength on Thursday and forced GBP/USD to stay on the back foot after the weekly data published by the Department of Labor revealed that the Initial Jobless Claims declined to 216,000 from 229,000.

Retreating US Treasury bond yields and the positive shift seen in risk mood limited the USD's gains in the Asian trading hours on Friday, allowing GBP/USD to erase a small portion of its weekly losses.

Pound Sterling price this week

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies this week. Pound Sterling was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.59% | 0.83% | 0.54% | 0.90% | 0.90% | 0.63% | 0.61% | |

| EUR | -0.58% | 0.23% | -0.04% | 0.32% | 0.33% | 0.05% | 0.03% | |

| GBP | -0.83% | -0.23% | -0.29% | 0.08% | 0.10% | -0.19% | -0.21% | |

| CAD | -0.54% | 0.05% | 0.28% | 0.37% | 0.37% | 0.09% | 0.09% | |

| AUD | -0.92% | -0.32% | -0.07% | -0.36% | 0.00% | -0.28% | -0.30% | |

| JPY | -0.92% | -0.34% | -0.08% | -0.40% | -0.01% | -0.30% | -0.30% | |

| NZD | -0.65% | -0.02% | 0.20% | -0.08% | 0.28% | 0.29% | 0.00% | |

| CHF | -0.61% | -0.04% | 0.21% | -0.10% | 0.29% | 0.28% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

There won't be any high-tier data releases featured in the US economic docket ahead of the weekend and markets could react to changed in risk perception. Following a bullish start to the day, US stock index futures turned flat in the European session, suggesting that investors refrain from betting on a risk rally.

Meanwhile, investors have lowered Bank of England (BoE) terminal rate forecasts following cautious comments from policymakers earlier this week. According to Reuters, markets are currently pricing in an 85% probability of a 5.75% BoE terminal rate, down sharply from 6.5% seen in July. Hence, investors could remain reluctant to bet on a steady GBP/USD recovery even if the market mood improves.

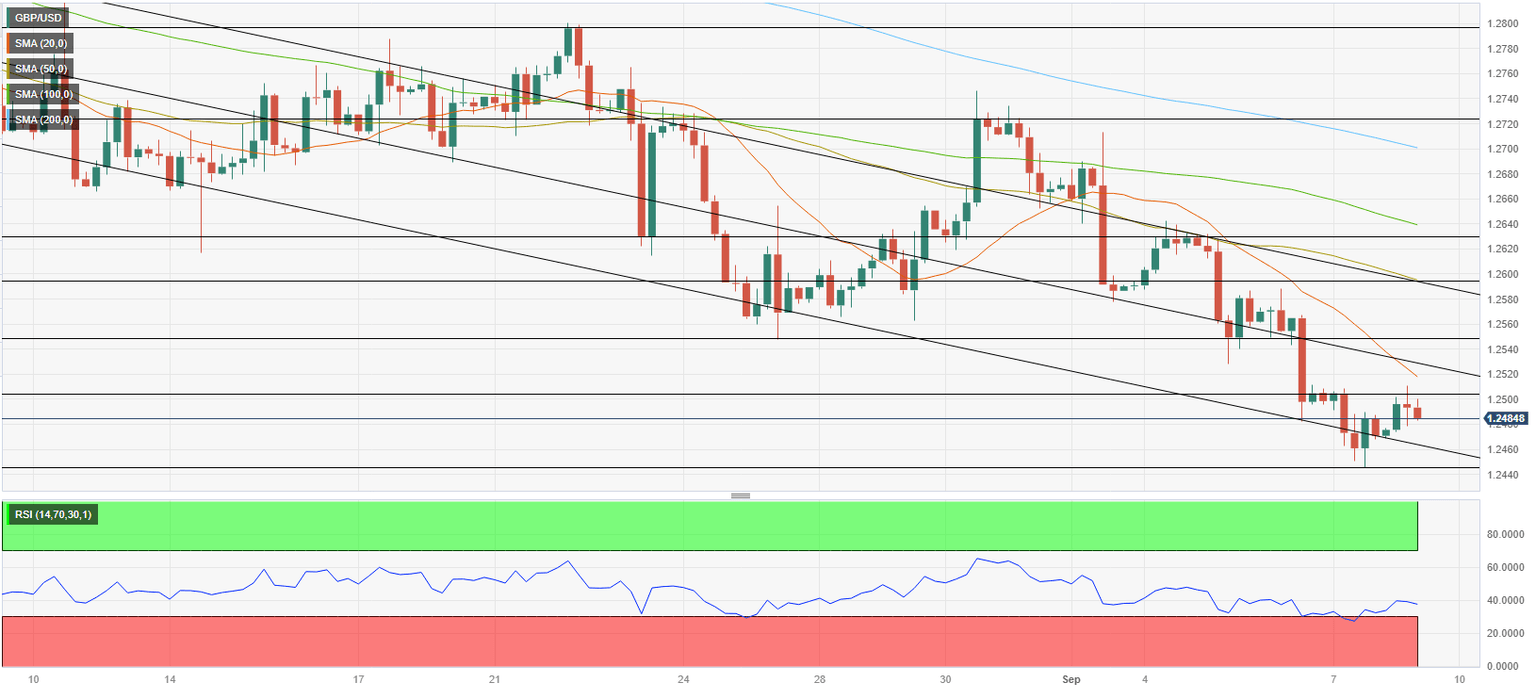

GBP/USD Technical Analysis

If GBP/USD manages to stabilize above 1.2500, sellers could start taking profits off the table ahead of the weekend and open the door for an extended correction toward 1.2530 (mid-point of the descending regression channel) and 1.2550 (static level).

On the downside, 1.2465 (lower limit of the descending channel) aligns as immediate support before 1.2445 (multi-month low set on September 7) and 1.2420 (static level from June).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.