GBP/USD Forecast: 1.2500 proves to be a tough resistance to crack

- GBP/USD has been having a hard time clearing 1.2500.

- The near-term technical outlook favors the bulls ahead of key US data.

- Risk aversion could cause the pair to stretch lower ahead of the weekend.

GBP/USD has edged slightly lower after having failed to clear 1.2500 for the third straight day on Friday. The near-term technical outlook doesn't yet point to a buildup of bearish momentum. In the second half of the day, risk perception and key macroeconomic data releases from the US could drive the pair's action.

Although the data from the US revealed on Thursday that the economy expanded at an annual rate of 1.1% in the first quarter, compared to the market expectation of 2%, the US Dollar (USD) stayed resilient against its rivals. The significant negative contribution of 2.26 percentage point of the change in private inventories to the GDP showed that the US economy has performed better than what the data suggests. Furthermore, the details of the report showed that consumer activity remained healthy despite strengthening price pressures in Q1.

Early Friday, the US Dollar Index builds on Thursday's modest gains and doesn't allow GBP/USD to regain its traction. Meanwhile, US stock index futures trade in negative territory, reflecting a risk-averse market environment.

In the second half of the day, the Personal Consumption Expenditures (PCE) Price Index for March, the Federal Reserve's preferred gauge of inflation, from the US will be featured in the US economic docket. Since the quarterly reading of the PCE inflation data was already revealed in Thursday's GDP report, this data is unlikely to trigger a significant reaction.

Market participants will pay close attention to Employment Cost Index data for the first quarter, which is expected to come in at 1.1%. A stronger-than-expected print could help the USD gather further strength ahead of the weekend and vice versa. A negative opening in Wall Street could also provide additional support to the USD and weigh on the pair.

It's also worth noting that month-end flows on the last trading day of April could ramp up volatility toward the end of the European session and cause usual inter-market correlations to weaken.

GBP/USD Technical Analysis

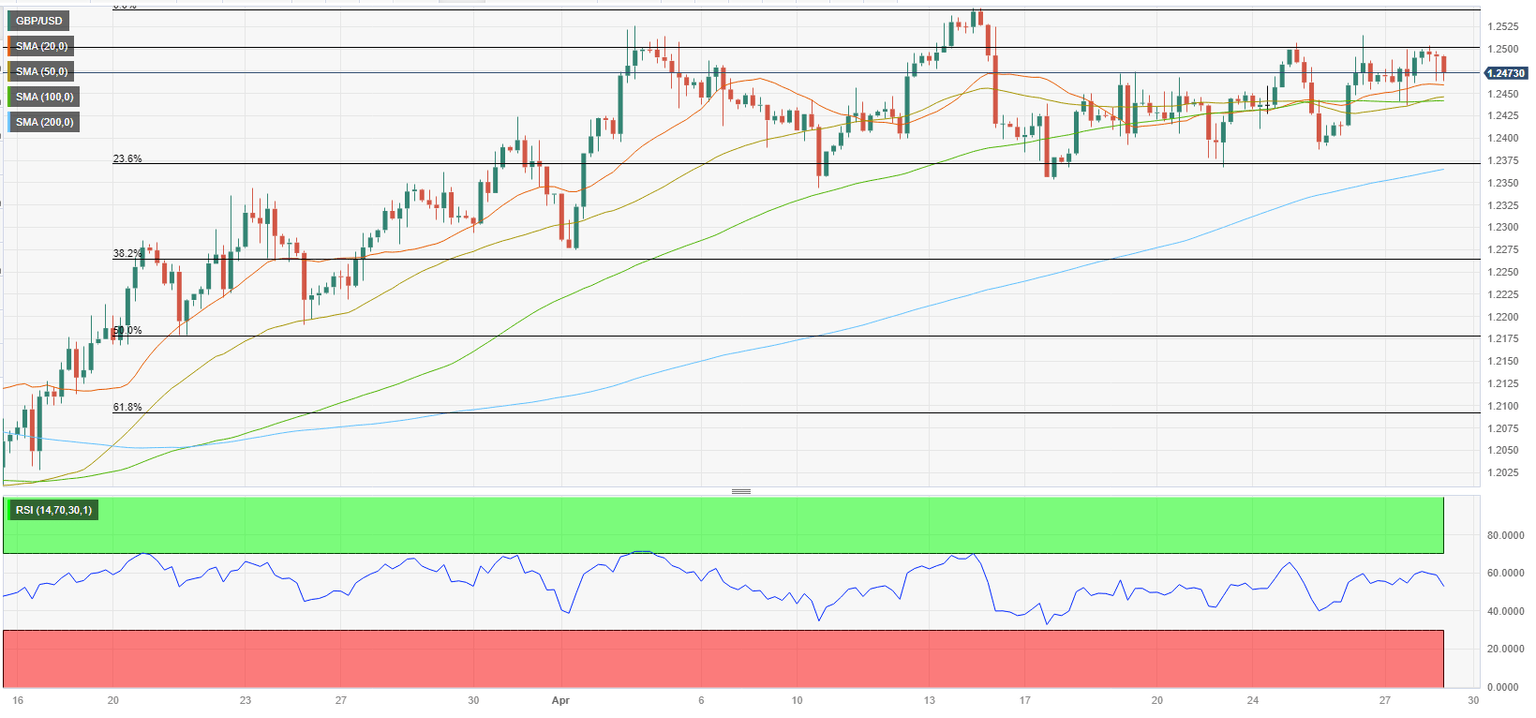

GBP/USD faces key support at 1.2450, where the 50-period and the 100-period Simple Moving Averages (SMA) on the four-hour chart are located. A four-hour close below that level could open the door for an extended slide toward 1.2400 (psychological level, static level) and 1.2370 (200-period SMA, Fibonacci 23.6% retracement of the latest uptrend).

On the upside, buyers could show interest in case GBP/USD rises above 1.2500 and starts using that level as support. In that scenario, 1.2550 (end-point of the uptrend) and 1.2600 (psychological level) could be seen as next bullish targets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.