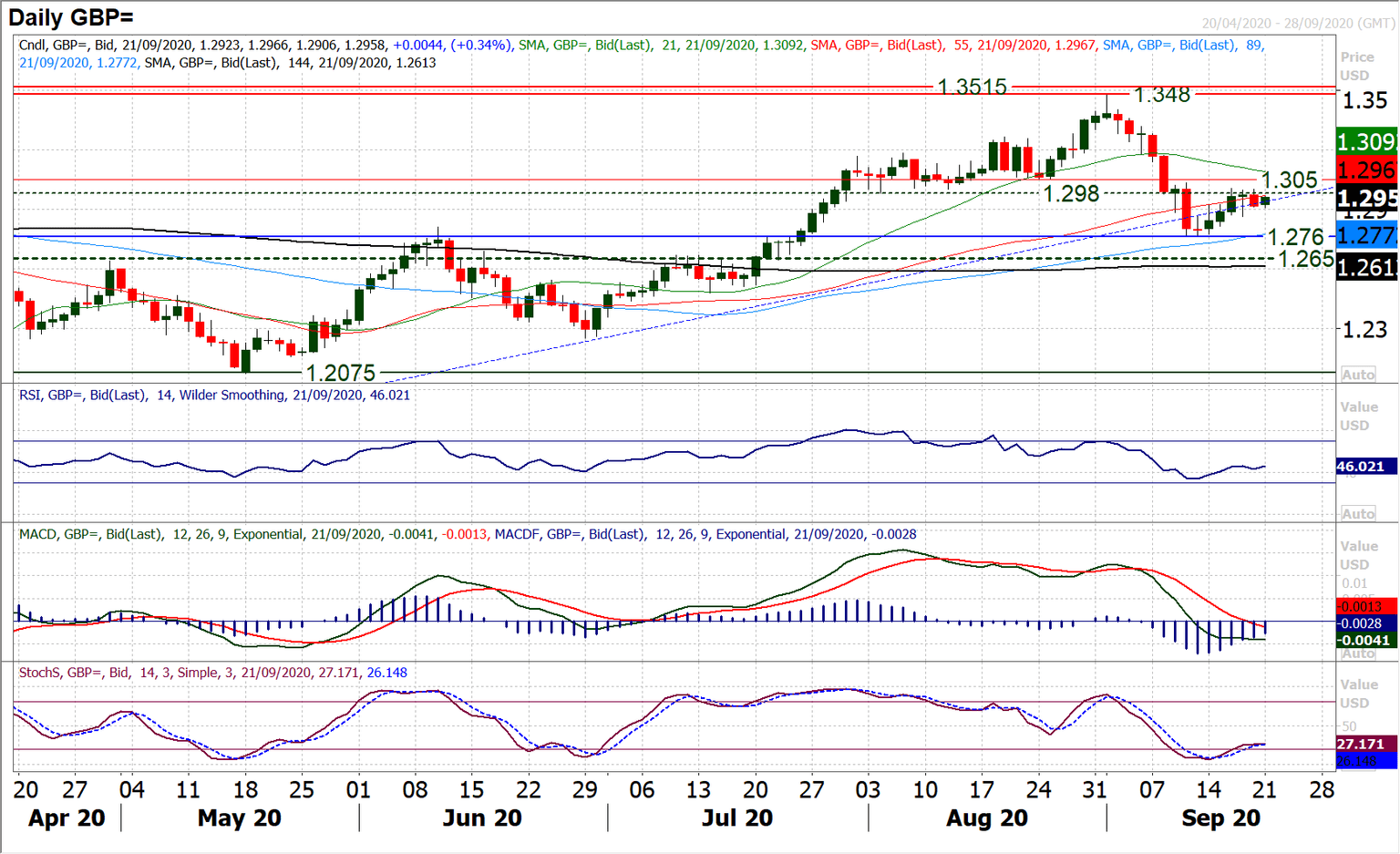

GBP/USD: Could the bulls break through the overhead supply around 1.3000? [Video]

![GBP/USD: Could the bulls break through the overhead supply around 1.3000? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-170160529_XtraLarge.jpg)

GBP/USD

As the rally kicked in early last week, the big question became whether the bulls could break through the overhead supply around 1.3000. The August lows between 1.2980/1.3050 have left significant resistance that now needs to be breached for the near term bounce to become a decisive bull move. Friday’s negative candle once more contained a key resistance forming around 1.3000. However, with the market ticking back higher once more today, it means that the next move on Cable could be crucial for the medium term outlook. After all the tests of the resistance, a move back into the 1.30s would be a positive signal for Cable. There was an initial slide back that rebounded from 1.2865 last week which is now initial support that takes on an increasingly important role in this phase of trading. A move back under 1.2865 would suggest the market rolling over again. There is a ranging and consolidation element to hourly indicators, as well as daily. Having rebounded early today from 1.2905 this will also be a level to watch today.

Author

Richard Perry

Independent Analyst