GBP/USD: buy into weakness Cable's strategy is coming under pressure [Video]

![GBP/USD: buy into weakness Cable's strategy is coming under pressure [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-472155766_XtraLarge.jpg)

GBP/USD

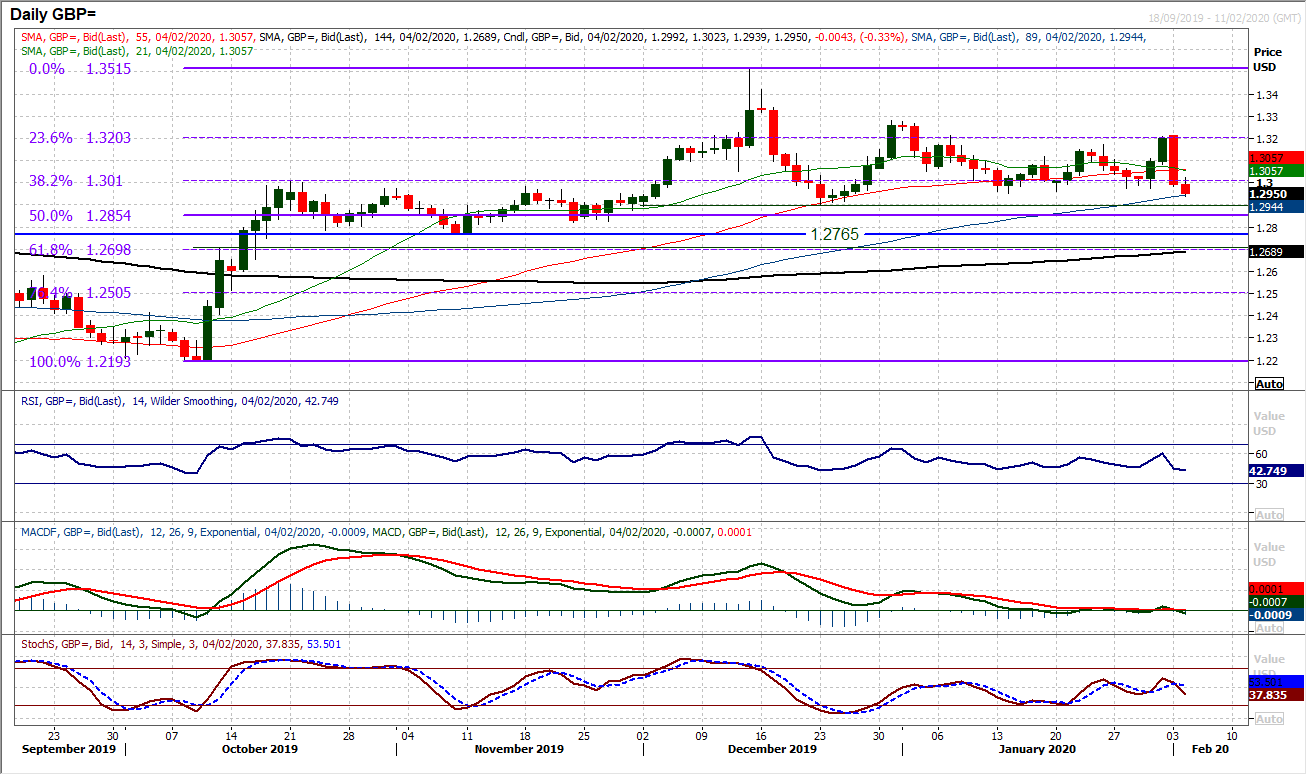

A welcome break from the politics of Brexit ended yesterday as a speech from UK Prime Minister Johnson laid out an initial hard line stance from the UK in trade negotiations with the EU. Sterling was hit hard and fell back around -220 pips versus the dollar. This turned what was an impressive move higher last week completely on its head. However, Cable is back around the $1.2900/$1.3000 support band which, on several occasions in the past month, has been the basis of a floor. This is therefore an important moment for sterling. The move continues what we have been increasingly seeing as an uncertain and indecisive outlook on Cable, but could it be more? An early tick higher in the Asian session has been sold into by the Europeans, now -50 pipis lower on the day. Our strategy that Cable is a buy into weakness is coming under pressure. The technicals are beginning to deteriorate and will do so if the market closes around here. RSI has been oscillating between 45/60 for the past few weeks, but has dropped to a near 4 month low this morning. MACD lines and Stochastics are mixed around neutral. Closing under $1.2950/$1.2960 is a negative signal and we change our positive outlook on a close under $1.2900. Yesterday’s high at $1.3215 is key, and the early resistance is at $1.3025.

Author

Richard Perry

Independent Analyst