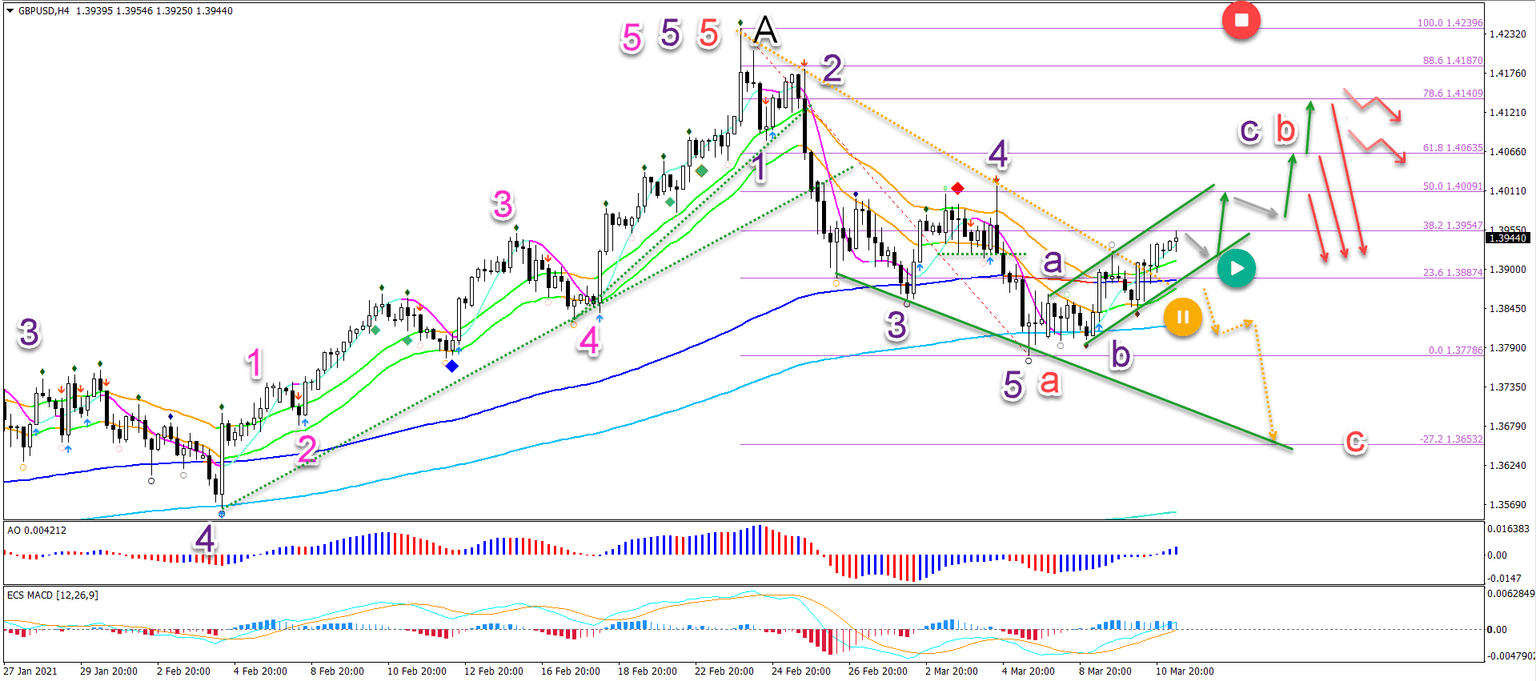

GBP/USD bullish ABC zigzag aiming at Fibonacci resistance

-

GBP/USD has made a bullish bounce at the 144-233 ema support zone. The higher low and higher high have launched a bullish breakout.

-

The GBP/USD seems to have completed multiple wave 5s at the recent top. The 5 wave decline (purple) only supports this wave outlook.

-

On the 1 hour chart, price completed a 5 wave pattern (purple) in wave A (red). Now a bullish ABC pattern could take the price up higher.

The bullish trend channel is now the key factor for more upside. Let’s review the 4 and 1 hour charts.

Price charts and technical analysis

The GBP/USD seems to have completed multiple wave 5s at the recent top. The 5 wave decline (purple) only supports this wave outlook. Let’s review the key zones and patterns:

-

The bearish 5 waves completed a wave A (red).

-

A larger bearish ABC (red) pattern is expected.

-

The push up is probably an ABC (purple) within wave B (red).

-

This ABC pattern remains valid as long as price stays below the top (red circle).

-

A break (dotted orange) below the support line (green) of the uptrend channel indicates an early bearish bounce at the 38.2% Fib (yellow circle).

-

A break above the 38.2% Fib confirms a deeper bullish break towards the Fibonacci retracement levels.

On the 1 hour chart, price completed a 5 wave pattern (purple) in wave A (red). Now a bullish ABC pattern could take the price up higher.

-

A bearish breakout below the support line (green) indicates a deeper retracement (yellow circle).

-

A break below the bottom indicates that the ABC (purple) pattern is completed sooner than expected (red circle).

-

A bounce at the support zone (green box) indicates a push up towards the Fibonacci confluence.

The analysis has been done with the ecs.SWAT method and ebook.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.