GBP/USD at the top of a bullish channel

-

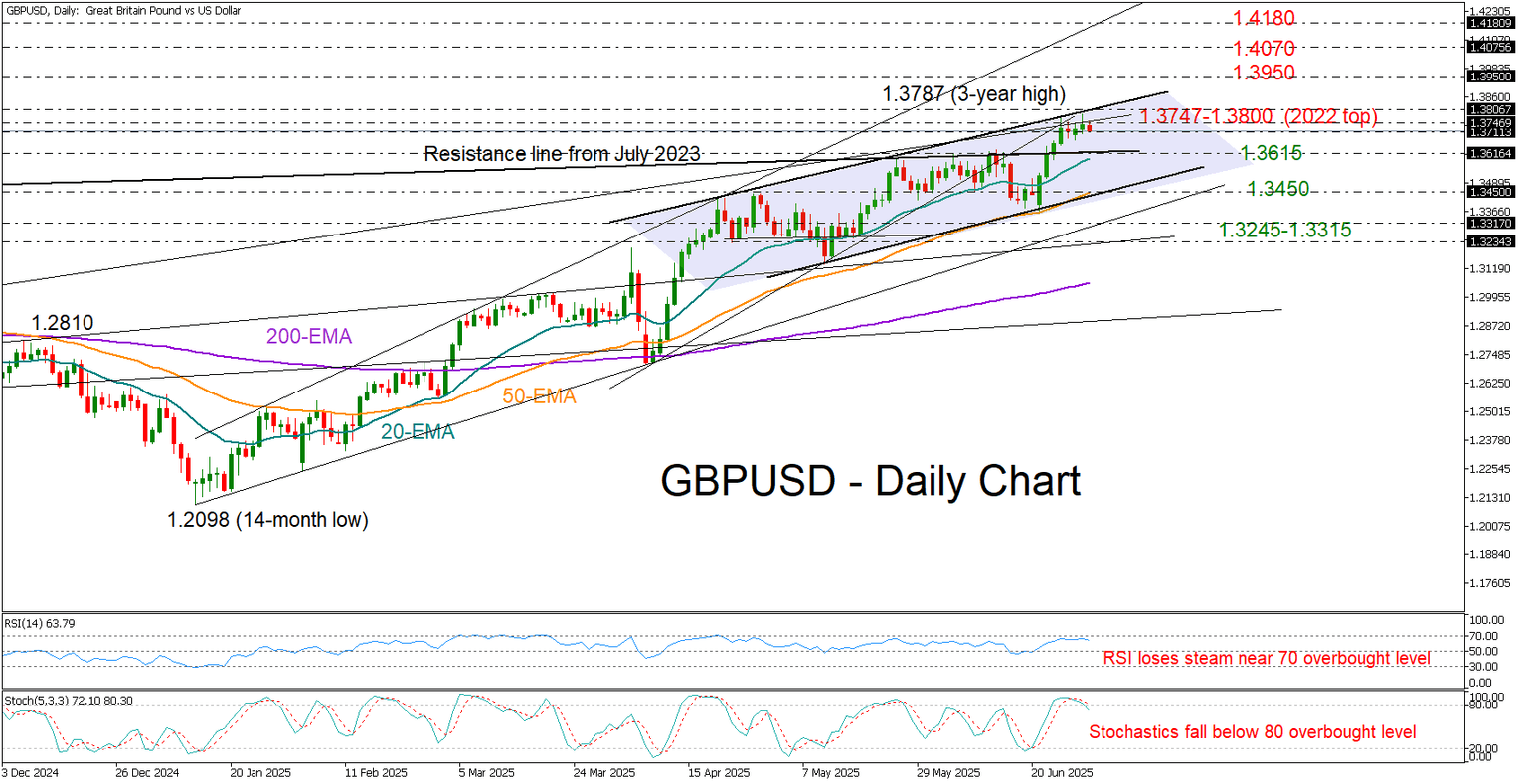

GBPUSD loses momentum near three-year high, tests the channel’s upper band.

-

Short-term bias remains bullish, but overbought conditions are evident.

-

Bullish outlook remains intact above 1.3450.

GBPUSD began July’s trading with sluggish momentum, following five consecutive months of gains that pushed the price to a three-year high of 1.3787 on Monday.

Much of the pair’s ascent is due to the dollar’s weakness, while the Bank of England’s gradual approach to rate cuts has been a positive catalyst too. Speaking on a panel with global peers in Portugal, BoE Governor Andrew Bailey reminded investors that interest rates are expected to decline further, while also hinting at a potential slowdown in quantitative tightening, clouding the outlook for the remainder of the year.

In the meantime, the RSI and the stochastic oscillator are issuing a warning about overbought conditions near the 2022 high of 1.3747 and the upper boundary of the bullish channel. The formation of small candlesticks at the top of the uptrend also reflects a degree of hesitation among traders.

If bearish pressure emerges, the pair could retreat towards the former resistance zone at 1.3615, where the 20-day exponential moving average (SMA) is converging. The 50-day EMA may provide additional support near the channel’s lower boundary at 1.3450, while the ascending trendlines at 1.3320 and 1.3235 could be the next levels to watch.

Should a bullish breakout occur above 1.3800, the next resistance may appear near 1.3950, a level derived from the June–August 2021 highs. Further up, the rally could pause around 1.4070 before potentially targeting the 2025 resistance line at 1.4180.

Overall, the recent bullish push in GBPUSD appears to have reached a critical pivot point, increasing the likelihood of a pullback or a period of consolidation. Nevertheless, only a break below the channel at 1.3450 would raise concerns about a potential bearish trend reversal.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.