GBP/USD at breaking point: Will the bulls roar back?

-

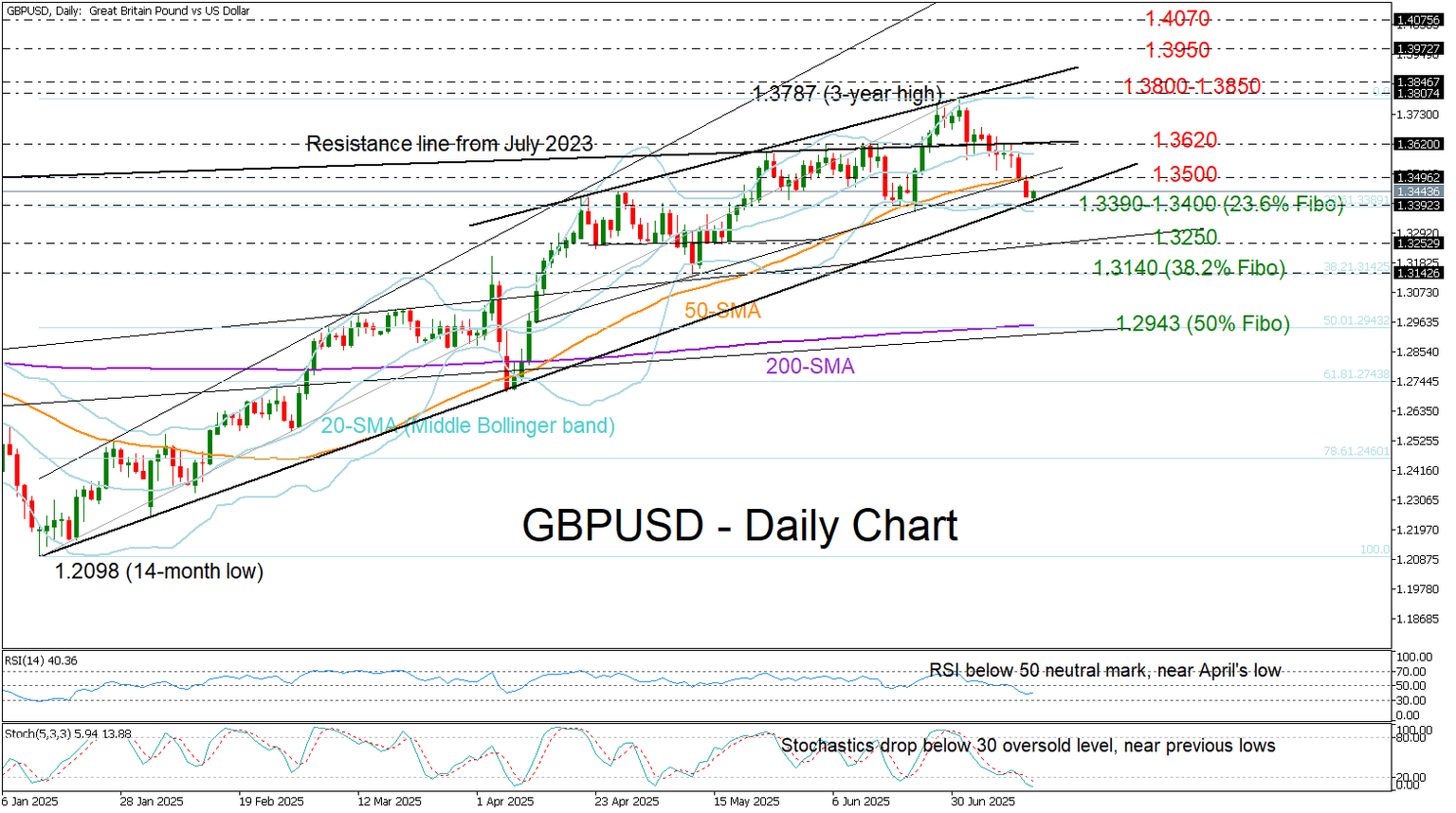

GBP/USD falls below SMAs but one last opportunity for rebound remains.

-

Short-term signals point to oversold conditions; eyes on 1.3400.

GBP/USD extended its decline below the 50-day simple moving average (SMA) after Bank of England Governor Andrew Bailey expressed a willingness to implement larger rate cuts if the labor market shows signs of weakness, according to an interview with The Times.

U.S. and UK CPI figures, due today and tomorrow respectively, are expected to show some persistence in inflation, and the pair is already hovering near a potential pivot zone, trading around the 2025 support trendline at 1.3400. Notably, the 23.6% Fibonacci retracement of the 2025 uptrend is also nearby, at 1.3390.

The stochastic oscillator has dipped into the oversold region, the price is nearing the lower Bollinger Band, and the RSI is testing its April low – all suggesting that the recent bearish cycle may be nearing exhaustion. If this proves to be the case, the bulls will need to reclaim the 50-day SMA at 1.3500 and then push past the 1.3620 barrier to target again the key 1.3800–1.3860 resistance zone.

Conversely, if selling pressure intensifies below 1.3400, the bears could aim for the 1.3250 constraining zone, followed by the May low at 1.3138. A decisive close below the latter could pave the way toward the 1.3000 level or even lower to the 50% Fibonacci of 1.2943.

In brief, GBPUSD is currently trading near a critical make-or-break point around 1.3400, with the technical picture slightly favoring a potential rebound.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.