GBP/USD analysis: Trades in channels

GBP/USD

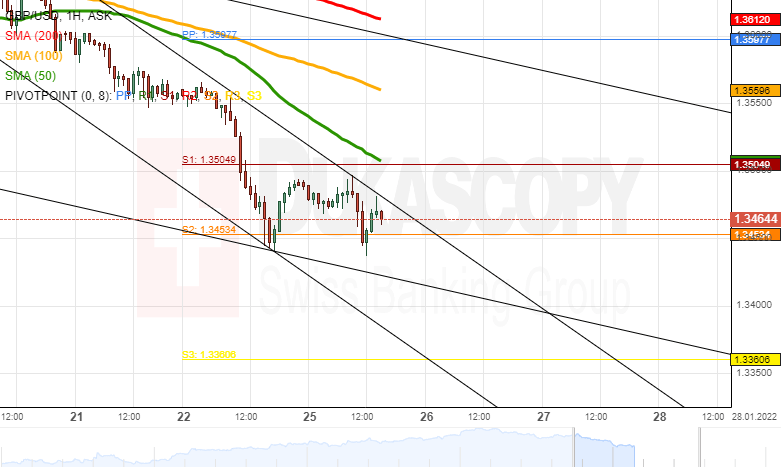

The GBP/USD has been declining in a broad channel-down pattern since January 13. Meanwhile, the rate has made sharper moves down in a junior pattern since January 20. Future forecasts were based upon whether the junior pattern holds. In addition, note that the market participants were expecting the US Federal Reserve announcements on Wednesday at 19:00 GMT.

A move above the pattern's upper trend line could find resistance in the weekly S1 simple pivot point at 1.3505, the 1.3500 mark and the 50-hour SMA close by. If the pair passes above these levels, there would be no technical resistance as high as the 1.3550 level, where the 100-hour simple moving average was located at.

On the other hand, a decline could look for support in the 1.3440 mark, as this level showed support during this week. A move below the 1.3440 mark would encounter the lower trend line of the large-scale decline capturing channel down pattern.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.