GBP/USD Analysis: Profit-taking kicks in as Brexit deal optimism fades

- GBP/USD witnessed some heavy long-unwinding on the first day of a new week.

- The early optimism over a last-minute post-Brexit trade deal faded rather quickly.

- A goodish USD rebound further aggravated the selling pressure around the major.

The GBP/USD pair witnessed a dramatic intraday turnaround on the first day of a new trading week and tumbled around 150 pips from daily swing highs, near the 1.3575 region. The euphoria over a post-Brexit trade deal faded rather quickly as investors flagged concerns about the exclusion of the crucial services sector from the accord. This, coupled with a goodish US dollar rebound, exerted some additional pressure and contributed to the steep intraday fall.

Relief over the long-awaited US stimulus triggered a fresh wave of the global risk-on trade and pushed the US Treasury bond yields higher across the board. This, in turn, was seen as a key factor that helped revive the USD demand. It is worth reporting that the US President Donald Trump signed a $2.3 trillion pandemic aid and spending package on Sunday, restoring unemployment benefits to millions of Americans and averting a partial federal government shutdown that would have started on Tuesday.

That said, the upbeat market mood kept a lid on any runaway rally for the safe-haven USD. The pair found some support near the 1.3430-25 region and managed to regain some positive traction during the Asian session on Tuesday. The uptick lifted the pair back closer to the key 1.3500 psychological mark, though the upside seems limited amid absent relevant fundamental catalyst and year-end thin trading volumes.

Short-term technical outlook

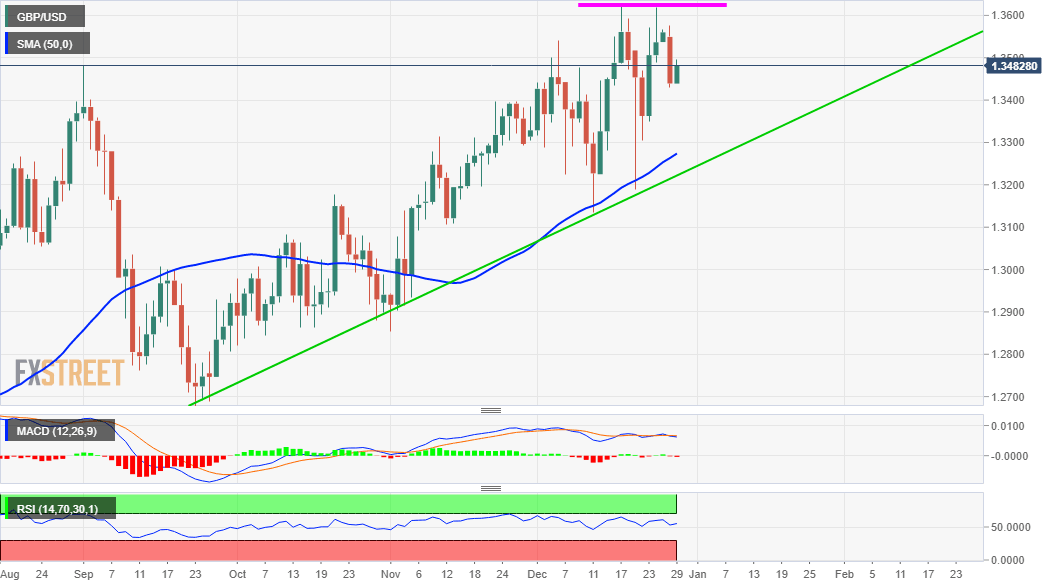

From a technical perspective, nothing seems to have changed much for the pair and the emergence of some dip-buying might still be in favour of bullish trades. However, repeated failures to find acceptance at higher levels and the subsequent sharp pullbacks warrant some caution before positioning for any further appreciating move. Meanwhile, momentum back above the 1.3500 mark might now confront some resistance near the 1.3540-45 region. This is closely followed by the overnight swing high, around the 1.3575 region. A sustained move beyond has the potential to push the pair further beyond the 1.3600 round-figure mark, towards retesting YTD tops, around the 1.3625 region.

On the flip side, the 1.3430-25 region now becomes immediate support to defend ahead of the 1.3400 mark. Some follow-through selling might turn the pair vulnerable to accelerate the slide further towards mid-1.3300s. The downward trajectory might then drag the pair further towards the 1.3300 mark en-route 50-day SMA, currently near the 1.3260 region. The latter coincides with a three-month-old ascending trend-line support and should act as a key pivotal point to determine the pair's next leg of a directional move.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.