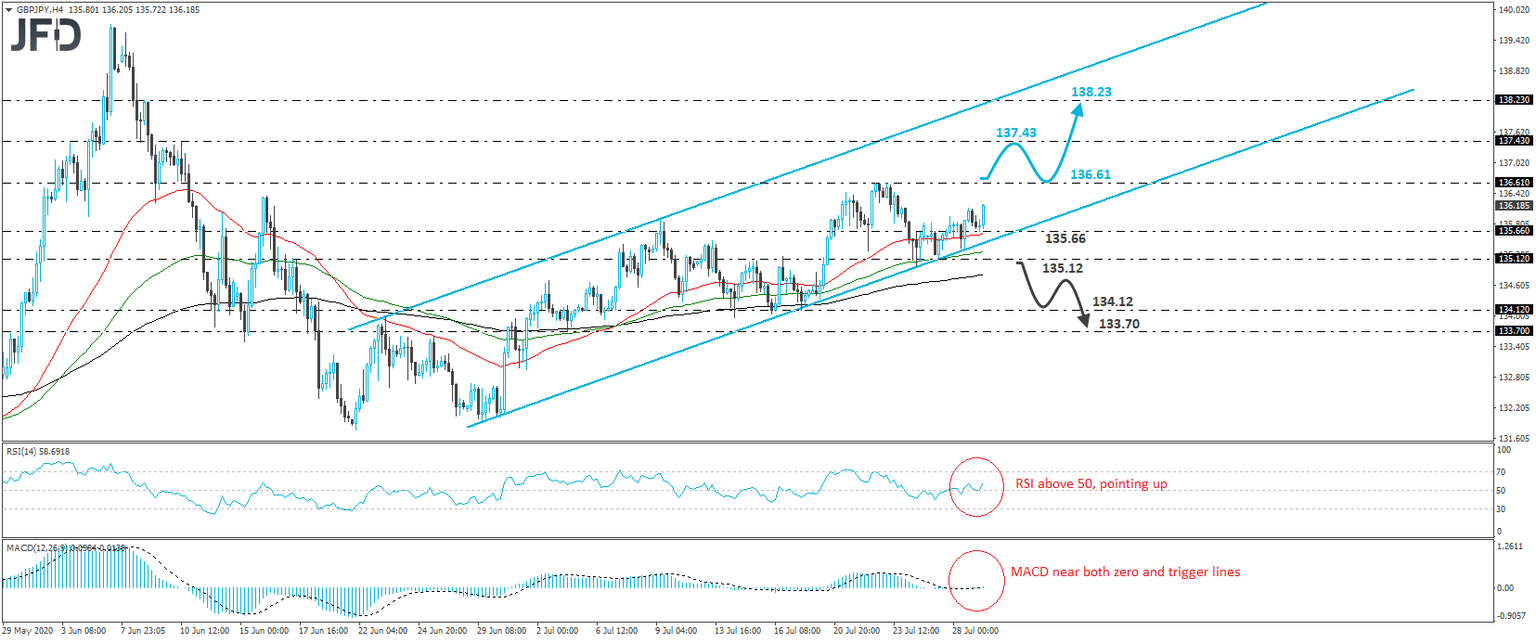

GBP/JPY stays within an upside channel

GBP/JPY traded higher on Wednesday, after it hit support near the 135.66 level during the Asian morning. Overall, the pair continues to trade within the upside channel that’s been containing the price action since June 23rd, and thus, we would consider the near-term outlook to be positive.

Nevertheless, in order to get more confident on larger bullish extensions, we would like to see a decisive break above 136.61, a resistance marked by the highs of July 22nd and 23rd. Such a move would confirm a forthcoming higher high on both the 4-hour and daily charts, and may initially pave the way towards the 137.43 barrier, identified as a resistance by the high of June 10th. Another break, above 137.43, could extend the advance towards the high of the day before, at around 138.23.

Taking a look at our short-term oscillators, we see that the RSI rebounded from near its 50 line, while the MACD although fractionally positive, is still flat and very close to its trigger line. The RSI detects positive momentum, but bearing in mind that the MACD is yet to suggest so, we would prefer to wait for a move above 136.61 before examining the case of a trend resumption.

On the downside, a dip below 135.12 may signal that the bears have gained the upper hand. The rate will already be below the lower end of the channel, and we may see declines towards the 134.12 territory, which provided decent support between July 14th and 17th. Slightly lower we have the 133.70 support, which is marked by the low of July 3rd.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD