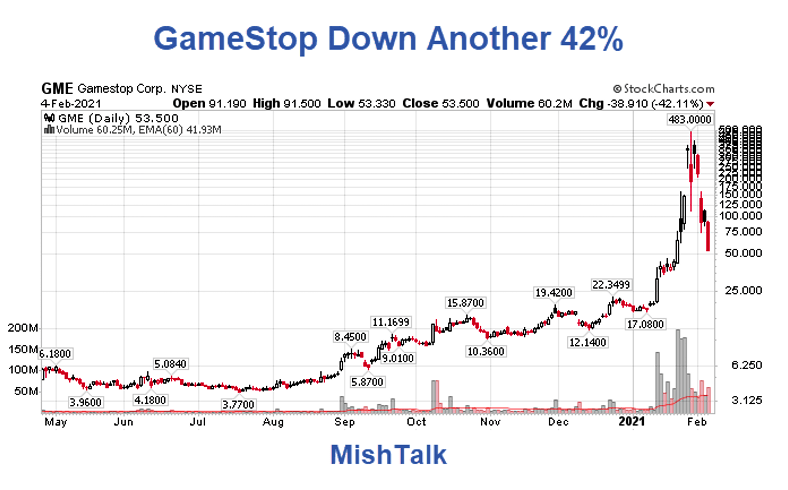

GameStop is down another 42%, when does the collapse end?

Story Much Deeper Than Widely Believed

There is much more to the story that widely believed.

Reddit traders were the catalyst for the squeeze idea, but that is all you can give them credit for.

Anatomy of a Short Squeeze

- Reddit traders on WallStreetBets discuss the GameStop idea. The incubation period lasts many months.

- The stock slowly rises and hedge funds pick up on the idea.

- Stubborn shorts keep at it and the stock is 140% shorted.

- More hedge funds pile in, this time with calls on the long side. They understand short squeezes.

- After they buy calls, the hedge funds flood place huge market orders for more shares.

- The market makers who sold the calls have to buy shares to hedge the calls they sold.

- Steps 5 and 6 repeat until the shorts capitulate. This marks the absolute top.

- In the process of 5 and 6, the hedge funds who were long take gains.

- Some of those hedge funds in step 8 understand what's next. They buy massive numbers of puts.

- The hedge funds who bought the PUTs then dump their longs in size.

- GameStop plunges.

- The hedge funds buy more puts and dump more stock with market orders, not limit orders.

- The option makers who sold the puts have to hedge. They hedge by shorting shares.

- There are no rules against market makers being naked short.

- Prices continue to collapse.

Not David vs Goliath

The Reddit traders and the mainstream media portray this as a David vs Goliath setup.

That is not at all what happened.

Reddit traders and individuals did not push two hedge funds to the brink. They were not big enough.

Hedge funds vs hedge fund is the real story behind the squeeze.

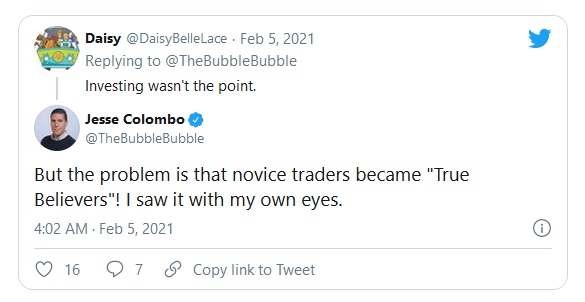

WallStreetBets and Reddit traders get credit for an idea and sticking with it, but they are not the driving force and they still do not understand what happened and why.

Stung by the Hate

Telling people to take profits was not the message the true believers wanted to hear.

Married to a Trade

Despite the obvious fact that the GameStop squeeze is not only over but in reverse (see points 9 to 15 above), denial runs deep.

The Short Squeeze is Over

On February 1, I asked GameStop Plunged 30% Today, Is the Short Squeeze Over?

My guess is the squeeze is over. Hedge funds have covered their shorts. And we have a three surge stage that frequently marks tops in short squeezes.

Gamestop was at $212 when I concluded the squeeze was over.

A number of people on Twitter informed me yesterday the squeeze is not over.

Well, the short squeeze in reverse was still not over.

Gamestop is now at $53.50. Anyone who bought north of $60 is sitting on huge losses.

Some of them will get the message. They will dump their shares. When enough do so it will mark the bottom.

I do not think we are there yet. And when it happens, don't expect another huge squeeze out of it.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc