G10 FX Week Ahead: The darkest hour

As the US prepares to face its darkest hour in this health crisis, signs of a slowdown in contagion in Europe are fuelling some optimism. In FX, more improvements in financial conditions are likely needed to dent the USD’s resilience, while the EUR is increasingly reliant on EU coordinated measures to ward off the risk of another sovereign debt crisis.

USD: Surprisingly resilient

The dollar last week stayed a lot firmer than we thought. Risk assets were generally under pressure and it seems that Federal Reserve measures to address USD money markets will take time to work their way through the system. USD Libor-OIS spreads remain quite elevated (signalling inter-bank tension), but may start to come down when the Fed starts buying commercial paper (hopefully this week or next) and allows US banks to raise short-term funding at levels substantially under 1.5%. Emerging markets also remain fragile, where outflows both directly and indirectly contribute to a stronger dollar.

Looking ahead, oil markets have been a big driver of equities in recent weeks and this week's focus will be on Thursday's OPEC+ meeting. Unless US shale producers participate in cuts, it is hard to see the Saudis and especially Russia delivering the cuts required to stabilise oil markets. Thus equities could stay fragile and the dollar supported. Let’s also see whether talk of a fourth US stimulus package gains momentum. However there is so much fiscal stimulus underway globally, we can’t see that outsized US fiscal stimulus will be a clear dollar positive – especially while the Fed is printing money so aggressively. We continue to think the dollar’s gains will not last – but need to see financial conditions firm first. In terms of the calendar, look out for the release of Fed minutes on Wednesday and another big surge in jobless claims on Thursday.

EUR: Eurogroup has an option to shine on Tuesday

Early indications suggest Europe has been particularly hard hit by the crisis. So far European debt markets have been contained – largely because of the European Central Bank's Pandemic Emergency Purchase Programme. This week the focus is on whether Europe is really ready to help the likes of Italy and Spain with a collective response – e.g. a Coronabond – or is merely ready to compound debt sustainability problems by lending them more money. Our team thinks it is probably too early to expect debt mutualisation at Tuesday’s Eurogroup meeting.

Trying to pick the low in EUR/USD remains a difficult proposition. And 1.05/1.06 cannot be ruled out whilst financial markets remain dysfunctional. It will take time, but once confidence returns to financial asset markets we expect the dollar to develop a negative correlation with risk assets e.g. risk-on dollar-off, as investors put money to work again. It is a relatively quiet week for data.

JPY: It's getting cheaper to hedge USD exposure

USD/JPY found good demand at 107 during a difficult week for equities. As expected, the Government Pension Investment Fund did increase its weighting to foreign bond markets as part of its review. We tend to think it will be a better buyer of foreign debt when USD/JPY is closer to 100 – and helping to prevent the fallout from a stronger currency on the local economy.

While the semi-public sector may be a bigger buyer of foreign debt, the private sector may be slightly negative for USD/JPY. Here USD/JPY hedging costs have collapsed – now that the JPY basis has swung around – and it costs just 1.1% to hedge USD exposure from a Japanese perspective. We would expect the private sector to be raising hedging ratios on USD/JPY right now – given what we see is scope for USD/JPY to be pressing 100 later this year. In terms of the calendar, Japan sees some March survey data and the February current account figures.

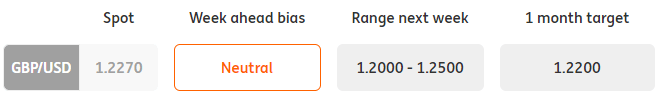

GBP: Sterling gains to stall

Sterling now benefits from the improvement on the US dollar liquidity front and the correction from its excessively oversold levels. This is why GBP did better than the EUR against USD last week, when the dollar started regaining ground against G10 currencies. With the risk environment remaining fragile and GBP already recovering a meaningful part of its March losses, the gains should stall.

We look for a range trade in the GBP/USD 1.2000-1.2500 area this week. The bar for the pair to move below the 1.2000 level is set rather higher in our view. As such levels would coincide with the peak pressure period on GBP largely caused by the lack of USD liquidity and concerns about the UK external funding position. These two risk factors now partly faded. On the domestic front, the UK data points will have a limited impact on sterling.

AUD: RBA looks at longer maturities

As we have recently stressed in more than one instance, we believe that the combination of (a) Reserve Bank of Australia’s increasingly large quantitative easing, (b) looming global recession keeping sentiment put and (c) depressed commodity prices, all suggest that the AUD/USD may be incompatible with trading sustainably above 0.60 throughout 2Q.

This week, the RBA will hold a policy meeting. The Bank is already pumping an enormous amount of liquidity for Australian standards, having bought AUD34 bn of government bonds so far within its QE programme. Considering that the minutes of the previous emergency meeting suggested that 0.25% is the lower bound for rates, the chances of a cut seem pretty low, in our view. If anything, the Bank may take decide to formalize that it will extend it yield-curve control scheme to longer maturities than 3Y: in practise, the RBA has already increased its purchases of securities closer to the 10Y tenor last week. Markets are pricing in 56% implied probability of a cut, but any benefit to AUD from a hold may be offset by indications of a more aggressive QE. In turn, we think the impact on AUD of the RBA meeting may be broadly balanced and AUD/USD may remain in a general bear trend this week as equities fail to materially recover.

NZD: RBNZ ready to do more (but what?)

The ongoing “bazooka” QE by the Reserve Bank of New Zealand has, surely, not helped NZD as another risk-off turn has put renewed pressure on the currency. Last week, the Governor, Adrian Orr, said that the Bank still has “various means” to provide stimulus if needed. The question is: what type of tools are still available in the RBNZ kit? Another cut might be an option (to zero, or negative), but the Bank had already argued that QE is preferred to more cuts, and that there is little appetite for negative rates.

So, more QE seems to be the answer. This is surely doable, and it is likely what Orr intended in his comment. Also, there is a chance of some more targeted QE in the style of the RBA’s yield curve control. However, there is maybe a third chance, and that could be some form of intervention in the FX market to keep the NZD highly undervalued in order to let the currency absorb the economic shock. Whatever measure the Bank will take, it seems fair to assume the downside room for NZD before a rebound is still relatively wide.

CAD: The end of Canadian labour market exceptionalism

Before the Covid-19 rocked the global economy, the Canadian labour market had repeatedly shown an exceptional resilience, with unemployment capped and wage growth spiking to the 4.4% area. After the grim payrolls in the US last week and several indications that many have already lost their jobs in Canada, this week’s jobs report is due to be the confirmation of a massive labour market slump.

Indeed, the Canadian Government’s “whatever it takes” is particularly aimed at the jobs market, with a colossal wage subsidy programme. The jobs data on Friday may help understand whether this programme will be enough to counter the rise in unemployment. In all this, the Bank of Canada should face additional pressure to ramp up its QE scheme that, so far, has been relatively modest compared to other developed central banks. The oil story is still unlikely to turn for the better anytime soon and all this keeps us of the view that USD/CAD will hit 1.45 soon and possibly extend the run to the 1.50 area later on.

CHF: SNB keeping its guard up

Fears around the more intense spread of Covid-19 worldwide continue to make a case for more safe-haven demand and, therefore, CHF appreciation. In turn, the Swiss National Bank, highly determined to curb any slump in EUR/CHF, still stands ready to further intervene in the FX market. Levels below 1.05 are likely to be particularly supported.

While the past couple of weeks surely offered a breather to EUR/CHF bulls, the downside risks for the pair are unlikely over. Global risk aversion aside, markets are increasingly reading into the disputes within the EU on whether issuing common debt instruments, ultimately fuelling speculation that such disagreement may lead to a debt crisis in the common area. CHF is the quintessential safe-haven when it comes to potential risks to the stability of the European Union/Euro Area, and this could provide steam to the currency if tensions among EU members fails to abate this week.

NOK: Pausing the rebound

NOK has continued its sharp recovery after its (even sharper) sell-off during the first half of March. With USD liquidity issues being corrected for and oil prices rebounding, the NOK extreme undervaluation does stand out. In the same way the krone’s low liquidity exaggerated the currency downside in the first part of March, now it is helping it to recover some of the prior losses. However, given the meaningful rebound already, the uncertainty about the extent of the possible oil production cuts indicated by some of the OPEC+ members and the very weak global growth outlook and the potential for a disappointment, the NOK gains should ease, with EUR/NOK to stay above the 11.00 level this week.

On the data front, the March CPI (Wed) will have a limited effect on the currency. Not only is NOK primarily driven by the risk appetite and the investors’ gauge of the krone extreme mis-valuation, but the fall in CPI is widely expected, with Norges Bank already delivering two meaningful cuts.

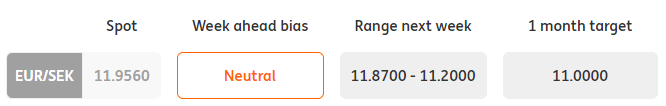

SEK: Another week of stability

Stability and range trading around the EUR/SEK 11.00 level seems to be the name of the game for SEK and we don’t expect this to change this week. As SEK outperformed other G10 cyclical currencies in the March sell-off, the scope for a rebound is more limited, particularly when compared to the previously heavily oversold and battered NOK.

We don’t expect Riksbank to follow its peers and either cut rates or embark on QE. As the next possible easing step, and if needed, we would expect the central bank to increase the pace of pre-investments (ahead of the bond maturities). This should have a limited impact on SEK, particularly when compared to larger policy easing made elsewhere. It is a fairly quiet week on the Swedish data front.

Read the original analysis: G10 FX Week Ahead: The darkest hour

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.