FX update – Dollar down again

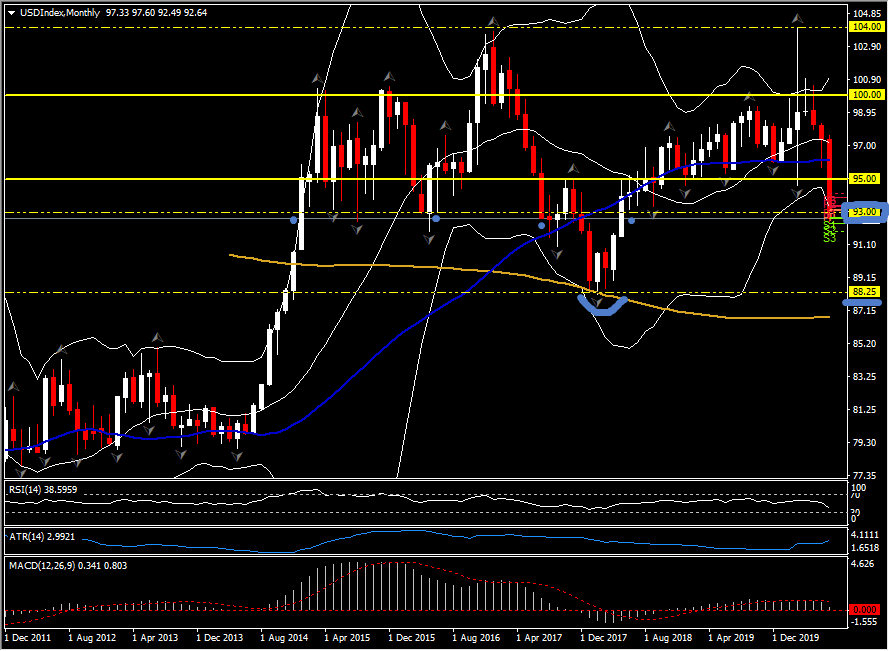

USDIndex, Monthly

The Dollar continued lower in what is now the biggest monthly decline the US currency has seen in a decade. The narrow trade-weighted USDIndex printed a fresh 26-month low at 92.49, the culmination of a 5% decline from the finishing level in June and marking just over a 10% drop from the highs seen in early March. US Treasury yields have printed fresh lows, with the 30-year bond in record low territory, extending declines seen since yesterday’s release of US Q2 GDP data, which came in at a dismal -32.9% y/y, although this met the consensus expectation. President Trump’s tweeted suggestion that the presidential election in November should be postponed has also been in the mix, adding a political element to arguments that the pandemic has precipitated a further erosion in the dollar’s reserve currency status. The EU’s recently greenlighted recovery fund is also seen as a first step in shared fiscal responsibility in the Eurozone, which by all accounts has triggered a re-weighting of euros in currency portfolios at the expense of the Dollar. Gold prices have lifted to back within a couple of dollars of the record nominal high seen earlier in the week at $1,974.90. EURUSD, amid its sixth consecutive week of accelerating gains, has pegged a fresh 26-month high at 1.1908. Cable pinned a new five-month peak, at 1.3143. USDJPY posted a five-month low at 104.19. AUDUSD saw a 17-month high at 0.7228. USDCAD has been an exception to the US Dollar weakening theme, with the pairing consolidating in the lower 1.3400s after making a nine-day high at 1.3461 yesterday. The Canadian Dollar has been affected by the drop in oil prices over the last day. Front-month USOil futures hit a three-week low on Thursday at $38.72, and while since recouping to levels over $40.0, remain down by over 2.5% from week-ago levels.

The big tech companies SMASHED it. APPL. $11 bln profit on $60 bln rev, 4 for 1 stock split coming, AMZN $5bln profit as income doubled & sales up 40%. Alphabet ad revenue down but still beat estimates & FB rev. up 11%, as activity increased 13%. Other companies reported mixed results. Today – Eurozone CPI & GDP (Q/Q) (Prelim), US PCE, Chicago PMI & UoM Sentiment & Exp., CAD GDP (m/m). Earnings are due from: Exxon, Chevron, Phillips 66, Caterpillar, Merck and Colgate.

Author

With over 25 years experience working for a host of globally recognized organisations in the City of London, Stuart Cowell is a passionate advocate of keeping things simple, doing what is probable and understanding how the news, c