FX alert: Fed hawks, China drags, and a market caught in a late-week gravity well

The late-week gravity well

There are weeks when markets simply misbehave, and then there are weeks like this — where every asset class feels slightly off-kilter, as if someone nudged the global macro machine a few degrees off true north and the bearings haven’t stopped grinding since. What began as a routine post-shutdown recalibration has morphed into a late-week doom loop, the sort of ambient tension traders can feel in their molars before they see it on the screens. And the question cropping up on every desk — from London to Singapore — isn’t philosophical: can equities spill another two or three percent from here? The answer is uncomfortably simple. Yes. Easily.

Momentum didn’t just melt this week; it bled out on the pavement. These long-leg unwind phases have a rhythm—historically around 25 sessions—and we’re sitting at day 21 of this one. Retail remains grotesquely over-their-skis, emboldened by months of one-way AI euphoria, and dealers are swimming in negative gamma. When vol spikes, the machines sell. When they sell, vol spikes. And so the carousel spins until positioning itself burns out or someone turns the lights back on in the rates complex.

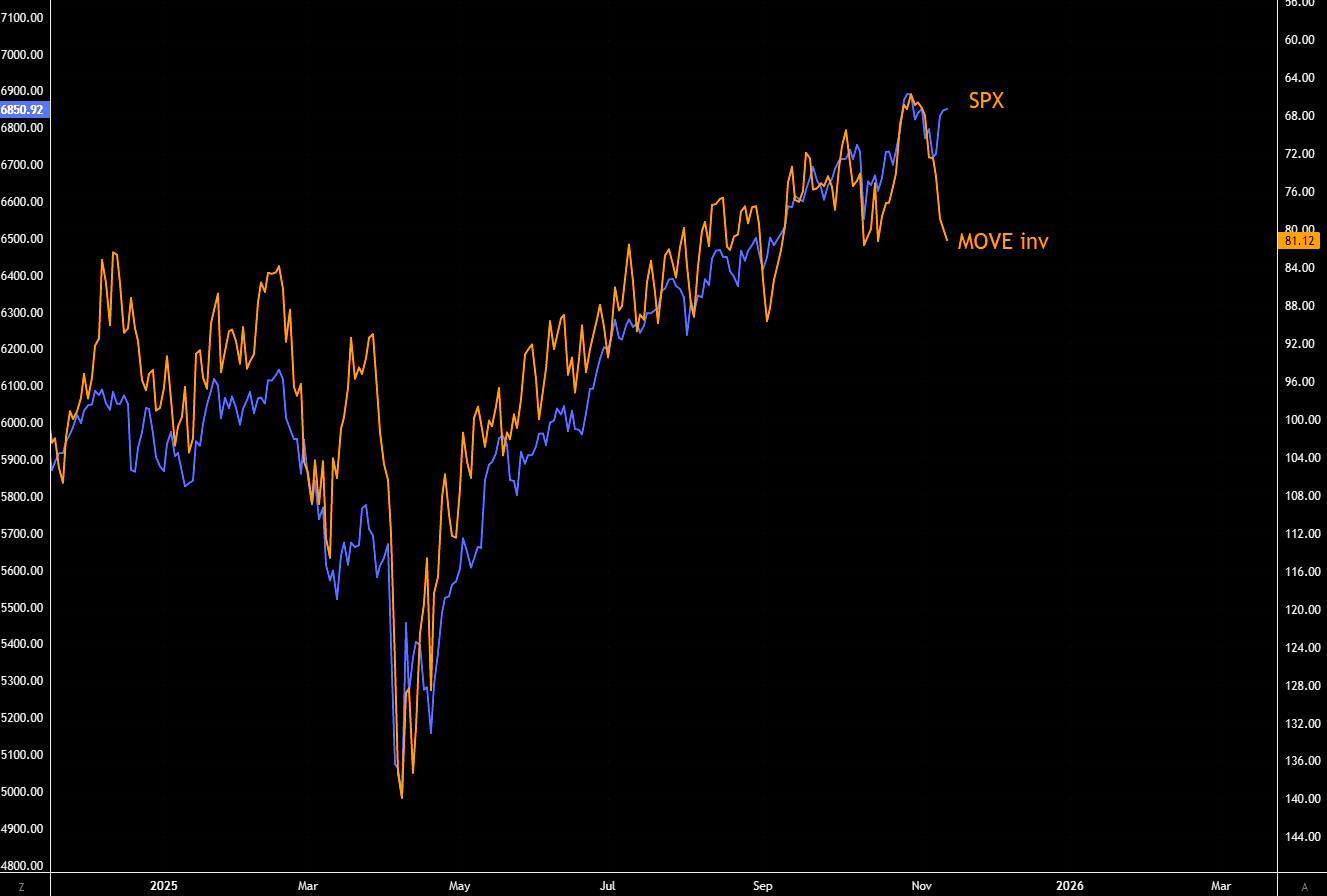

But the thing that has every veteran trader rubbing their temples is far simpler: the SPX–MOVE gap has blown wide open, and SPX despises surging bond volatility.

Chart Via Market Ear

Rates vol is the market’s bad-tempered houseguest — slamming cabinet doors, waking the neighbours, complaining about the plumbing — and equities have been forced into perpetual flinch mode. Until that volatility storm settles, the tape will continue to twitch like an overloaded circuit board.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.