FTSE 100 moves between 6,856 and 7,175

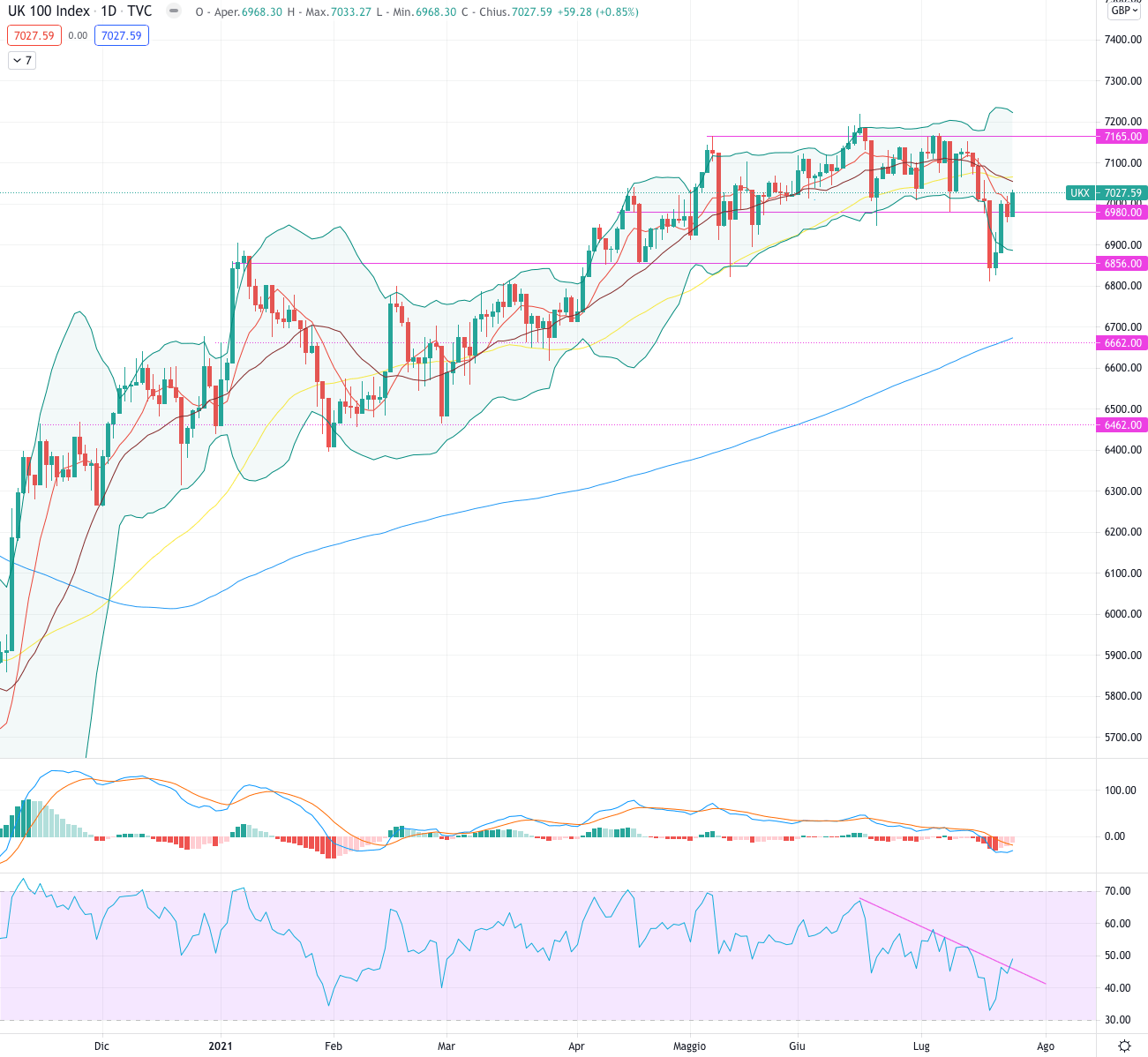

FTSE 100 (#UKX)

The FTSE 100 had a positive week up + 1.55%.

For the week ahead, we believe the positive trend can continue with the ultimate target at 7.165.

Indicators

This week the index retested the intermediate resistance level at 6.822 and then returned to the upside.

MACD is crossing to the upside and a break of 0 could give further boost to the index. RSI, after almost reaching oversold, has room to support a bullish movement, considering also that it has managed to break the bearish trend line.

Given the last few months, we can see how the FTSE100 moves between 6,856 and 7,175. This week the index tested the bottom of the channel and we believe it can now target to the top it.

Support at 6,980.

Resistance at 7.165.

FTSEMIB (#FTSEMIB)

The FTSEMIB had a positive week up + 2.62%.

For the coming week we expect a continuation of the uptrend with a target of 25.554.

Indicators

The FTSEMIB continues to remain below the 50MA but we believe there may now be enough momentum to break above it.

MACD is about to crossover to the upside which would support a further bullish extension.

RSI is now at 53, a resistance level rejected several times. A surpassing of it would open the way to a bullish momentum.

The index is once again reaching the upper part of the bearish channel: unlike in the previous times, now MACD and RSI are close to a bullish movement that could support the break of the channel.

Support at 24.930.

Resistance at 25.554.

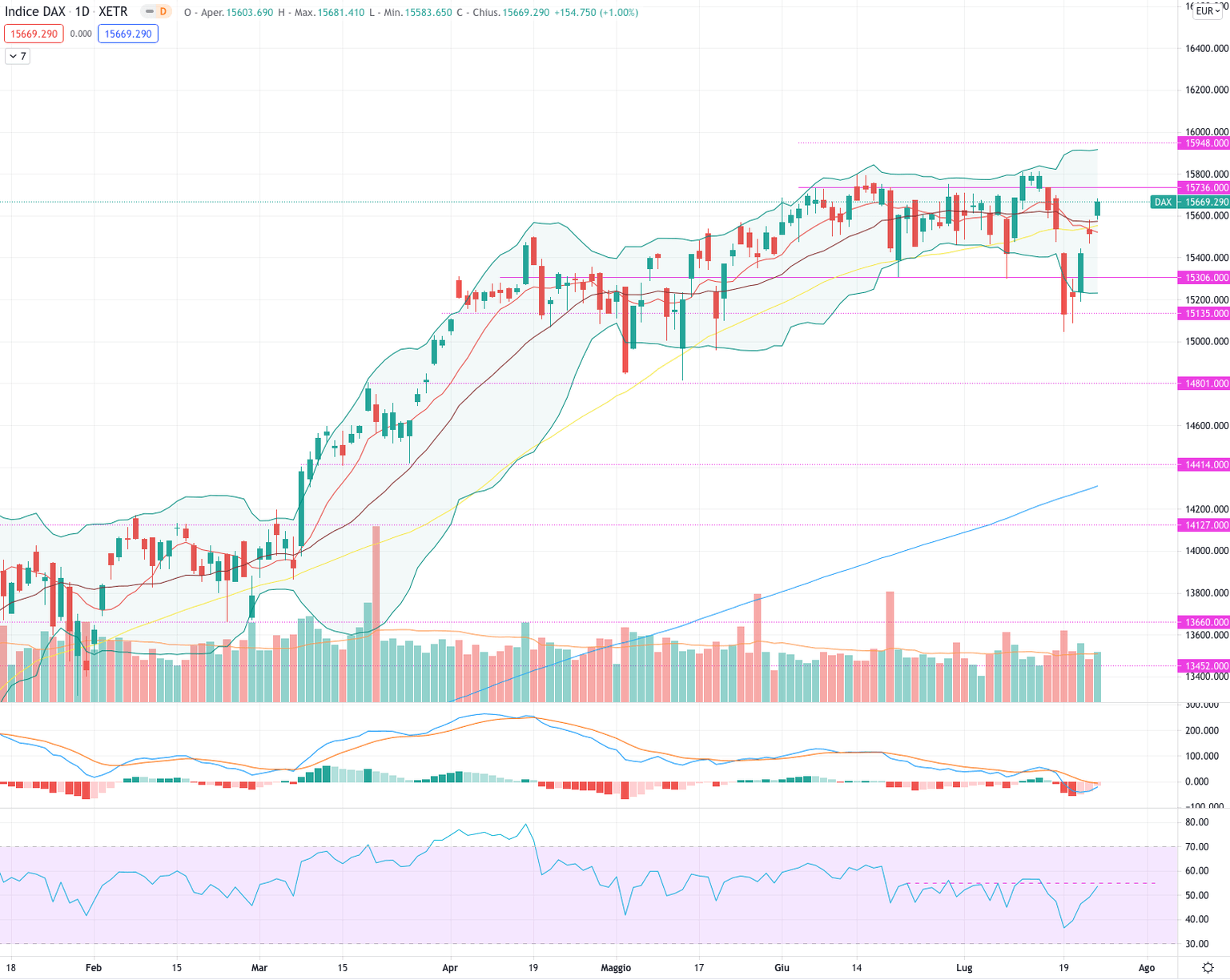

DAX (#DAX)

The DAX ended the week up + 1.69%.

For the week we expect a continuation of the uptrend with a target of 15.800.

Indicators

After a retracement to intermediate support levels, the DAX has returned to the upside with a strong break of the 50MA.

MACD is crossing to the upside and breaking out of the 0 level.

RSI is approaching the level of 55, which has played the role of resistance for the last month: a break of it would confirm and support a continuation of bullish moves.

Support at 15.306.

Resistance at 15.736.

S&P 500 (#SPX)

The S&P 500 had a positive week up by + 3.32%.

For the coming week, the index could continue the bullish move targeting 4.468.

Indicators

The rejoining with the 50MA lead to a strong reversal to the upside, hitting a new high.

The bullish momentum is supported by a MACD which seems to cross to the upside and the RSI which has not yet reached the overbought zone.

However, a negative note is given by a divergence between RSI and price that could lead to further retracements in the near future.

For the moment, however, we are in favour of a bullish continuation.

Support at 4.390.

Resistance at 4.468.

NASDAQ 100 (#NDX)

NASDAQ had a positive week up + 4.16%.

For the week ahead, the index could continue the bullish movement up to 15.226 and then retrace back to 14.827.

Indicators

The Nasdaq retested the intermediate resistance level at 14.420 and then hit a new all time high.

MACD is crossing to the upside along with a RSI that has reached the overbought level.

The index could have a last push up to 15.226 and then retrace at least until 14.827.

Support at 14.827.

Resistance at 15.226.

Dow Jones (#DJI)

DOW JONES had a week up + 2.52%.

For the coming week we expect a continuation of the uptrend to 35,200.

Indicators

The index retested previous support levels and then rebounded to the upside.

The bullish push at the moment is very strong and could lead the index to break the resistance area.

MACD is crossing to the upside along with a RSI approaching 61, levels rejected several times in the past: a break out it could support further bullish momentum for the Dow Jones.

Support at 34.261.

Resistance 35.096.

Author

Francesco Bergamini

OTB Global Investments

Francesco, BSc Finance and Msc in Business Management, graduated with Merit, is a professional with experience in the financial services industry and a keen interest in the financial markets.