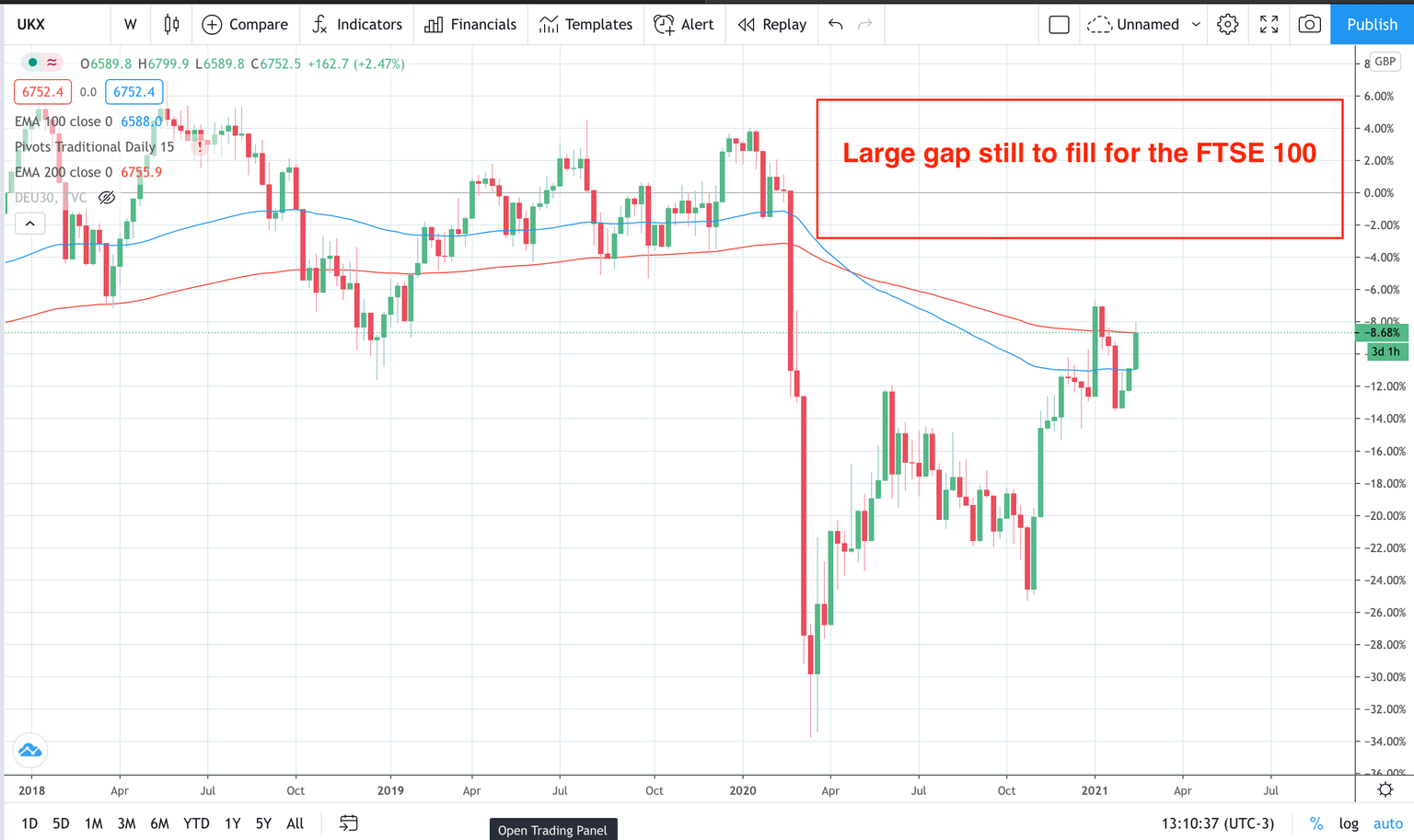

FTSE 100: Mind the gap!

The FTSE 100 has reasons for strength and that is due to the following factors:

-

Brexit is now behind the UK. A ‘no-deal’ Brexit has been avoided which means that those investors holding back from UK investment can breathe a sigh of relief.

-

Fast vaccination programme. The UK is now ahead of the curve in terms of the vaccination programme. Around 25% of the UK population has now been vaccinated. This puts the UK only behind the UAE and Israel in terms of speed of vaccination and should provide a tailwind for UK re-opening.

-

The latest UK GDP data for Q4 was admittedly the worst in the UK for around 300 years. However, crucially it was not as bad as expected. This meant the latest GDP reading was a boost for the GBP. Remember in trading it is all about the expectations vs the reality.

-

The move higher in commodities has helped the FTSE100 higher. This is due to bank stocks and mining stocks being prevalent in the FTSE 100.

-

The FTSE 100 has far more upside to recover from the COVID-19 drops compared to other European bourses, like the DAX for instance. The gap in the FTSE 100 has still to be filled and that looks like happening this year based on these factors.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.