Friday’s US-China sell-off eases, but risks remain

- Stronger Chinese trade data lifts European miners.

- Friday’s US-China sell-off eases, but risks remain.

- Gold hits record high, as confidence in US falters further.

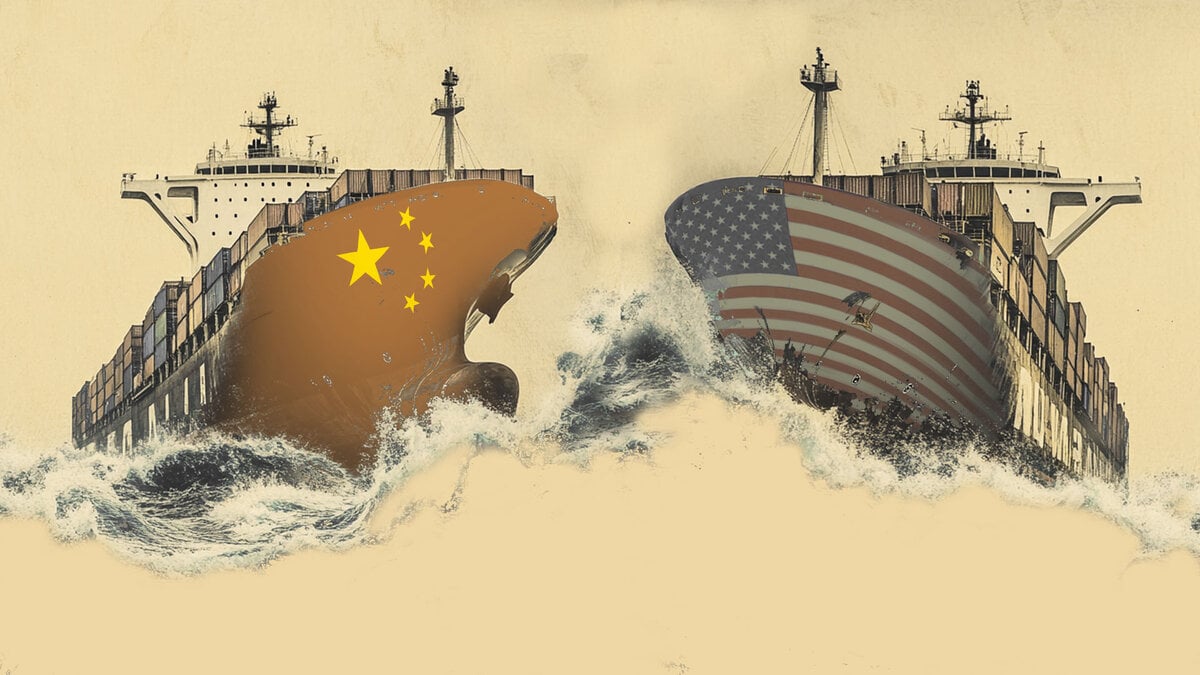

European equities are trading higher in early Monday action, a relief rally after the violent swings seen on Friday. London’s FTSE 100 is being lifted by the miners, led by Fresnillo as gold and silver prices push sharply higher once again. Meanwhile, the likes of Anglo American and Antofagasta have also gained traction as copper prices push higher in the wake of Chinese trade data that saw exports (8.3%) and imports (7.4%) beat markets expectations. The bounce seen in European indices and US futures signal a tentative confidence that Friday’s knee-jerk sell-off was somewhat overblown. However, the truth remains uncertain, with the dramatic breakdown in relations between the world’s two largest economies highlighting just how quickly the tide can change in the absence of any trade deal between the two nations. The fact that the initial market rebounds are already starting to fade does signal that risk remains, with greater clarity needed over the coming days.

The core issue remains the US-China relationship, which has gone from fragile to openly hostile. Beijing’s move to restrict exports of rare earths is not just a technical trade measure, it is a reminder that the hunted now appears to be the hunter. Trump played his hand, but the Chinese use of rare earths as the basis of their retaliation has brought plenty of signs that the US are now well aware of the problem cause if US businesses are suddenly shut off from this key material that is needed to create key products within the tech and defence space. The US response, threatening 100% tariffs, looks more like bluster than strategy, with US businesses likely to feel the pinch over businesses in the China given their centrally controlled economy. Trump’s attempt to calm nerves with “it will all be fine” reads more like hope than facts, with markets clearly in need of a follow up announcement that the two sides are working to resolve their differences. The uncomfortable truth is that China holds the upper hand here, accounting for 90% of the world’s rare earth processing, and 70% of the mining. Trump’s 100% tariff announcement came with a key detail that highlights his desire to find an agreement rather than impose the price hike; it doesn’t kick in for almost three-weeks.

The breakdown in US-China relations simply adds to the ongoing narrative around US instability, with the government shutdown rolling on towards its third week. The lack of credibility feeds directly into a broader sense of US instability, with traders watching closely to see if businesses are feeling the pinch when Q3 earnings season gets underway this week. With China clearly emboldened in the trade war with the US, the shutdown continuing apace, and continued efforts by the BRICS bloc to build a financial architecture outside of the dollar, and the image of the US as the bedrock of global stability is being chipped away. The clearest barometer of that erosion is gold, which has hit yet another record high today. This isn’t just a technical trade, gold is becoming the default vote of no-confidence in the US, as investors and traders seek to find a haven that is separate from the fiat system headed up by the US.

Author

Joshua Mahony MSTA

Scope Markets

Joshua Mahony is Chief Markets Analyst at Scope Markets. Joshua has a particular focus on macro-economics and technical analysis, built up over his 11 years of experience as a market analyst across three brokers.