Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The currency pair has completed a wave of growth to 1.1816. Today the market is forming a consolidation area under this level. We expect a decline to 1.1750. In case of a breakaway of 1.1820 upwards, growth might continue to 1.1900. In the case 1.1750 is broken downwards, the pair might drop to 1.1700.

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of growth to 1.3910. Today the market is forming a consolidation range at these highs. The range can extend to 1.3930. Then we expect a decline to 1.3805.

USD/RUB, “US Dollar vs Russian Ruble”

The currency pair is trading in a declining structure to 75.76. Then is should grow to 76.26. At these levels, we expect a consolidation range to form. With an escape downwards, a decline to 75.49 will become possible, and with a breakaway of this downwards, we expect a decline to 74.40.

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair has completed a structure of a declining wave to 109.96. Today it might correct to 110.51. Practically, we expect a consolidation range to develop at these levels. With an escape upwards, the price might go up to 111.44, and with an escape downwards, the decline might continue to 109.40.

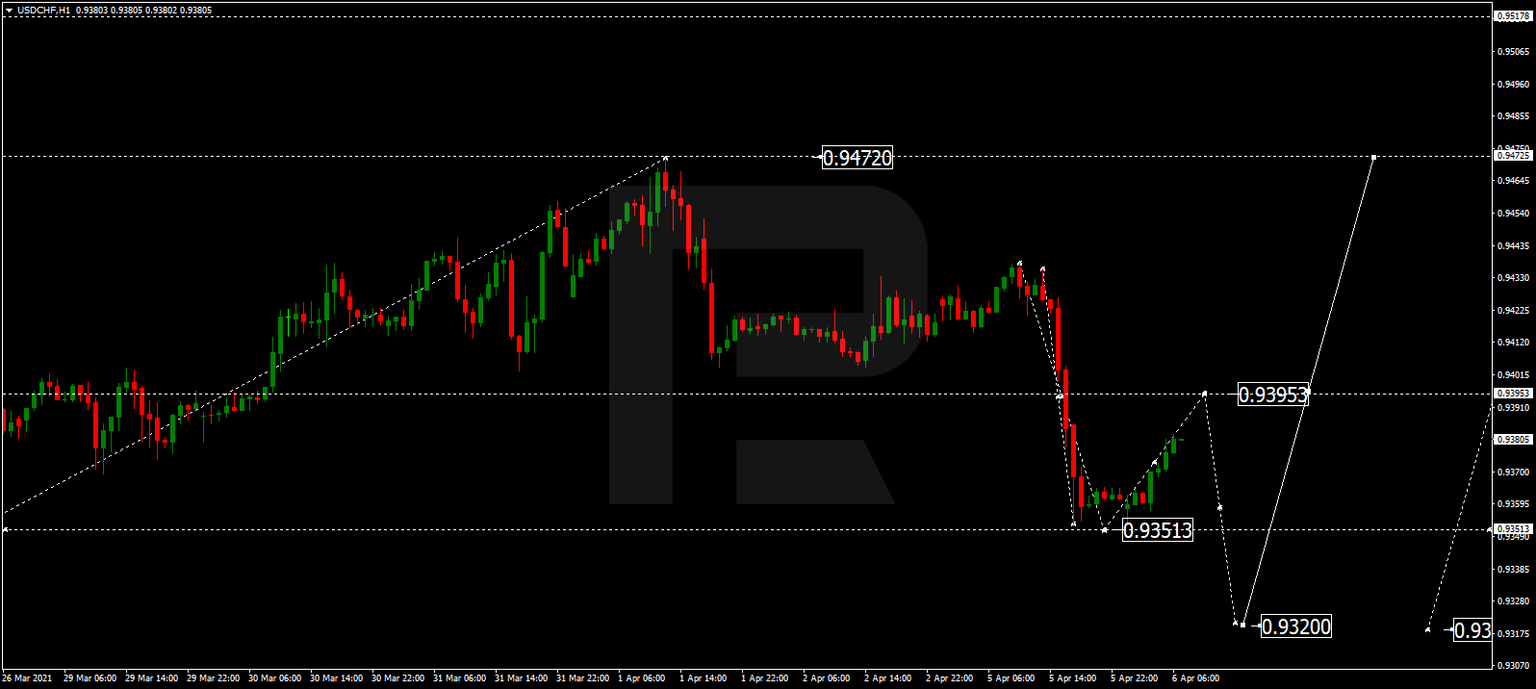

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair has performed a wave of decline to 0.9355. Today it might correct to 0.9393, then continue declining to 0.9300 and then grow to 0.9474.

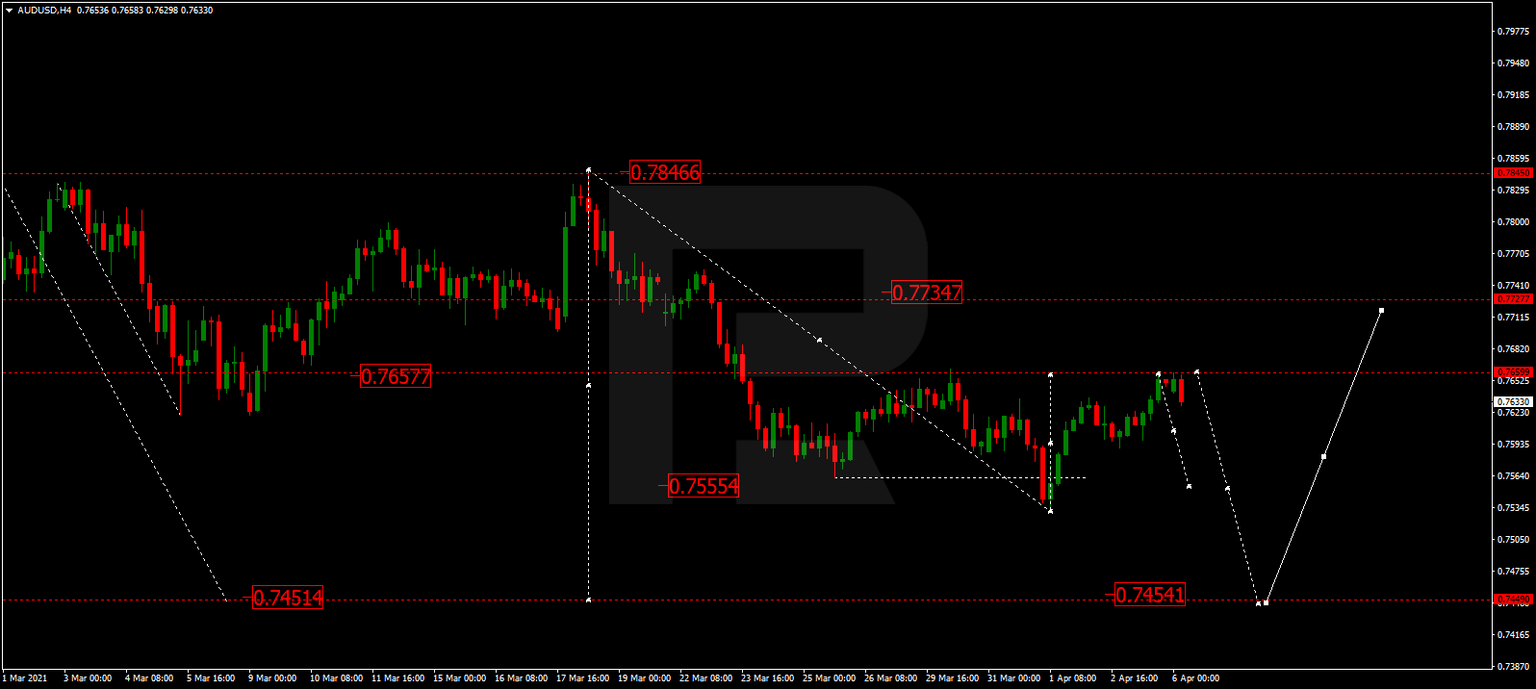

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair has completed a correction to 0.7657. Then we expect a decline to 0.7454. Here the wave of decline will be completed, after which growth to 0.7730 should follow.

Brent

Oil has broken through 62.80 downwards. Practically, a declining pathway to 60.50 has opened. The goal is local. Then we expect growth to 62.80 (a test from below), followed by a decline to 60.00. Then a link of growth to 65.50 is expected.

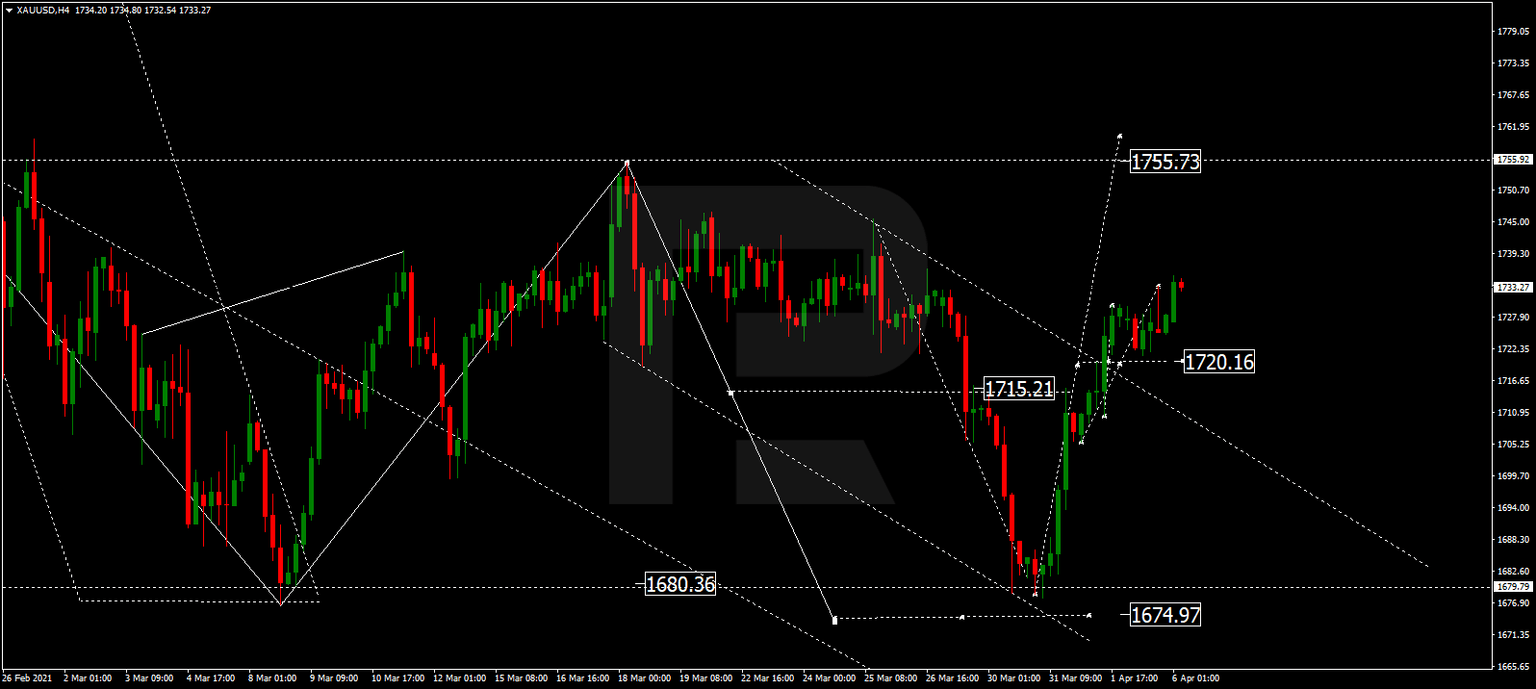

XAU/USD, “Gold vs US Dollar”

Gold has formed a consolidation range around 1720.16. Today the market is growing, practically breaking through the upper border of the range. We expect the wave of growth to continue to 1755.75.

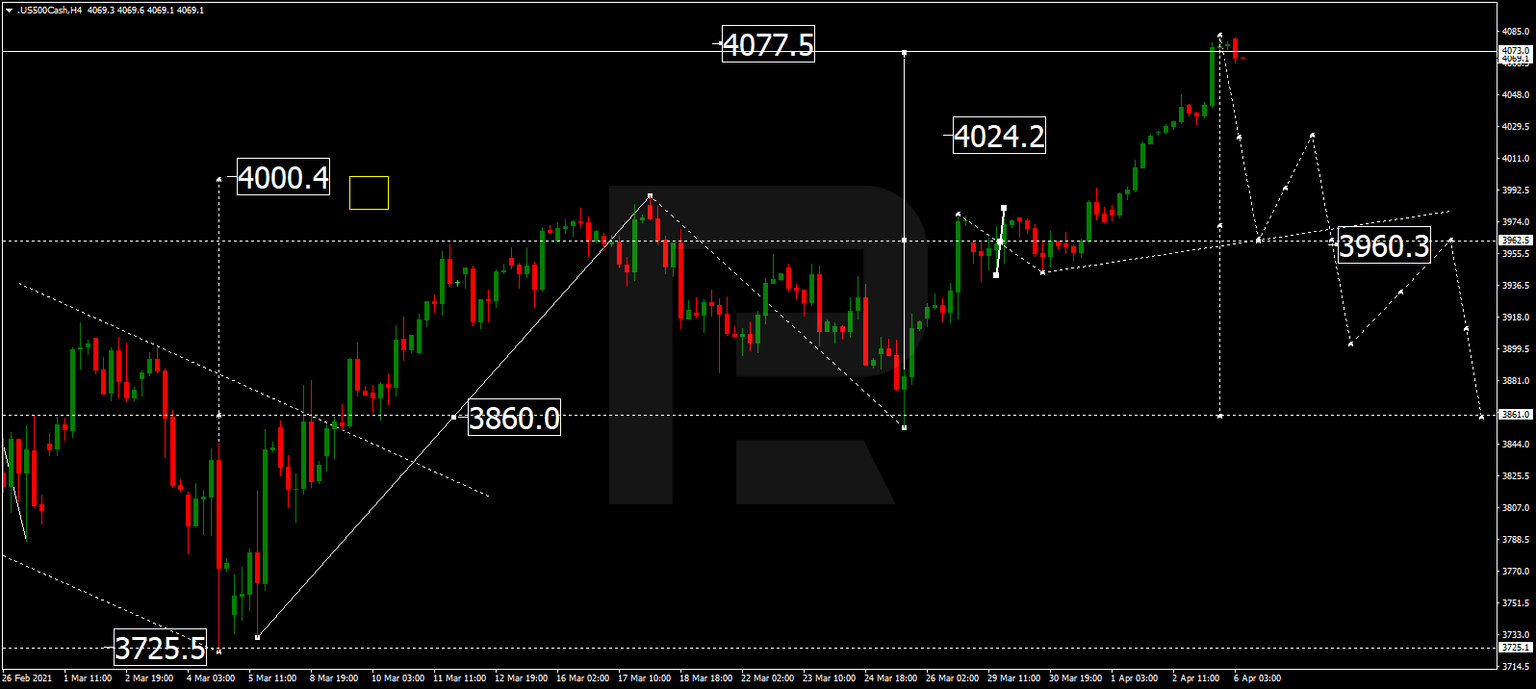

S&P 500

The index formed a consolidation range around 3960.3, escaped it, and extended the wave to 4077.5. Today we expect a decline to 3960.3 (a test from above). Then the trend might continue to 4160.0.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.