Forex technical analysis and forecast: Majors, equities and commodities

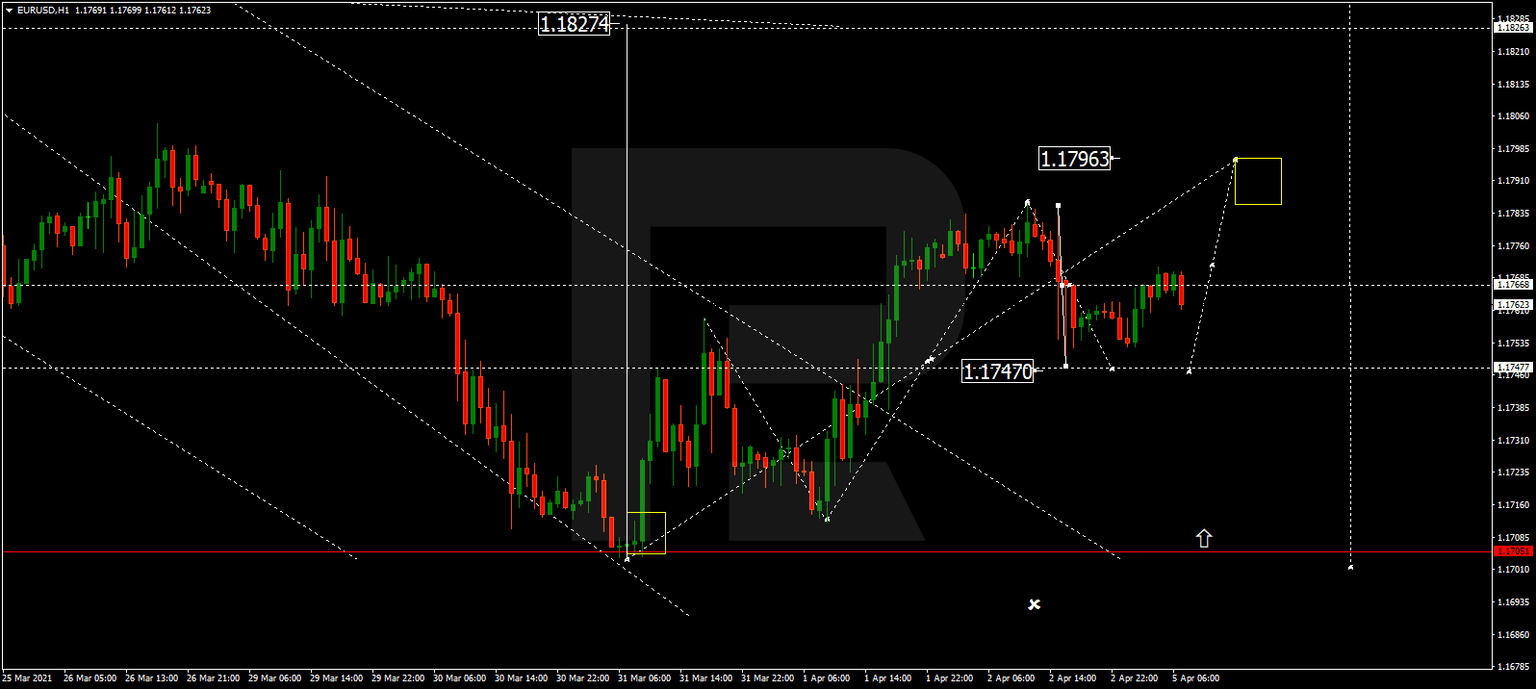

EUR/USD, “Euro vs US Dollar”

The currency pair completed a wave of growth towards 1.1785. Today the market is correcting to 1.1747, after which we expect growth to 1.1797. The price can even leap up to 1.1830, after which a wave of decline to 1.1700 might start.

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair is trading in a consolidation range around 1.3800. Today, it might extend to 1.3859, then correct to 1.3800 again. After the correction, we expect the price to grow to 1.3911.

USD/RUB, “US Dollar vs Russian Ruble”

The currency pair keeps forming a consolidation range around 76.00. The range might then extend to 76.70. Then the price might drop to 75.10 (at least), after which growth to 77.50 should follow.

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair is forming a consolidation range above 110.51. The main scenario is a downward correction to 110.08, followed by growth to 111.44.

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair is trading in a consolidation range around 0.9444 without any bright trend. Today, the price might drop to 0.9371. After which growth to 0.9520 might follow.

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair has performed a decline to 0.7535. At the moment, the market is correcting to 0.7600. After the end of the correction, we expect a decline to 0.7454.

Brent

Oil keeps developing a consolidation range around 64.00. Today the range should extend to 65.52, after which the price is expected to drop to 60.00.

XAU/USD, “Gold vs US Dollar”

Gold is trading in a consolidation range around 1720.00. Today, growth might continue to 1755.73, followed by a decline to 1720.00. With an escape from this range upwards, potential for growth to 1815.00 will appear. The goal is local.

S&P 500

The index has completed a wave of growth to 4040.4. Today, we expect a consolidation range to develop above this level. With an escape downwards, a correction to 3946.7 might happen. Then growth should continue to 4160.0.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.