Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

After re-testing the mid-term resistance level at 1.1869, EURUSD failed to reach the resistance line of a Triangle pattern at 1.1896. However, the pair has managed to break the support level at 1.1832 and reach the projected support area at 1,1789. After forming another pullback and testing from below, the asset may continue its mid-term decline with the target at 1.1675.

GBP/USD, “Great Britain Pound vs US Dollar”

After reaching the projected resistance line of the mid-term channel at 1.2890 and testing it, GBPUSD has fixed above it; the current support is at 1.2895. The MACD indicator is directed to the upside, thus confirming the potential for further growth to break 1.3030 and then reach 1.3150. However, if the price breaks the local support area at 1.2895, the market may continue falling towards 1.2805 and then update the lows at 1.2600.

USD/RUB, “US Dollar vs Russian Ruble”

USD/RUB is still slowly falling towards the support area at 74.50. If the price breaks it, the market may continue the current descending tendency with the target at 71.90. This scenario is confirmed by the MACD indicator, which is directed to the downside. After testing the support area and rebounding from it, the pair may form a new ascending wave to reach the high at 76.58 and then 77.50.

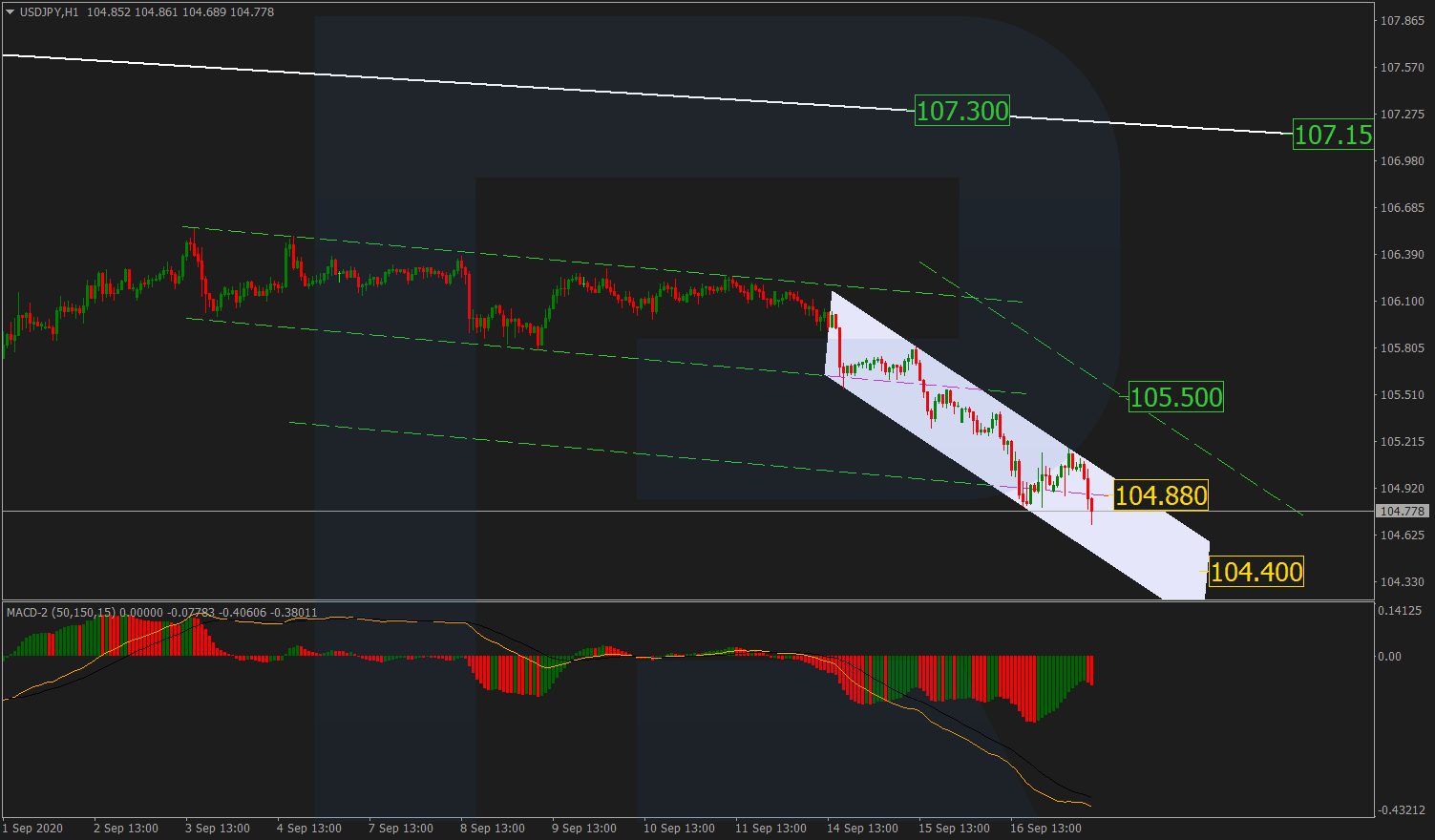

USD/JPY, “US Dollar vs Japanese Yen”

After testing and breaking 104.88, USDJPY is expected to continue falling with the target at 104.40. The MACD indicator is forming a convergence, which may hint at a short-term pullback or a reversal after the instrument reaches the above-mentioned target. The resistance line is at 105.50.

BRENT

After reaching the targets at 38.2% and 50.0% fibo at 42.00 and 42.75 respectively, Brent is correcting but may yet update the highs soon. After that, the instrument may reverse and resume falling towards the key support area at 40.00.

XAU/USD, “Gold vs US Dollar”

After testing the support level at 1954.00 from above and then forming a new ascending structure, Gold has updated the local high but yet failed to reach a psychologically-crucial level at 2000.00. However, there is a divergence on MACD, which indicates a potential reversal and a breakout of the support area at 1954.00 and continue falling within the Triangle pattern with the target at 1921.60.

BTC/USD, “Bitcoin vs US Dollar”

BTCUSD is forming a new correctional uptrend and has updated the local high but yet failed to reach 61.8% fibo at 11200.00. Taking into account a stable ascending tendency, the MACD indicator is forming a divergence, which may hint at a new decline towards the support area at 10440.00 and then continue falling towards with the key target at the low at 9824.00.

S&P 500

The S&P 500 index is correcting upwards; it has already reached 38.2% fibo but yet failed to reach 3451.0. After a short-term pullback and a divergence, the pair has fallen towards the support area at 23.6% fibo at 3376.6. “Black Cross” on MACD hints at further decline to reach the low at 3310.6 and then the mid-term 23.6% fibo at 3258.9.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.