Forecast and News: EUR/USD, GBP/USD, USD/JPY stock indices, Gold, and Crude Oil

Today's Squared Financial Forecast

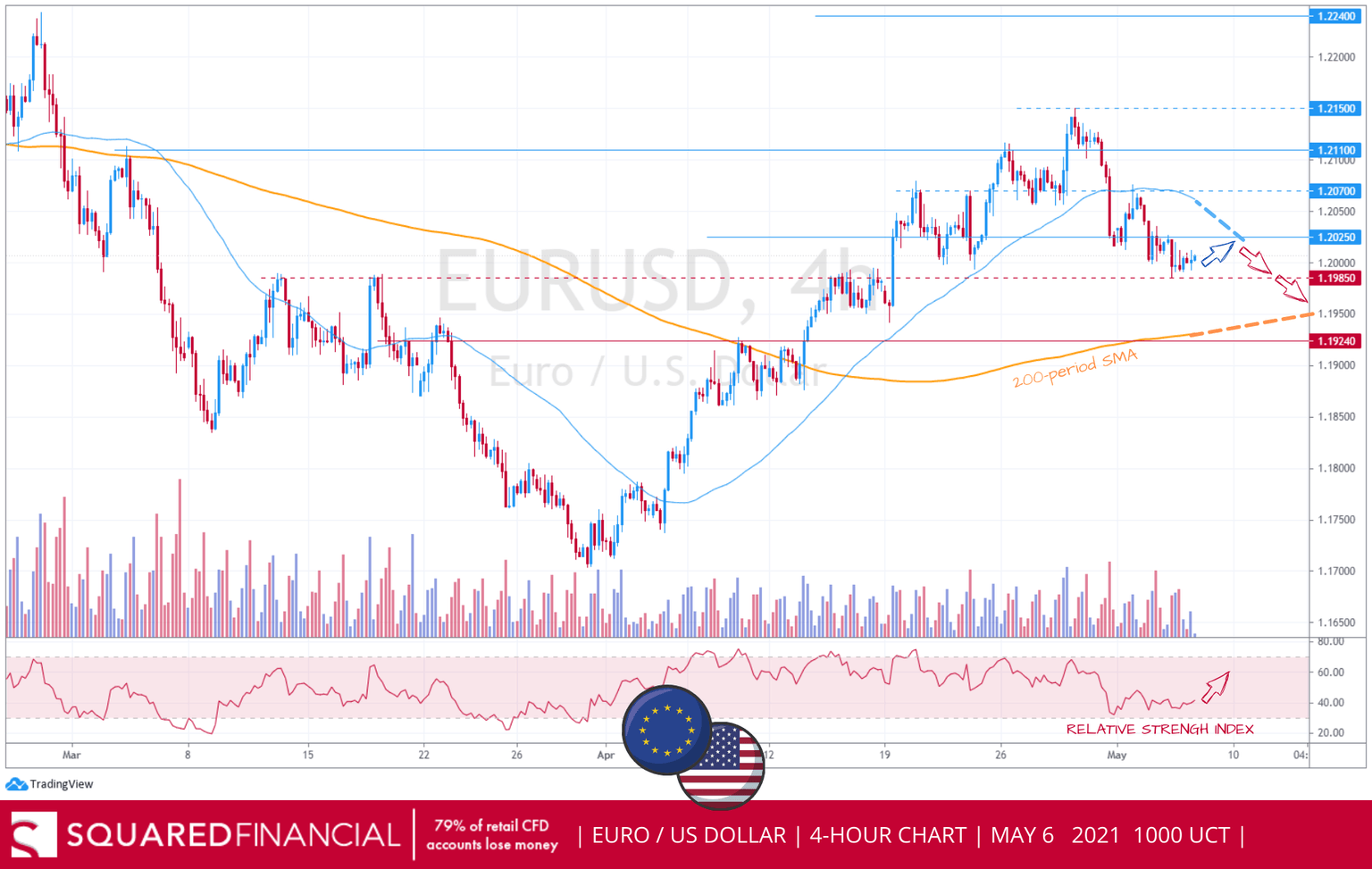

EUR/USD

Services PMI rose yesterday from 49.6 to 50.5 indicating the fastest expansion since July 2020 and the 2nd best in nearly 3 years, with Germany leading the way in overall growth. But that wasn’t enough to lift a weakening Euro. German factory orders and Eurozone retail sales figures, in addition to US jobless claims later in the session, will have an impact on the single European currency today. Technically speaking, EURUSD remains on a downtrend printing lower lows, with a breach of the 1.1985 support level to trigger an acceleration to the 200-period SMA around 1.1950 / 1.1924.

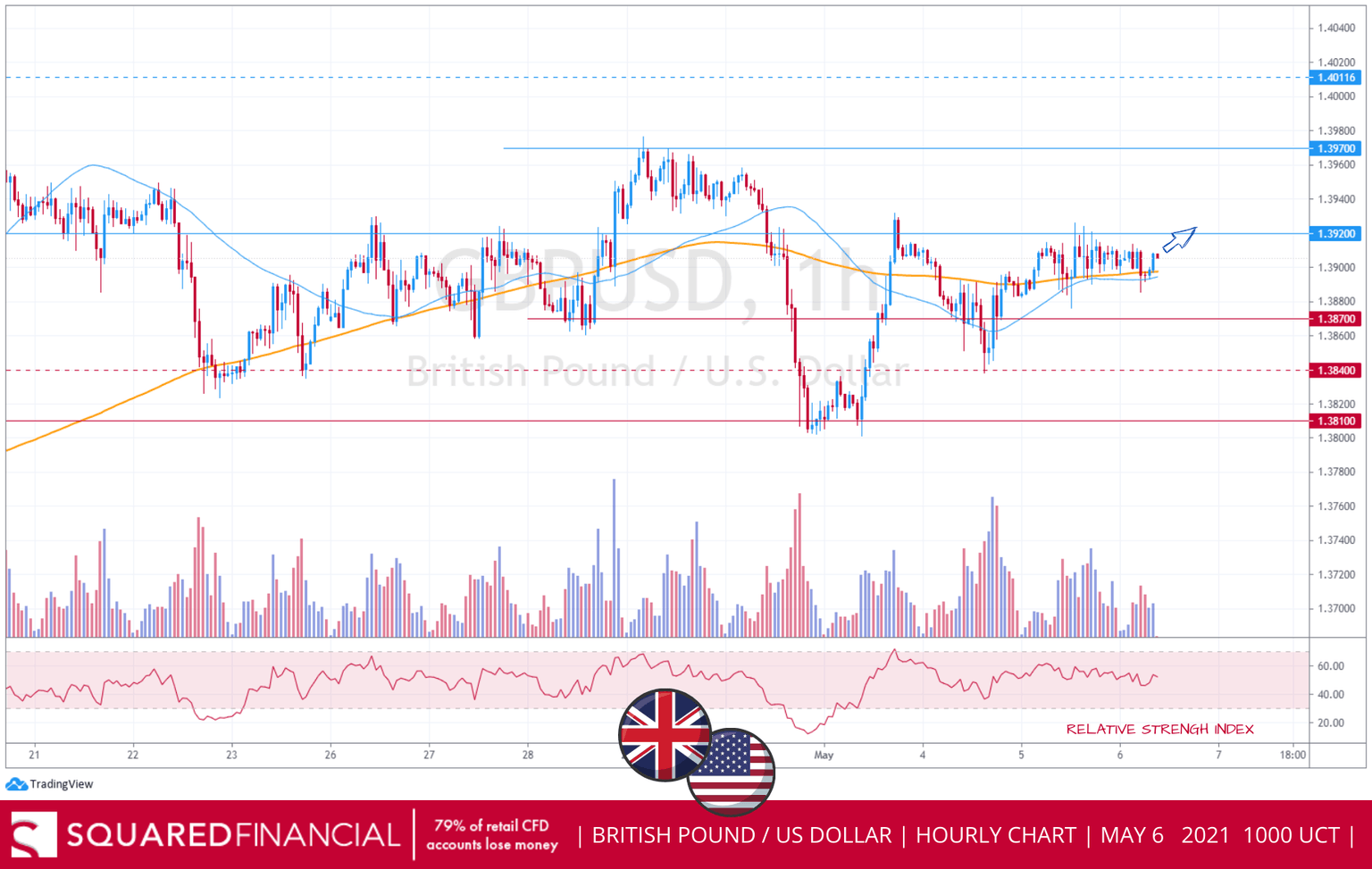

GBP/USD

The British Pound continues to consolidate around the 1.39 area, as traders await the BoE Monetary Policy Report due later today, and the US NFP number tomorrow, with technical indicators still favoring a move higher in the short-term.

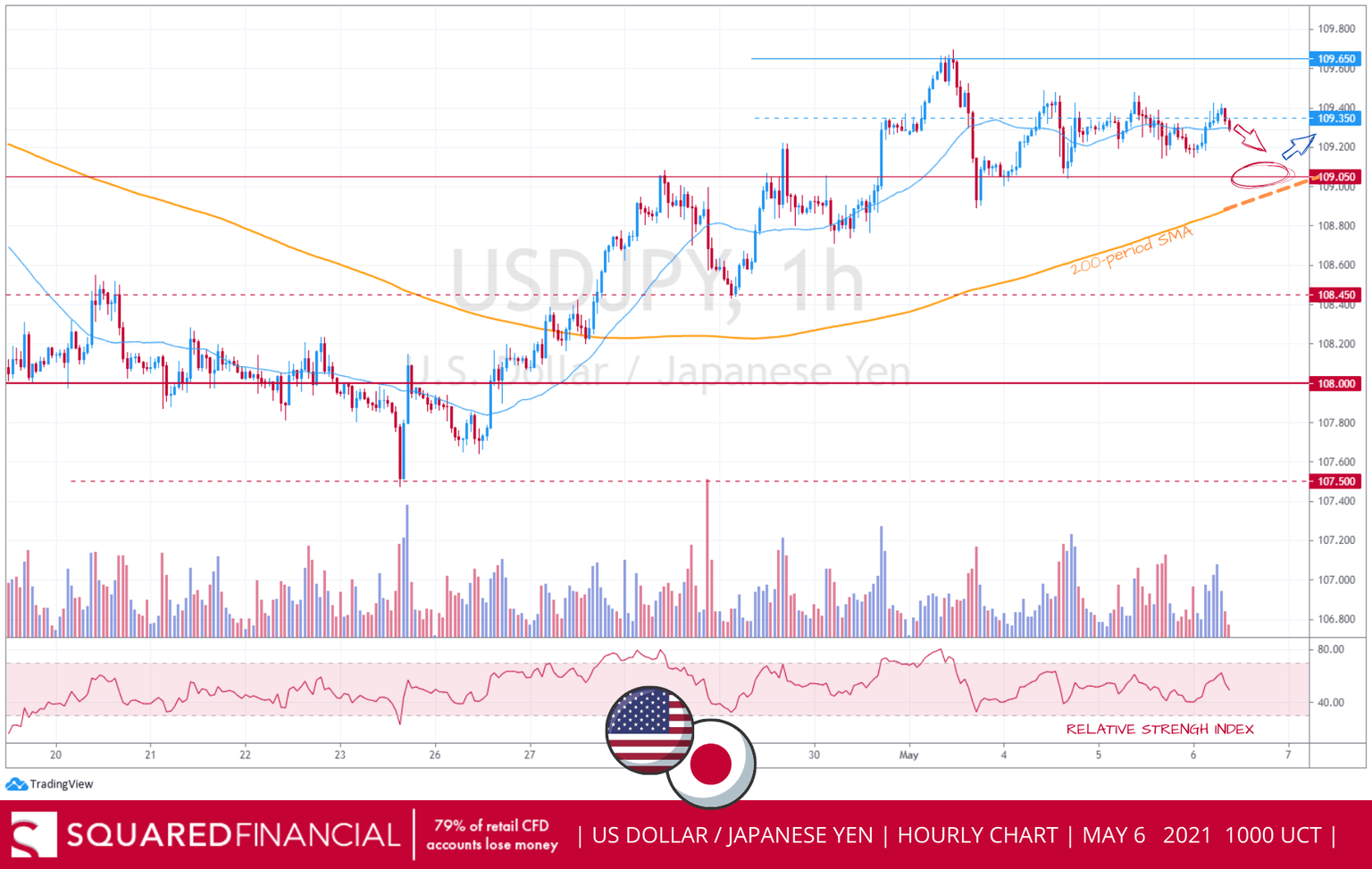

USD/JPY

USDJPY failed to retest the ¥109.65 resistance area as the pair continues to consolidate and selling pressure seems to be building up, with the US jobs number coming out on Friday to otherwise trigger some price action in this quiet market. Technically, the forex pair remains supported by the 200-period SMA around ¥109.05.

FTSE 100

Strong momentum and good corporate earnings pushed the FTSE100 index above the 7030-resistance level, ahead of the BoE’s latest monetary policy decision to be released at midday today. Focus will be on whether we could start to hear some taper talk or not. Regional elections across the UK, especially in Scotland, will also be in the spotlight.

DOW JONES

The Dow Jones Industrial Average hit a new record yesterday as investors and money managers rotate away from growth and technology stocks and buy value stocks and Dow components, as prospects for rising rates increase. The Labor Department will publish April’s employment report on Friday.

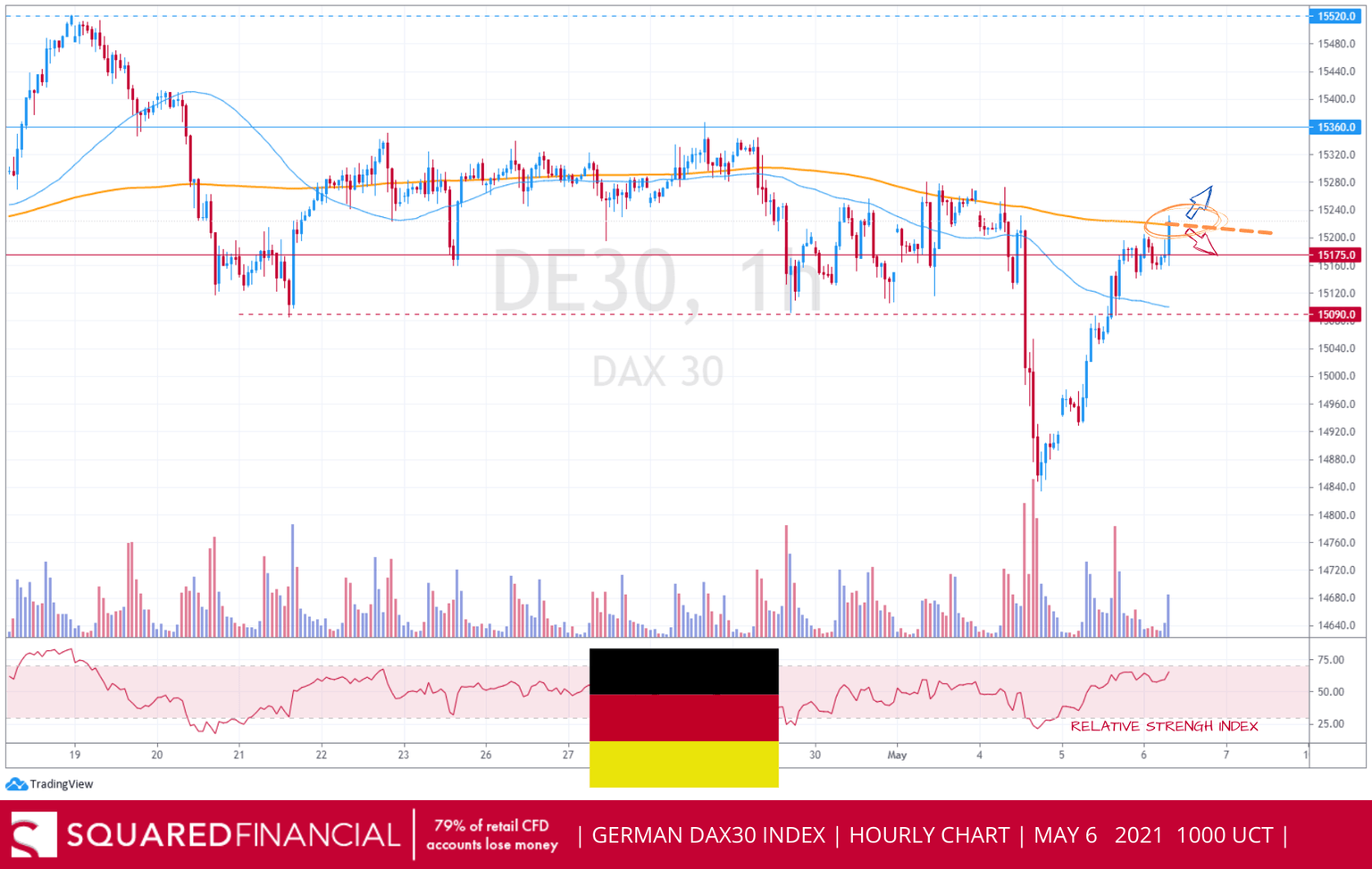

DAX 30

The DAX30 climbed back all the way to the 200-period moving average, as data showed better-than-expected overall growth in the Eurozone, particularly in Germany. Moreover, earlier this morning, German Factory Orders increased more than expected suggesting that the manufacturing sector in Europe’s top economies are seeing an impressive post-pandemic recovery, with a sustained move above 15200 to signal more upside potential.

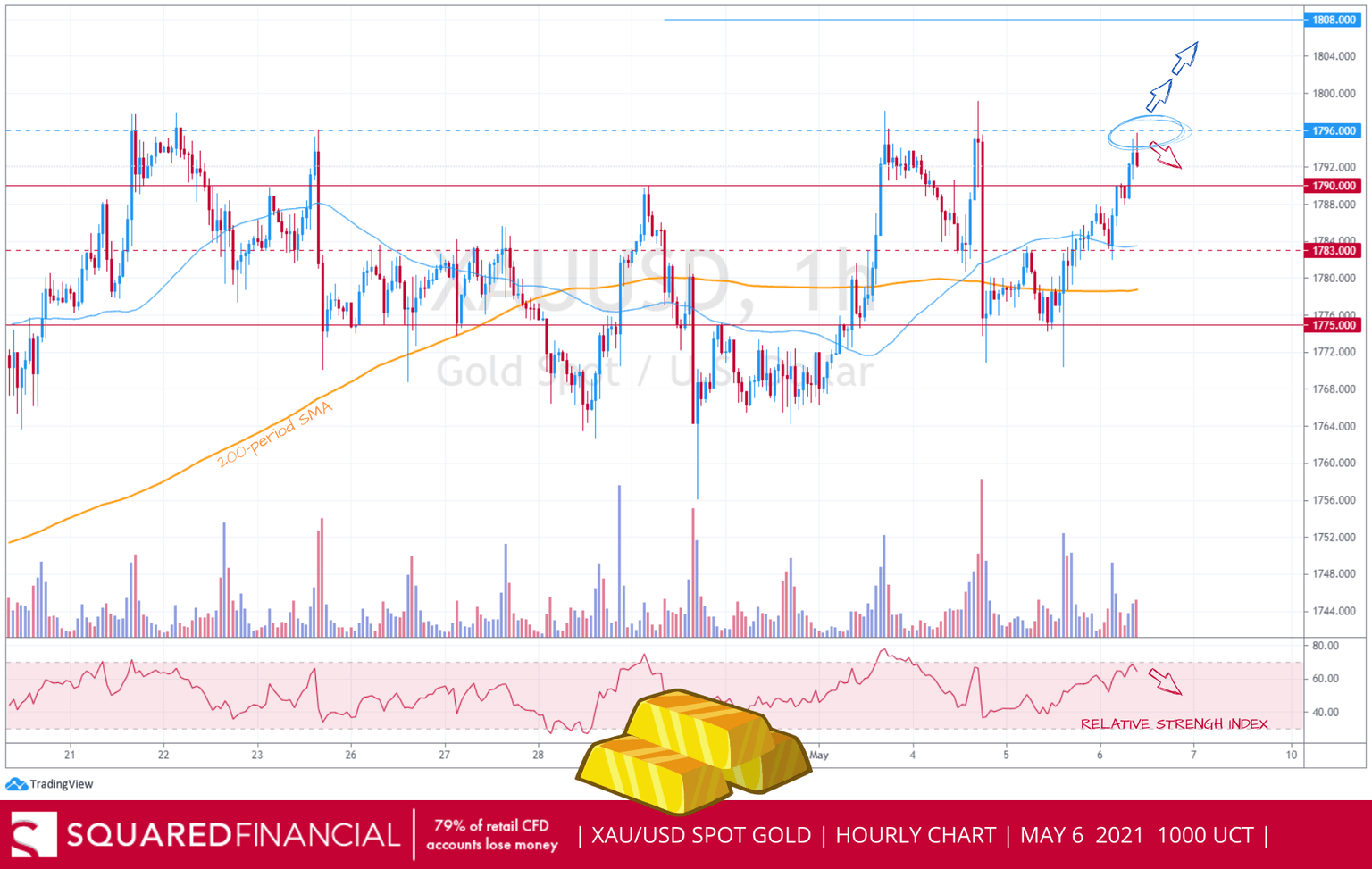

GOLD

Gold hit our support target at $1773 before bouncing back and ending yesterday’s session in the green, as the five-year breakeven rate jumped to its highest since 2008 as investors look ahead towards today’s Initial Jobless Claims data. With the greenback kicking off the day on the backside and as inflation risks remain the main driver for the yellow metal, an hourly close above $1796 will open the door to further upside with $1808 as the next resistance target.

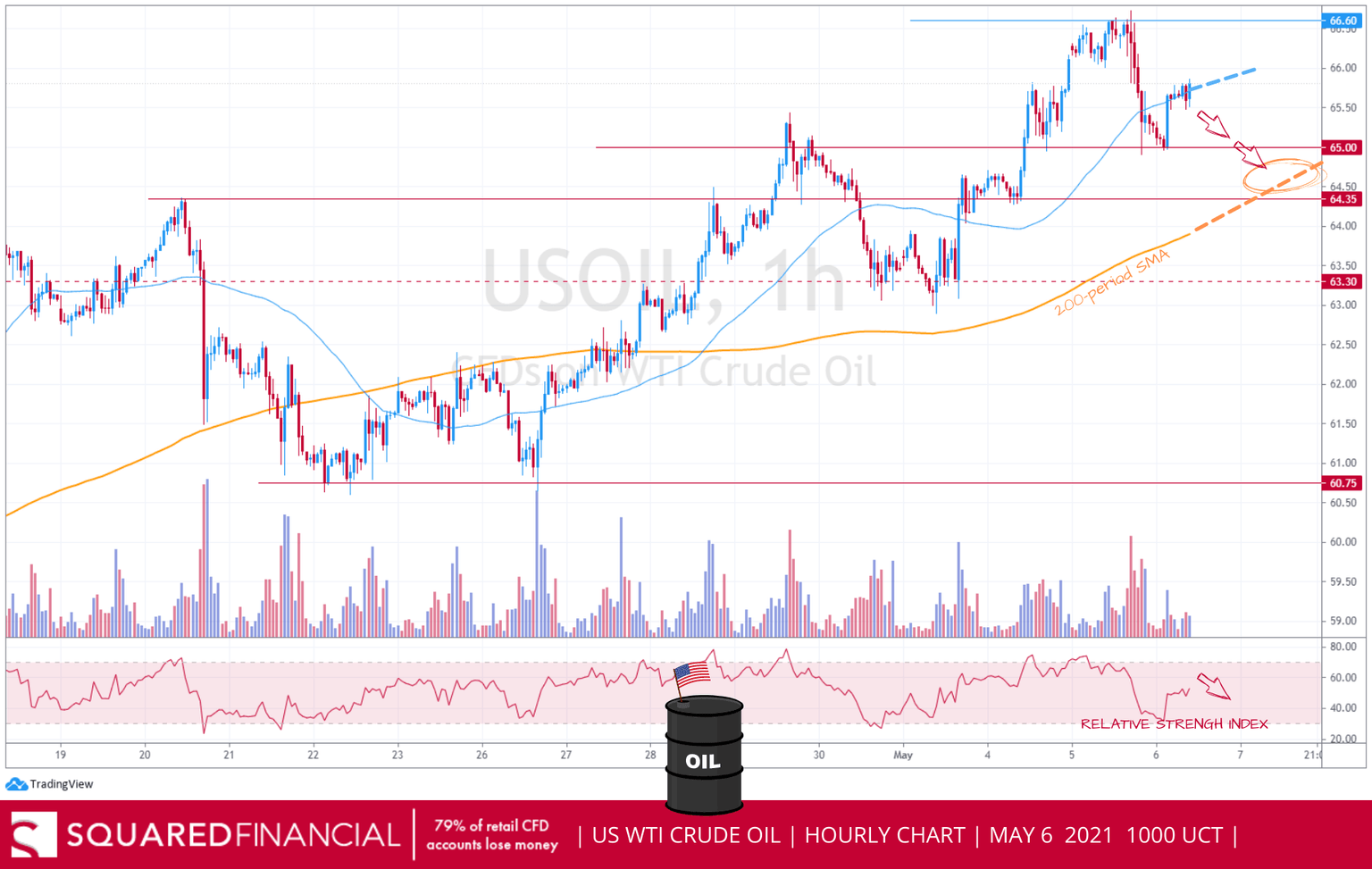

US OIL

An uneven recovery in global demand and Covid-19 cases surging dramatically in India weighed down on WTI Crude oil prices, while a drawdown in US inventories of -7.99Mb vs. consensus of -2.436Mb provided some support, holding the black gold above $65. Technically, an hourly close below $65.50 will favor further downside with $65 and $64.35 as next support targets.

Author

Rony Nehme

SquaredFinancial

Rony has over twenty years of experience in financial planning and professional proprietary trading in the equity and currency markets.