FOMC as called for you – Now what?

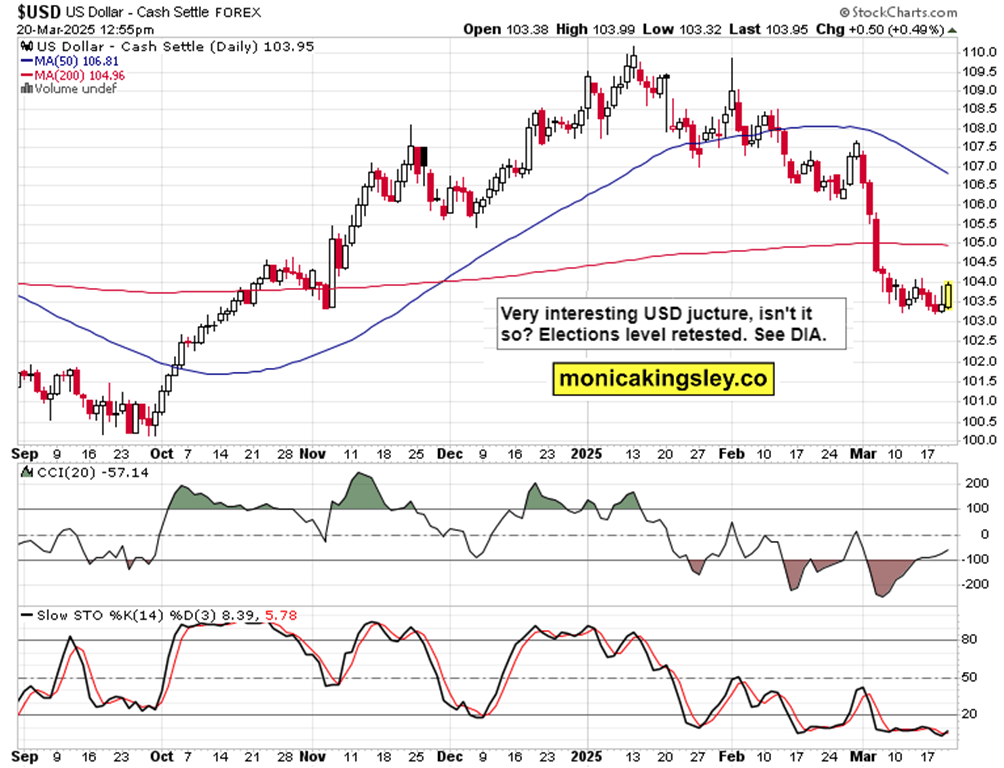

S&P 500 consolidated before FOMC, and then liftoff, exactly what I told clients to expect. It doesn‘t matter there was no cut, what counts is that there was the dot plot with two 25bp ones for 2025, and most importantly significant dialing back of QT to only $5bn. The advance clues presented in yesterday‘s smashing video brought great fruits to all clients – and I‘m on the record for saying that today‘s premarket flush is no game (trend) changer is the S&P 500 bottoming process, humbly starting as a short squeeze (bullish reaction to Friday‘s stagflationary data was the first giveaway in need of further confirmation) – we‘re now in the oversold bounce getting mature stage, back to very technical trading amid positive macro news that will underpin BTC, MSTR as well. USD is sending important signs for industrials, precious metals and copper, don‘t miss them (that‘s Trading Signals). All eyes on king dollar here around 103.50.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.