Five Fundamentals for the Week: Trade war, inflation and consumer confidence to shake markets

- Trade-war developments continue dominating headlines, with several levies set to come into force.

- US inflation figures are set to rock markets despite not fully reflecting tariffs.

- Consumer sentiment is of high interest after the plunge seen last time.

Where are trade wars heading? Are US consumers feeling higher prices and more fear, or are things improving? The action continues after the mixed Nonfarm Payrolls. Here is a preview of upcoming events.

1) Tariff wars continue at full speed

"Transition period," said US President Donald Trump about the impact of his tariffs on the economy, seeming to accept pain. On the other hand, Jerome Powell, Chair of the Federal Reserve (Fed), acknowledged uncertainty but seemed upbeat.

Markets are torn between various narratives, and in the meantime, additional duties come into effect. Chinese counter-tariffs have just come into effect, while American steel and aluminum levies are due on Wednesday, impacting Canada more than other countries.

To complicate matters, China is set to implement retaliatory tariffs on Canada on March 20, while the northern nation is on course to expand its retaliatory measures on the US on March 25. Mark Carney, who is set to replace Justin Trudeau as Canadian Prime Minister, has maintained the tough line.

Trump has suspended some of the implementation of tariffs on Canada and Mexico until April, but his due date for reciprocal tariffs, April 2, is nearing.

Headlines suggesting an escalation in trade wars are set to hit Stocks and affected currencies, while reports of negotiations toward a deal, suspensions of tariffs, or the less likely removal of measures, will be good news.

2) US JOLTs set to jolt markets

Tuesday, 14:00 GMT. The JOLTs job openings figures are for January, but the Fed watches hiring and firing data closely as a sign of underlying trends. Job openings dropped to 7.6 million annualized in December, pointing to a cooldown.

This time, the economic calendar points to an increase of 7.71 million. An increase back above eight million would be a positive sign, while a slide below 7.5 million would weigh on sentiment.

Apart from the headline figure, the level of quits – people voluntarily leaving their jobs – is a sign of confidence. If it falls, it shows people are more fearful of a downturn. An increase in quits is a positive sign.

3) Core CPI has a low bar to cross, and stagflation fears could emerge

Wednesday, 12:30 GMT. Investors and the Fed were disappointed to see inflation figures edge up in January. This upcoming Consumer Price Index (CPI) report for February is set to show a small cooldown in price rises.

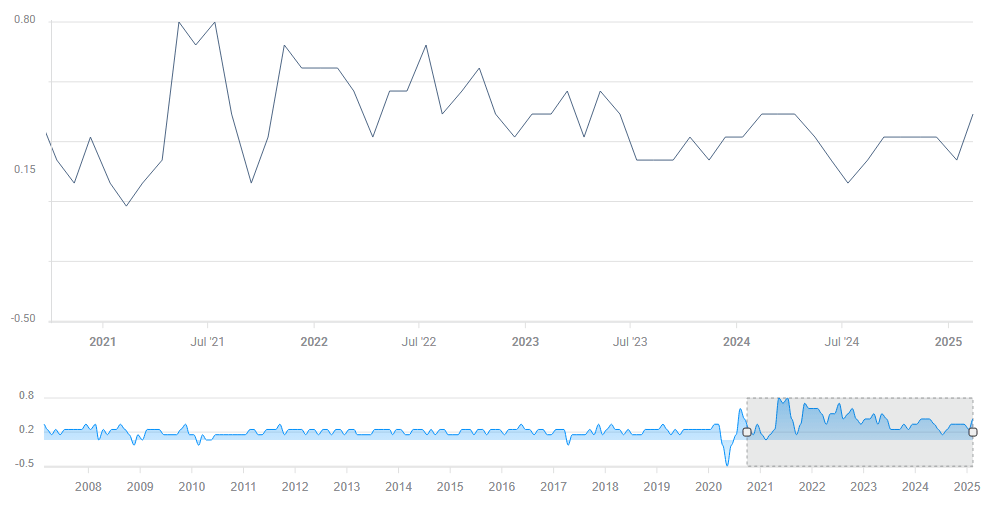

The most important release is the monthly core CPI. It reflects the most recent price development, excluding volatile food and energy prices, which the Fed has less influence on. After a jump of 0.4% in January, a 0.3% advance is projected for February. Nevertheless, that would also be too high.

Core CPI MoM. Source: FXStreet.

Any 0.1% deviation in monthly and yearly core CPI would shake markets. Headline CPI is important for politics – it is Trump's first inflation report card – but not for markets.

4) BoC set to cut rates again, comments on tariff impact are eyed

Wednesday, decision at 13:45 GMT, press conference at 14:30 GMT. The Bank of Canada (BoC) is torn between a rock and a hard place. On the one hand, inflation is falling and the central bank would like to cut interest rates and bring them back to pre-rate-hike-cycle levels. That is why the BoC is set to slash borrowing costs by 25 basis points (bps) on Wednesday.

On the other hand, the trade war between the US and Canada means higher prices for consumers, implying potential rate hikes. BoC Governor Tiff Macklem faces tough dilemmas.

While this rate cut will likely happen as expected, the Canadian Dollar (CAD) is set to rock on the bank's comments on the impact of tariffs. I expect the announcement to have an impact beyond the Loonie, as the BoC's thinking may serve as a prelude to the Fed decision due one week later.

Incoming Canadian Prime Minister Mark Carney, who led the BoC during the financial crisis, has taken a tough line on trade wars with the US, and the BoC could reflect a worst-case scenario. I expect the BoC to convey a gloomy message about the North American economies, hitting global sentiment.

5) US Consumer Sentiment could take a dive, weighing on sentiment

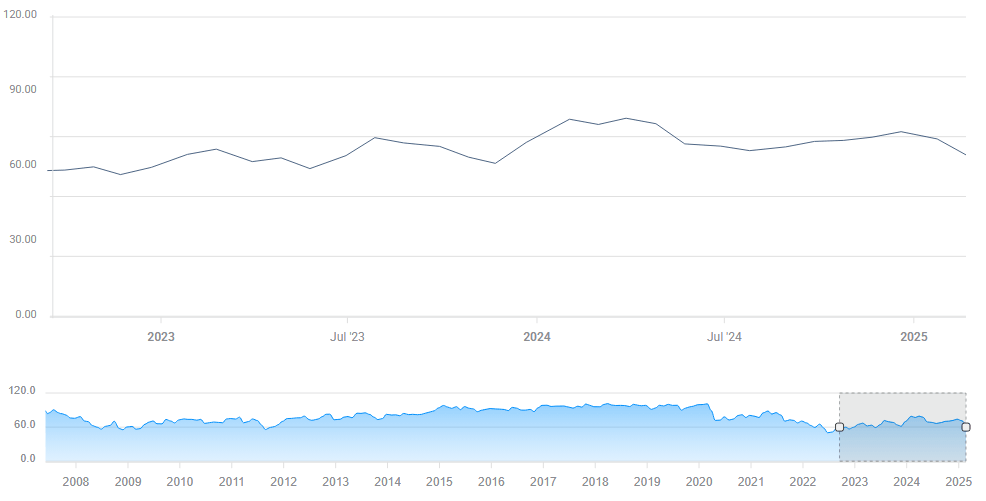

Friday, 14:00 GMT. The University of Michigan's Consumer Sentiment Index plunged to 64.7 in the revised figure for February, pointing to an increase in worries. The upcoming preliminary release for March is set to edge down to 64, but it could retreat further.

Consumer Sentiment. Source: FXStreet.

A fall under 60 would be a big blow, but any miss would hurt sentiment. An increase toward the 70 handle would be good news.

Apart from the headline, investors will also watch the 5-year inflation expectations figure. It jumped to 3.5% in February, pointing to concerns about rising prices. A stagnating economy and an increase in inflation are bad for the Fed and markets. Such a "stagflation" scenario would paralyze policymaking and weigh on sentiment.

Final thoughts

As every week so far in the Trump 2.0 era, headlines may rock markets, and they heavily compete with data. And note that the US moved clocks this weekend, which means release times have changed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.