Five fundamentals for the week: Fed minutes may cool Bessent boost, jobless claims, core PCE eyed

- Statements from officials in the new Trump administration will continue moving markets.

- Jobless claims and core PCE provide updates on the Federal Reserve's two mandates.

- Minutes from the latest Fed decision are of interest as well.

Will the rally around Scott Bessent's nomination continue? The short Thanksgiving week features a busy Wednesday packed with events, and the central bank may cool the enthusiasm.

1) Statements from the incoming administration may continue rocking markets

Will President-elect Donald Trump focus on tariffs or tax cuts? That is a critical question for markets, which prefer lower rates on everything. The nomination of Scott Bessent – a hedge fund manager who previously worked with George Soros – has inspired markets. Bessent supports tax cuts.

Contrary to the outgoing administration of President Joe Biden, the new White House will likely provide more color to markets – but not necessarily upbeat for them.

I expect the optimism to last a few more days, supporting Stocks and Gold while weighing on the US Dollar (USD).

2) CB Consumer Confidence to show post-election mood

Tuesday, 15:00 GMT. The Conference Board's (CB) monthly gauge of Consumer Sentiment jumped to 108.7 in October, ahead of the elections. It showed that falling inflation encourages shopping and that Americans are more content with their economic situation.

Has the decisive outcome of the election further boosted sentiment? While Democrats are disappointed, the lack of any post-election mess may have supported overall optimism. A rise would extend the current trends in Stocks, Gold, and the US Dollar.

3) FOMC Meeting Minutes to make for a quiet Thanksgiving

Tuesday, 19:00 GMT. Fed Chair Jerome Powell dismissed a subtle wording change in the bank's recent rate statement, signaling that he is not worried by the minor bump up in inflation. However, Powell tends to be more dovish than some of his colleagues, who may come out of the woodwork now.

The FOMC Meeting Minutes are not merely a protocol of what went down in the Fed's latest meeting in early November but rather a document revised to emphasize or de-emphasize certain aspects according to what the Fed wants to convey to markets.

I expect the minutes to show some members wanted a tougher message against inflation, cooling expectations of a rapid decrease in interest rates. Officials may be worried about the fast rallies on Wall Street.

4) Jobless Claims watched for any deterioration

Wednesday, 13:30 GMT. The economic calendar is packed at this time – a result of the Thanksgiving holiday. While the Gross Domestic Product (GDP) release is merely an update for the third quarter, the weekly Unemployment Claims release is for the week that ended on November 22.

Initial Claims dropped to 213K last week, showing the labor market is robust. A minor increase could come now, as the figure is close to its historic lows.

A jump above 230K would be worrying, but that is unlikely. I expect another upbeat figure, showing that the economy has room to run.

5) Core PCE to show the last mile of fighting inflation is the longest

Wednesday, 13:30 GMT. The Federal Reserve (Fed) targets the core Personal Consumption Expenditure (PCE) as its inflation target. This gauge is below 3% year-over-year (YoY), but getting to the 2% bank’s target proves hard.

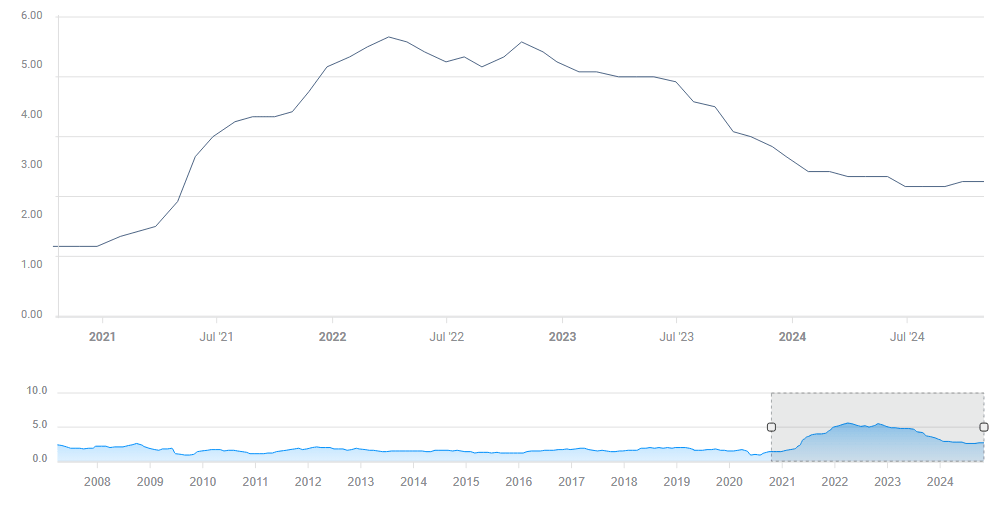

Core PCE stood at 2.7% YoY in October, above the lows:

US Core PCE YoY. Source: FXStreet

Core Consumer Price Index (CPI) showed that underlying inflation rose by 0.3% in October, the third straight such increase, which is 3.6% annualized. This gauge – which is released earlier and uses a different methodology – implies that the core PCE for last month will be too high.

Unless there is a surprise, this release may cool markets, weigh on Gold, and support the US Dollar.

Final thoughts

The fact that this is a short week doesn't mean that market moves will be slow – investors may be scrambling to position themselves before the holiday. Beware of erratic moves.

That would cool Stocks and Gold while supporting the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.