Federal Reserve stays silent on taper timing after status quo FOMC

- Fed funds rate and bond purchases unchanged at 0.25% and $120 billion.

- Chair Powell says Fed awaiting “substantial further progress’.

- Equities, dollar and Treasury yields fall after Powell refuses to laud progress.

The US economy is improving by leaps and bounds. Covid cases are in steep decline. Payrolls added almost one million jobs in March. Layoffs dropped 200,000 in the last two weeks. Help wanted signs are sprouting like spring crocuses.

With so much good news why is Federal Reserve Chair Jerome Powell so dour?

Perhaps we are unfair.

Why would Mr Powell not talk to the markets about the progress that has been made? Or how much brighter the US future looks than a mere three months ago? If the good news continues won't the Fed begin to end its extraordinary economic support?

When asked by reporters about the quickening recovery and what it might mean for the Fed’s $120 million in monthly bond purchases Mr. Powell had only two answers.

It is not time yet to withdraw support and our standard is "substantial further progress".

No matter how many times reporters asked or how they phrased the query, the response was always the same. Not yet. When we feel it is time we will inform the public.

Mr. Powell repeated this formulation numerous times during the press conference without offering any elaboration.

It may seem a bit uncharitable of the Fed, in its official capacity, not to offer some positive news or to recount the achievements of the past quarter to a US public that has been through the trials of the past year. The Federal Reserve is one of the few American institutions that has not seen a steep decline in its approval rating.

At one point Mr. Powell, whose equanimity is remarkable, was asked by a reporter if he has visited the homeless encampments near the Federal Reserve Building. Presumably to confer on interest rate policy. Without missing a beat he said that he had not but that would like to when his trip would not be a story in itself.

When pressed yet again on the meaning of progress, Mr. Powell retorted, “We had one great jobs report, that is not enough.”

US economic improvement

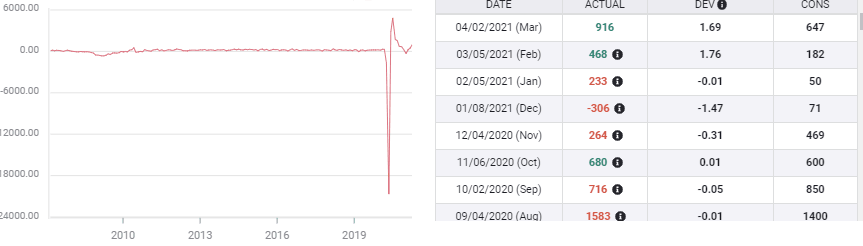

The improvement in the US economic picture is clear with or without the Fed's endorsement. The labor market is booming with 1.617 million people hired in the first quarter, nearly one million of those in March. The consensus forecast for April’s Nonfarm Payrolls due on May 7 is for another 925,000 to be employed.

Nonfarm Payrolls

FXStreet

Initial Jobless claims, the telltale for the economic collapse a year ago, fell from 769,00 to 547,000 in the most recent two weeks. The drop indicates the damage from the lockdowns has probably halted even in the most hard-hit sectors.

On the productive side optimism among manufacturing executives is at its highest in a generation propelled by a nine-month tsunami of new orders. Service managers are equally buoyant with the highest reading in the purchasing managers’ indexes in two decades.

Market response

If markets were hoping for a more definitive statement on the future of the US economy and the Fed’s bond purchase program they did not show it.

Equities were modestly lower. The Dow lost 164.55 points, 0.48% to 33,820.38. The NASDAQ shed 0.28%, 39.189 points to 14,051.03, and the S&P 500 was stable, down 0.08%, 3.54 points to 4,183.18. As all of the averages are near their all-time highs, the reaction cannot be judged a disappointment.

The currency market had the most negative assessment with the dollar losing ground in all the major pairs but in small amounts.

Treasury yields were also unaffected with the 2-year, 10-year and 30-year bonds all off by less than one basis point.

10-year Treasury yield

CNBC

Federal Reserve cautionary logic

Treasuries provide the best explanation for the Fed’s reluctance to become optimistic despite the rather overwhelming evidence.

Markets, especially the Treasury market, are notorious for taking an indicator, a word or a phrase and running with it. The 2013 ‘taper tantrum’ spike in interest rates was sparked by a comment from then Chairman Ben Bernanke. No doubt that event has been much on the minds of Jerome Powell and the governors.

Clearly Mr. Powell and the FOMC members feel that anything that they might say about the rapidly improving economy or the conditions for the beginning of a taper will be taken by the credit market as proof that it is imminent.

It is not inconceivable that if Mr. Powell had been more effusive about the remarkable reversal in US prospects, the 10-year yield would already be on its way to 2%.

The decision to refrain from optimism was considered and deliberate. Substantial further progress, is a carefully chosen phrase. Its repetition was not coincidence but the epitome of Fed caution.

However positive the economic future looks, Mr. Powell is not about to engineer a sharp rise in interest rates and the risks that might entail, just for a little semantic accuracy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.