Fed stays strong against inflation

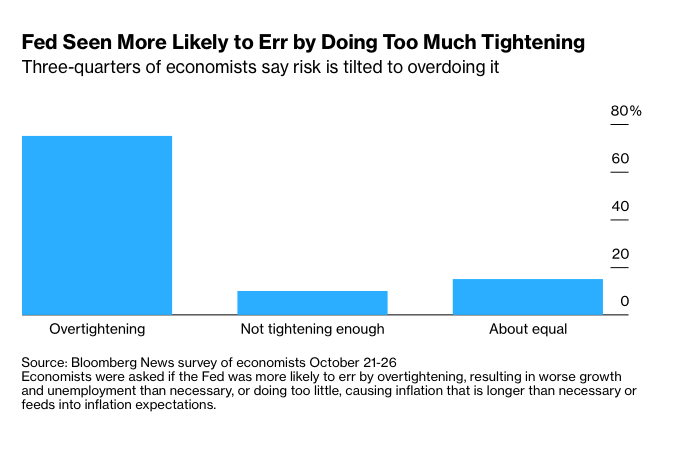

The Fed hiked by 75 bps as expected and initially had bullish stock hopes firing. The Fed said, in its statement, that it would consider the impact of monetary tightening lags as it moved forward. This was a dovish statement as it suggested that the Fed was not going to just automatically keep taking large rate hikes. It was the Fed trying to reassure the economists who thought the Fed risked over-tightening. See here for the Bloomberg survey which showed that nearly 75% of all economists surveyed thought the Fed risked over-tightening. However, all bullish hopes for stocks quickly faded once the Press Conference started.

Higher rates ahead

The key statement was when Powell said that he thought it was appropriate for rates to be higher than previously thought. This was a hawkish statement and the terminal rate, according to Short Term Interest rate Markets, has now gone up to over 5% from under 5% a week ago. Jerome Powell also made it clear that there was a need for ongoing rate hikes with ground left to cover.

The takeaway

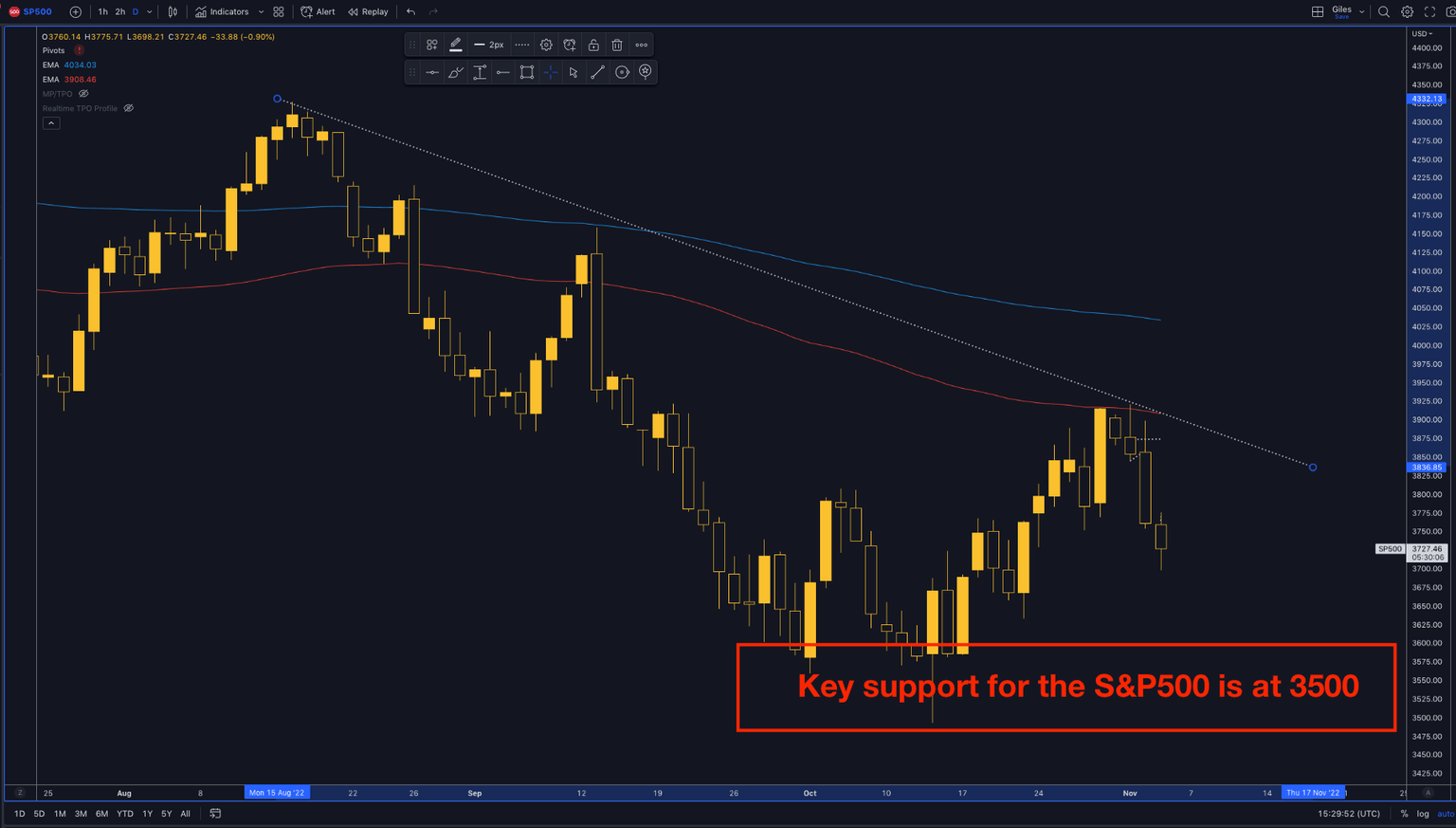

Was the Fed hawkish? Yes. Is it expecting higher rates ahead? Yes. Does this mean that the Fed will 100% move rates higher? No. The Federal Reserve will look at three key things: inflation, the US labour market, and the impact of the rate hikes it has done so far. So, this is a good time for volatility. If inflation looks like peaking, expect stocks to rally in anticipation of a Fed pause. If the US labour market shows signs of stress, then again expect stocks to rally on the hopes of a Fed pause. So, seeing the medium-term path clearly has just got harder. However, the potential for short-term volatility on certain key Fed-focused economic data points has just increased. There is now a 50/50 chance of a 75 bps hike in December. The other option is a 50bps hike.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.