Fed sees pickup in inflation, labor market gains as reopening underway

Longer-term US yields have eased post the US CPI numbers. Even though headline US CPI beat estimates, coming in at 0.6% mom and 2.6% yoy. The spike is largely attributed to the base effect and is likely to be transitory.

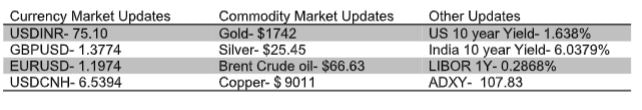

US 10y yields have retreated to 1.63% from close to 1.68% and 30y yields have retreated from 2.36% to 2.31%. US 2y real rates have become more negative as inflation expectations have spiked to 2.72%. A fall in short-term US real yields and lower longer-term yields have caused the Dollar to weaken across the board. The Euro has rebounded and is close to reclaiming the 1.20 mark. USDJPY has broken below the 109 marks. Commodity Linked currencies too have strengthened significantly. The Sterling too has strengthened after better than expected GDP data.

The Rupee has gone from becoming the best performing Asian currency over the last quarter to the worst-performing Asian currency over the last fortnight on surge in domestic COVID cases. The Rupee had weakened to 75.50 in offshore but has gained some ground amid overall USD weakness. Maharashtra has imposed a 15-day lockdown. Indian assets may continue to remain under pressure if the Virus curve does not relent. It will be interesting to see the intensity with which the central bank intervenes to curb volatility. One needs to keep a close eye on forwards as well. If forwards recover, Rupee could stabilize. Domestic CPI continues to remain in RBI's comfort zone, Core inflation is however sticky. However given the weak Feb IIP data and downside risks to the economy from a surge in COVID cases, the expectations of RBI tightening are likely to be pushed back.

One of the state-owned distressed debt management companies in China, Huarong has seen the yields on its bonds spike by 12% and seems to be in trouble. This has raised concerns over credit quality in China and one needs to watch the developments closely to see if concerns spill over to the rest of Asia. China has been attempting to temper down the pace of credit growth amid worries of excessive build-up in leverage.

The focus will be on US March Retail sales and weekly jobless claims data today.

Strategy: Exporters are advised to cover a part of their near-term exposure on upticks towards 75.50. Importers are advised to cover through forwards on dips towards 74.50. The 3M range for USDINR is 73.50 – 76.00 and the 6M range is 73.00 – 76.50.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.