Fed Preview: Powell to reignite dollar rally with promise to crush inflation, whatever the cost

- Economists expect the Federal Reserve to raise rates by 75 bps once again.

- Fed Chair Jerome Powell's message on accepting pain to pin down inflation is set to boost the dollar.

- Only an acknowledgment of peak rises in prices would weigh on the greenback.

Double triple – the Federal Reserve is set to raise interest rates by 75 basis points for the second time in a row, placing borrowing costs at a range of 2.25-2.50%, matching the post-financial crisis high. Will climbing down from a 100 bps cool down the dollar? Not so fast, as I suspect Fed Chair Jerome Powell will sustain his open-ended commitment to crushing inflation – even if it results in recession.

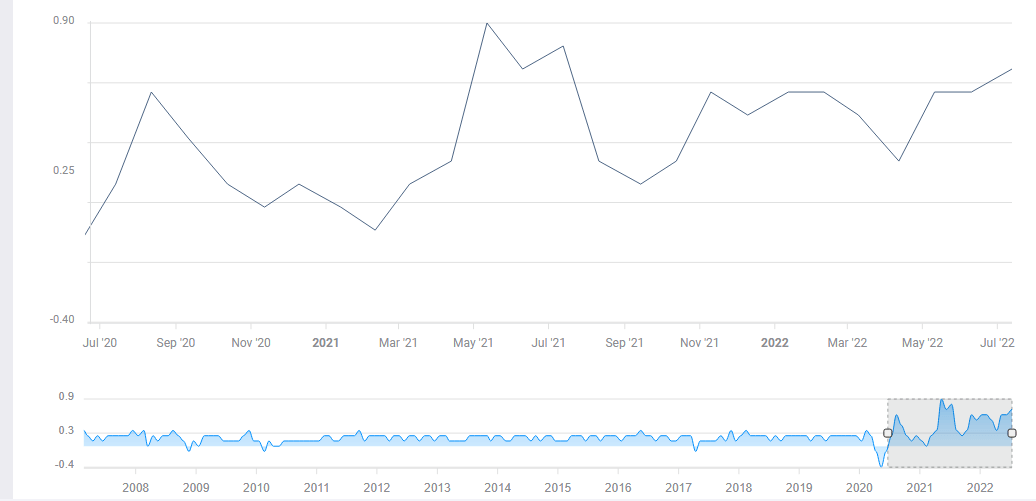

Background: inflation is unrelenting

While the price at the pump is off its $5/gallon peak, costs of everything else are rising. The Fed focuses on core inflation, which excludes volatile energy and food costs, and data for the last three months have shown that it is rising at an annualized pace of roughly 8%. The bank´s target is 2%.

High core inflation:

Source: FXStreet

In 2021, prices of used vehicles and supply chain issues pushed underlying inflation higher, and in 2022, price rises are even more widespread. Efforts by the Fed to cool demand with a total of 150 bps in three months have yet to encourage Americans to save money instead of taking loans, the way higher borrowing costs are meant to work.

While consumers may tell surveyors they are unhappy about the state of the economy and that the country is on the wrong track, they hardly seem to hesitate when it comes to new purchases. Such spending sprees make sense when employment remains high – and is growing at a fast pace.

Nonfarm Payrolls have exceeded expectations in five out of six releases so far in 2022. The Fed has been successful in securing full employment, its second mandate – is currently underprioritized due to the focus on inflation:

Strong job growth:

Source: FXStreet

These are signs of a heating economy – one that needs to be cooled down by further rate hikes. Back in June, Fed Chair Jerome Powell said that he expects the next move to be of 50 or 75 bps. The data suggests a bigger 75 bps is on the cards.

Decisions: 75 bps again, but then what?

The Fed's policy acts with a lag, and it needs to be aware not only of current price rises but also of expectations for the future. Returning to the June event, Powell cited the increase in the University of Michigan's long-term inflation expectations figure as a reason for a 75 bps move rather than the 50 bps originally telegraphed.

Back then, the preliminary read for June came out at 3.3%, a jump that implied everybody was expecting higher prices to remain entrenched, the Fed's worst fear. It is hard to change habits and it is better to prevent them from taking root. The 1970s inflation was crushed only with draconian interest rates, which caused a devastating recession. Powell wants to avoid such a scenario.

The Fed Chair must have felt relief when the final figure for June was revised down to 3.1%, and perhaps jumped with joy when the preliminary release for July showed a substantial drop to 2.8%. That latest publication calmed nervous investors, who had already begun pricing a whopping 100 bps increase.

Inflation expectations are off the boil

Source: Trading Economics

Does the drop in inflation expectations mean the worst of inflation is behind us? That is the critical question for Powell and for the market reaction. If the answer is yes, the high point of interest rates can be marked as well, providing certainty and relief to stock markets. For the dollar, it would deal a blow.

The hawkish case

I think Powell will take a different route. It is probably too soon – perhaps preliminary would be a better term – to claim victory, even partial, when prices continue rising. The Fed will likely prefer conveying a hawkish message regarding fighting price rises.

He needs to see more signs of a peak in inflation – not only in expectations but also in hard data. Such evidence would need to be sustained in inflation figures, and unfortunately, the Fed may also want to see some economic pain before letting go.

I would like to stress that economics is no less a social science than a mathematical one. Powell needs to convince the public that inflation will fall, reverting consumer behavior to the pre-price surge norm.

Conveying certainty about fighting inflation and uncertainty about how high rates could go would trigger a downfall in stocks – perhaps desired by the Fed. It would also send the dollar higher, ending its breather. In addition to benefiting from being backed by higher rates, the greenback would also attract safe-haven flows.

If the Fed is cooling the US economy, the rest of the world will struggle as well – that is how the thinking goes.

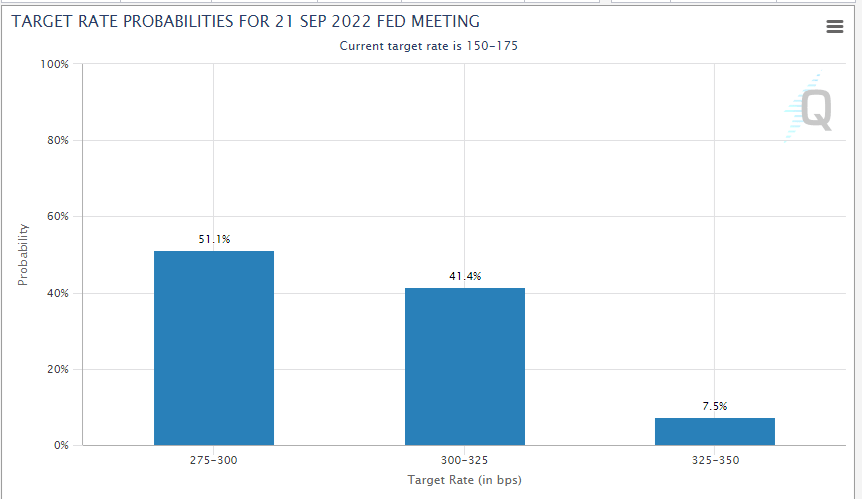

Powell may drop guidance for the next meeting altogether, or leave the door open for a third triple-dose hike of 75 bps. That is beyond current expectations, as reflected in bond markets. A 50 bps hike is priced for September 21, the next meeting.

A total of 125 bps worth of hikes is projected for the July and September meetings combined:

Source: CME Group

Final thoughts

I believe that the fight against high inflation continues not only in the hard numbers of interest rates but also in the hearts of wary Americans. That means a hawkish message and a stronger dollar.

The Fed announces its decision one day before the US releases initial Gross Domestic Product (GDP) for the second quarter. There is a good chane that the Fed receives the data ahead of markets, and reporters' questions about a recession would shape expectations for trading the data.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.